An Important Week for Gaining Perspective

It’s a big week for corporate earnings announcements with approximately 2,500 companies reporting earnings. We will have a good idea by the end of the week how rising costs are affecting trailing earnings as well as forward earnings guidance.

On the economic data front, it is also a big week. Over the course of the week, we will see updated data on retail gas prices, durable goods, manufacturing, housing (prices and volume), GDP, vehicle sales, employment, and consumer sentiment. PHEW!

By Friday, we will have a much clearer picture than we do today of how rising prices and interest rates are affecting behavior and corporate earnings.

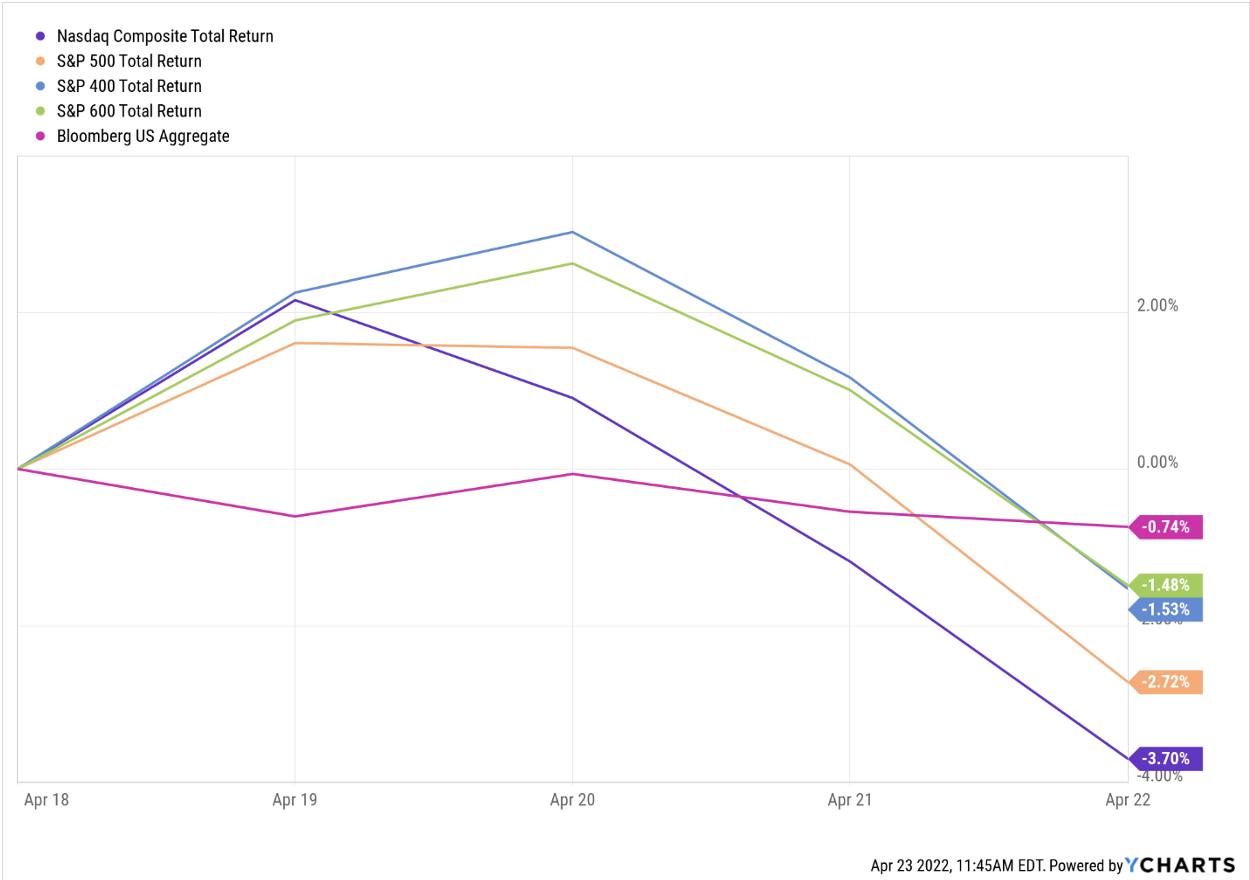

Below is a chart of capital market returns for last week. We continue to see rising interest rates, which are bringing bond indices down (pink line). Even so, stocks attempted a rally early in the week; but the decidedly hawkish rhetoric from Fed members took markets down by the end of the week.

We remind readers that so far, Fed action has been “more bark than bite.” For all the rhetoric, we have seen only one 25 basis point rate hike at this time. And there has not been any unwinding of the balance sheet yet. If the Fed delivers on three fifty basis point hikes as some members have intimated AND begins reducing the Fed balance sheet by $95 billion per month (both policy tactics to combat inflation), then we will have heightened uncertainty for some period regarding how those policies are affecting the economy. We will very likely have bouts of heightened uncertainty and market volatility as the effects of these tactics becomes clearer.

For the foreseeable future, assessing the effects of the Feds inflation fighting actions will leave markets in a state of “limbo.” A best-case scenario would be a “soft landing” in which inflation is brought under control without causing an economic recession. If markets can manage to trade in a sideways pattern as all this sorts out, we would view this as a HUGE win.

Rest assured that as these things work themselves out, we at WealthPlan Group continue to manage portfolios by working with clients toward their long-term objectives and always ensuring that they are lined up with the appropriate strategy given their goals. Our “Smarter Portfolios” continue to show stability and consistency, despite a market that exhibits a good deal of uncertainty. Our focus on dividends and current yield serve as ballast to portfolios, which we believe to be beneficial given the market climate. If you have specific questions or concerns, please contact your advisor. We appreciate your business very much.