All Hallows Eve and Fed Week: Trick or Treat?

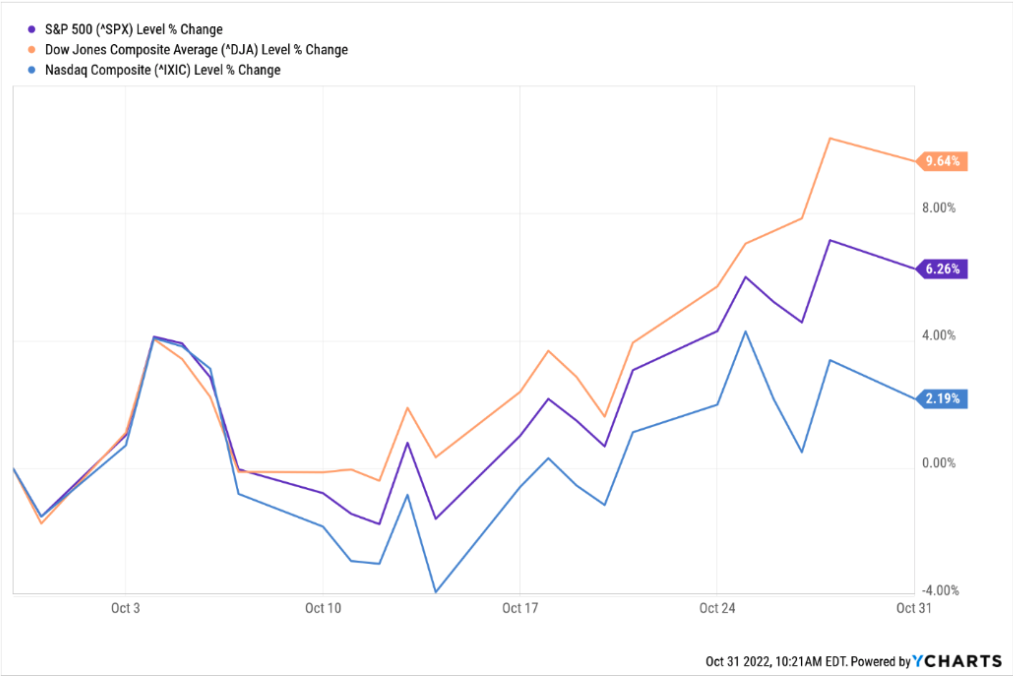

Sometimes the cliché headline is the right choice! While the stock market is completing one of its best months in a long time (see chart above), we enter this week on All Hallows Eve with the specter of another 75-basis point increase in the Fed Funds rate on Wednesday. Many hope the Fed will tone down its hawkishness with some conciliatory language around future rate increases.

This may be why the market rallied in October. We think this is perhaps too hopeful. Especially so given today’s ultra-hot Eurozone CPI print which came in at 10.7%!

Our perspective continues to be that the process of fighting inflation will be a long, drawn-out affair. Stock market rallies like the one we experienced off the October low is all part of the process. We expect the market character will remain about the same (slow declines followed by sharp rallies) for a meaningful time (many months) as the inflation battle is waged.

The risks are plentiful as we don’t know how high rates will need to rise. The higher rates go, the greater the risk of recession. Even now, the yield curve remains inverted, which has historically been a reliable recession indicator. It seems to us a recession is all but guaranteed and the only questions are about its magnitude and duration.

The good news in all this is that the Fixed Income markets are in much better shape. With the ten-year treasury yielding about 4%, bond managers are ecstatic about the longer-term prospects the asset class has for investors. There could be some additional pain in bonds as rates continue to rise, but most bond managers think the worst is over. Whether this expectation comes to fruition is yet to be seen, but large institutional bond managers are sanguine for the asset class.

In the meantime, enjoy your All Hallows Eve. We will check back in next week on the events that today stand in front of us.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which Investment(s) may be appropriate for you, consult your financial advisor prior to investing. Information is based on sources believed to be reliable, however, their accuracy or completeness cannot be guaranteed. No investment strategy can assure success or completely protect against loss, given the volatility of all securities markets. Statements of forecast and trends are for informational purposes and are not guaranteed to occur in the future. All performance referenced is historical and is no guarantee of future results. Securities investing involves risk, including loss of principal. An investor cannot invest directly in an index.

Advisory services offered through WealthPlan Group, a DBA for WealthPlan Investment Management, a subsidiary Registered Investment Advisor of WealthPlan Group, LLC. WealthPlan Group, LLC is not a registered investment advisor, but is the holding company for WealthPlan Partners LLC and WealthPlan Investment Management, LLC