A Fresh Look at Money Supply

The economy in the broadest sense is a complex system of multiple inputs, outputs, and interactions between millions of variables and independent agents. As such, it can be a difficult thing to grasp, let alone predict. Nonetheless, economists and professional investors attempt to make predictions about the direction and magnitude of various aspects of the economy.

We at WealthPlan see these forecasting efforts, overall and in the aggregate, as valuable to society. Yet, we also recognize how hard it is to be consistently correct, both in direction and magnitude, about the movement of economic variables. The forecasting exercise is fraught with difficulty and error. It is hard.

Against this backdrop, consider the current efforts by professionals to understand and predict inflation and economic growth. We happen to be at a point in time that is particularly confounding. We find very intelligent and informed practitioners on both sides of many important points. They are on both sides of the inflation forecast, on both sides of the interest rate forecast, and on both sides of the GDP forecast. Up? Down? Sideways? Hard landing? Soft-landing?

Forecasts are varied and wide—it’s a forecasting mess! Thus, Investors are unsure what to make of things, which we think explains a lot about the recent stock market gyrations.

In our commentaries, we have tried to emphasize the degree of uncertainty in making prognostications and how hard it is to make accurate forecasts. Given this inherent uncertainty, we emphasize that focusing on the long term and staying committed to a long-term focus is one of the most valuable disciplines investors can have.

The right horizon and the right risk posture combined are the best ingredients for ensuring people meet their goals—even when things become uncertain and uncomfortable. Moreover, we attempt to emphasize data and facts and to minimize feelings and emotions when making important long-term investment decisions.

So What Is Important?

Given all the uncertainty expressed above, we want to zero in on something we think is important: money supply. Before diving into the money supply data, we want to emphasize some words of wisdom delivered on the subject by the late, great, Nobel laureate economist, Milton Friedman. He said the following things about inflation and money:

“Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output… A steady rate of monetary growth at a moderate level can provide a framework under which a country can have little inflation and much growth. It will not produce perfect stability; it will not produce heaven on earth; but it can make an important contribution to a stable economic society.”

“Central bankers always try to avoid their last big mistake. So every time there’s the threat of a contraction in the economy, they’ll over stimulate the economy, by printing too much money. The result will be a rising roller coaster of inflation, with each high and low being higher than the preceding one.”

These words are profound. Not everyone agrees with the Monetarist school as championed by Friedman, but we do! We think the growth of money explains a great deal about current economic conditions. And we think his words above help contextualize the Fed’s response to the economic contraction caused by the COVID-induced economic shut down. So, let’s look at money supply over the past several years to see if it can tell us something about the inflationary impulse within the economy and to see when it may subside.

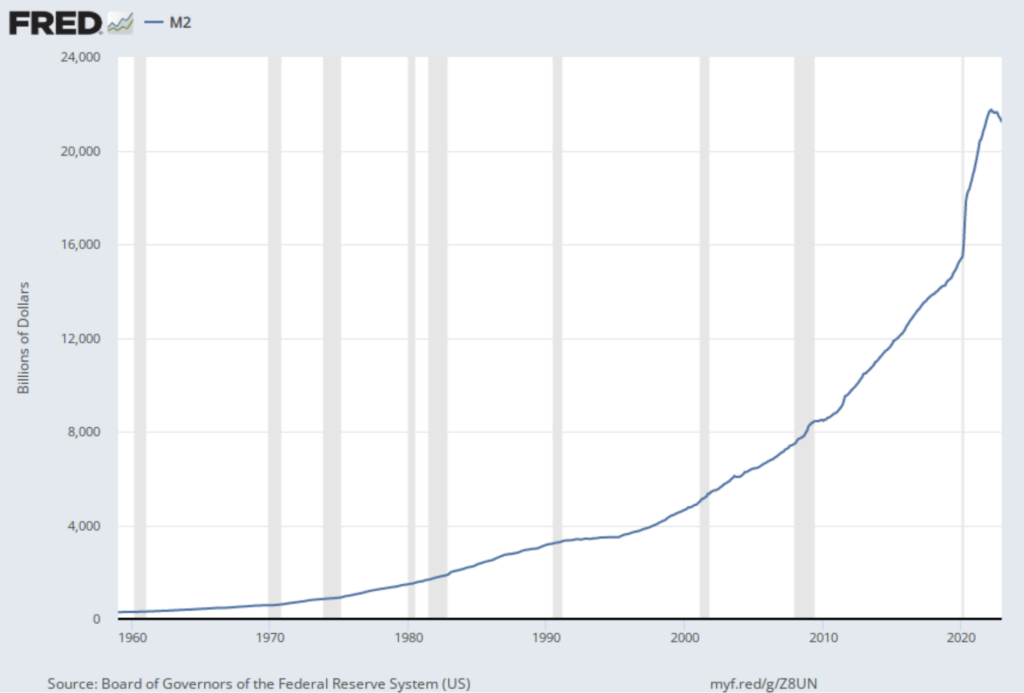

Below is a chart of M2 money supply over the decades. The run-up in M2 just after COVID was nothing short of massive. Given Friedman’s strongly held views that excess money growth causes inflation, we should carefully consider whether he might have been right. It seems to us; the growth of money is the leading candidate for causing inflation (over and above supply constraints which have undoubtedly contributed some.)

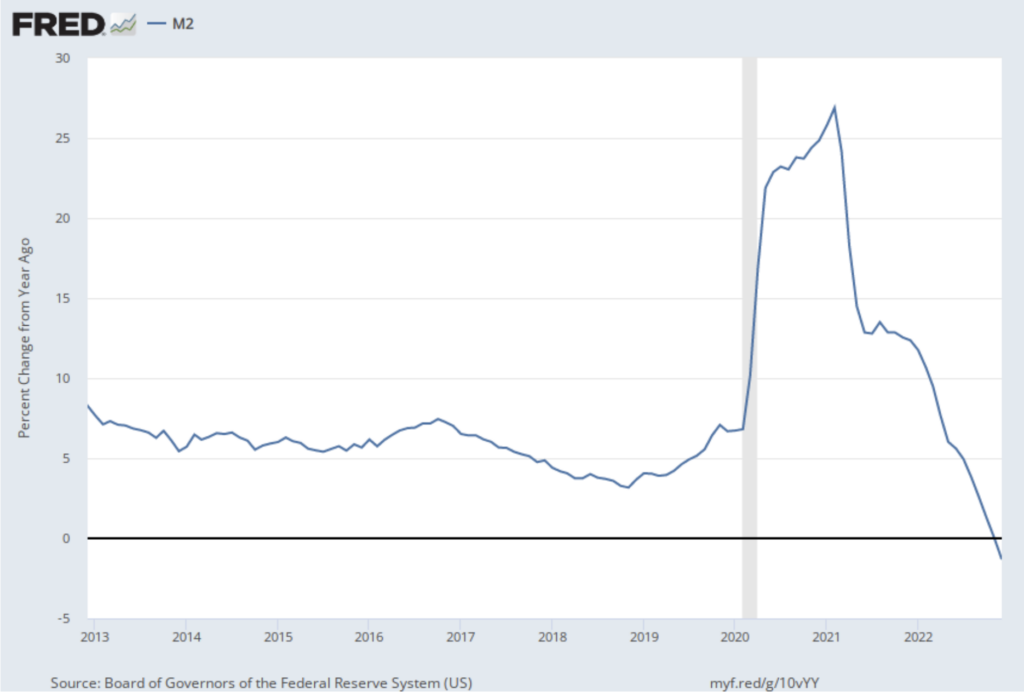

Now let’s look at the same money supply data, but instead of looking at the absolute supply of money over time as shown above, let’s look at just the change in the money supply over a one year look back period (see below.) This ten year history creates a crystal clear picture of how much money was created in response to COVID. It also shows that the Fed’s policies have been working to drain the excess money from the economy. Importantly, the money supply is now shrinking which should hasten disinflation.

There is a lot in the money supply story as told above to provide evidence that the Fed is doing what is necessary to reduce inflation. We are also comforted by Fed chairman Jerome Powell’s insistence that the Fed will stay with their inflation fighting policies until inflation abates. We are encouraged this will happen. As such, the Fed seems aware of the risks encapsulated in Friedman’s second quote above by sticking with the policies until inflation reaches an acceptable level. In the meantime, stick with your long-term strategy and thinking. Trying to time markets by wildly shifting your portfolio is usually a prescription for sub-par results and falling behind your long-term plans.

Advisory services offered through WealthPlan Investment Management, LLC.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which Investment(s) may be appropriate for you, consult your financial advisor prior to investing. Information is based on sources believed to be reliable, however, their accuracy or completeness cannot be guaranteed.

No investment strategy can assure success or completely protect against loss, given the volatility of all securities markets. Statements of forecast and trends are for informational purposes and are not guaranteed to occur in the future. All performance referenced is historical and is no guarantee of future results. Securities investing involves risk, including loss of principal. An investor cannot invest directly in an index.