Alternative Investments Portfolio – October 2022

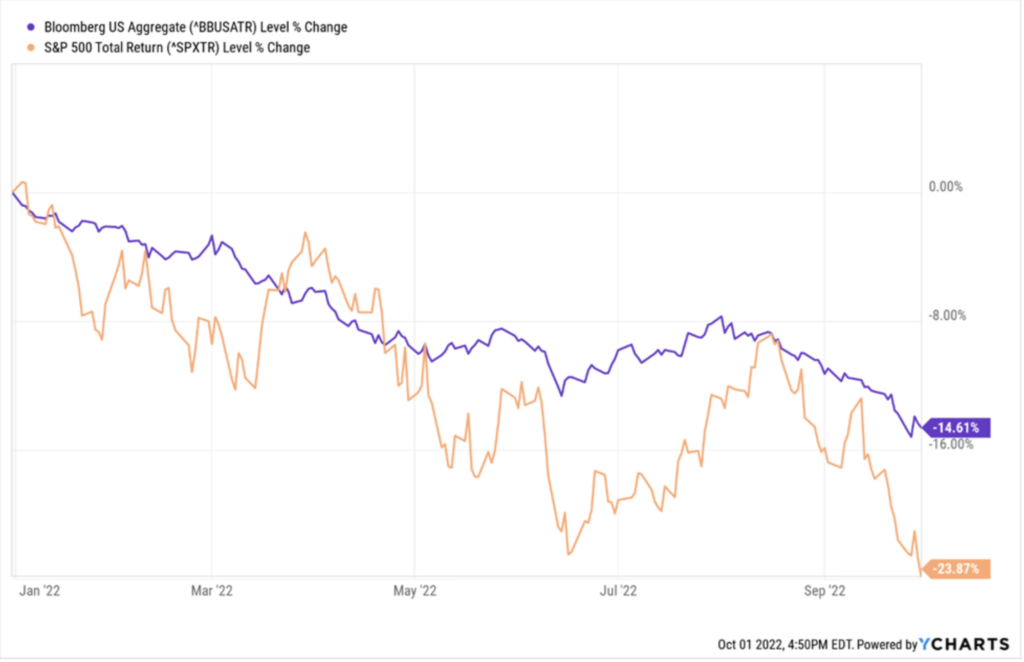

Below is the chart of the year-to-date returns through September 30, 2022—for both US stocks and bonds.

This is UNPRECEDENTED on a couple of important dimensions. First, bonds normally provide a return that offers a low correlation to stocks; meaning that normally when stocks are down like they are this year, bonds provide some positive returns. Not so this year. Second, bonds are down on an absolute basis more than they have ever been. This is the worst year on record for bonds.

If you are an investor that has relied on an investment portfolio composed of just stocks and bonds (and had counted on bonds to hold up better), there are things that can be done. For example, WealthPlan’s Alternatives strategy is designed to provide our clients’ portfolios with a return profile that can help when bonds don’t do the job. To learn how we did it, read on.

What Differentiates Our Alternatives Fund?

“Alternative Investments” can mean many things to many people. To some, it means high potential return and high risk. To others, it means illiquid investments which can make it hard to get your money back. And for some, it means putting your money into highly opaque investments with limited insights into what is held. Alternative investments often have many of the following characteristics: narrow specialization of investment managers; relatively low correlation of returns with those of traditional investments; less regulation and less transparency than traditional investments; concentrated portfolios; restrictions on redemptions (i.e. “lockups” and “gates”).

The reality is, while the characteristics mentioned above are typically associated with “typical” alternative investments for good reason, we believe that alternative investment portfolios can offer a much more varied role, and in fact, may be used for specific purposes (see below). In the final analysis, the question of what constitutes good alternative investments is a lot like art: It is in the eye of the creator or in the eye of the beholder that determines what a good alternative investment is.

At WealthPlan Group, we set out to build an Alternatives portfolio that serves a specific set of purposes. These specific purposes are:

- Low Correlation to traditional portfolios composed of stocks and bonds.

- Absolute return-oriented with limited directionality and limited downside.

- Daily liquidity with no lockups or notice periods.

- Full transparency into investment holdings.

Based on these design principles, we set out to re-engineer WealthPlan’s Alternatives portfolio in the fall of 2021. The primary goal of the reengineering effort was to achieve the design purposes highlighted above. We were attempting to reduce or eliminate most of the return directionality that was embedded in the original lineup. We also wanted to introduce a higher level of diversification among the underlying strategies.

The Alternatives portfolio is currently composed of the following strategies with these approximate weights:

Market Neutral Income – 40%

The investment seeks high current income. The Adviser pursues the fund’s investment objective by implementing a proprietary, “market neutral” investment strategy designed to seek income from its investments while maintaining a low correlation to the foreign and domestic equity and bond markets.

Managed Futures – 20%

The investment seeks positive, risk-adjusted returns, consistent with prudent investment management. The fund seeks to achieve its investment objective by pursuing a quantitative trading strategy intended to capture the persistence of price trends (up and/or down) observed in global financial markets and commodities. It will invest under normal circumstances in derivative instruments linked to interest rates, currencies, mortgages, credit, commodities (including individual commodities and commodity indices), equity indices and volatility-related instruments.

Event Driven – 15%

The investment seeks long-term capital growth. Normally, the fund invests at least 80% of its net assets in equity securities and related derivative instruments with similar economic characteristics. It seeks to achieve its investment objective by employing an event-driven strategy, primarily investing in companies that have announced a material change or in companies that the advisor expects to undergo a material change. The fund’s investment in equity securities may include common stock, preferred stock, securities convertible into common stock, non-convertible preferred stock, and depositary receipts.

Long/Short Commodities – 15%

The investment seeks capital appreciation in rising and falling commodities markets with managing volatility as a secondary objective. The Commodities strategy is designed to produce capital appreciation by capturing returns related to the commodities markets. The fund seeks to achieve its investment objectives by allocating its assets to both long and short commodity investments.

Equity Hedged – 10%

The investment seeks to achieve positive total returns in rising or falling markets that are not directly correlated to broad equity or fixed income market returns. The fund seeks to achieve its investment objective by allocating its assets generally among the components of the S&P 500® Dynamic VEQTOR Index. The Benchmark is composed of up to three types of components: (i) an equity component, represented by the S&P 500® Index; (ii) a volatility hedge component, represented by the S&P 500® VIX Short-Term Futures Index (“VIX Futures Index”); and (iii) cash.

It is important to note here, that even though we are discussing our approach to alternative investments, readers and investors should be aware that these views are not recommendations to any specific person viewing this content. As always, your specific situation will dictate what the best approach is for you as an investor.

The Result

The design parameters we adhered to in re-engineering our Alternatives portfolio results in a portfolio that provides ballast to a stock and bond portfolio. While the strategy is not designed to provide large upside returns (that’s what stocks seek to accomplish over the long term) it is designed to provide steady, more consistent returns and to do so with limited downside. In the current market environment marked by volatility, uncertainty, and large simultaneous downside in both stocks and bonds, a low correlation alternatives portfolio can be the right step for many investors. Talk to a WealthPlan Group Advisor to see how we can help improve your portfolio.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which Investment(s) may be appropriate for you, consult your financial advisor prior to investing. Information is based on sources believed to be reliable, however, their accuracy or completeness cannot be guaranteed. No investment strategy can assure success or completely protect against loss, given the volatility of all securities markets. Statements of forecast and trends are for informational purposes and are not guaranteed to occur in the future. All performance referenced is historical and is no guarantee of future results. Securities investing involves risk, including loss of principal. An investor cannot invest directly in an index.

Advisory services offered through WealthPlan Investment Management, a subsidiary Registered Investment Advisor of WealthPlan Group, LLC.