A BIG Earnings Release Week

A Market Commentary by WealthPlan Group || Written July 18th, 2022

Over nine hundred publicly traded companies will announce earnings this week across multiple economic sectors. In addition to releasing the earnings for the past quarter, many companies will provide guidance of some kind about business conditions going forward. Then the process of incorporating these things into forward-looking earnings estimates for calendar year 2023 by Wall Street analysts will begin.

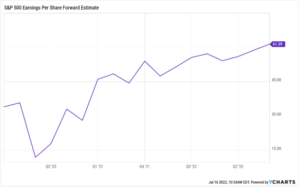

This will be a gradual process and won’t fully play out until August. Presently, aggregated analyst earnings expectations for the S&P 500 Index are $230. The chart below depicts these expectations as of July 15, 2022.

Given the Fed’s stated objective of aggressively fighting inflation by aggressively raising interest rates, it seems implausible that earnings estimates will remain at the levels in the chart above. The uncertainty centers around both the depth and duration of the earnings impacts of these Fed moves. We will check back on earnings estimates in several weeks.

Concurrent to the earnings announcements, this week we will get a series of important economic announcements related to inflation, housing, employment, and growth indicators. Altogether, this should provide a sense for whether inflation pressures are easing or not, and whether recessionary forces are manifesting further.

All of these things will set the stage for the next meeting of the Federal Reserve on July 27th. The market will attempt to glean from the data what the Fed is likely to do. From our perspective, we continue to exercise a degree of patience and are not in any particular rush to add risk to portfolios at this time.