Bond Vigilantes Ride – Q1 Market Commentary

We began the first quarter with a sobering message, stating that after several good years (with a punctuated but brief COVID scare) that the investment climate was going to change. We suggested it would be good for people to temper their capital market expectations considering: 1) high stock market valuations, 2) high inflation, and 3) a changing Fed posture (rising interest rates) in response to inflation. We cautioned we were likely to experience a year of rising rates, market volatility, and negative returns (for both stocks and bonds). At the same time, we acknowledged that no one has a crystal ball and that we could be wrong. Furthermore, we stated the best investment policy for long-term investors is to stay the course because market timing is treacherous. Market timing is made even worse for taxable investors…so staying the course is prudent almost all the time.

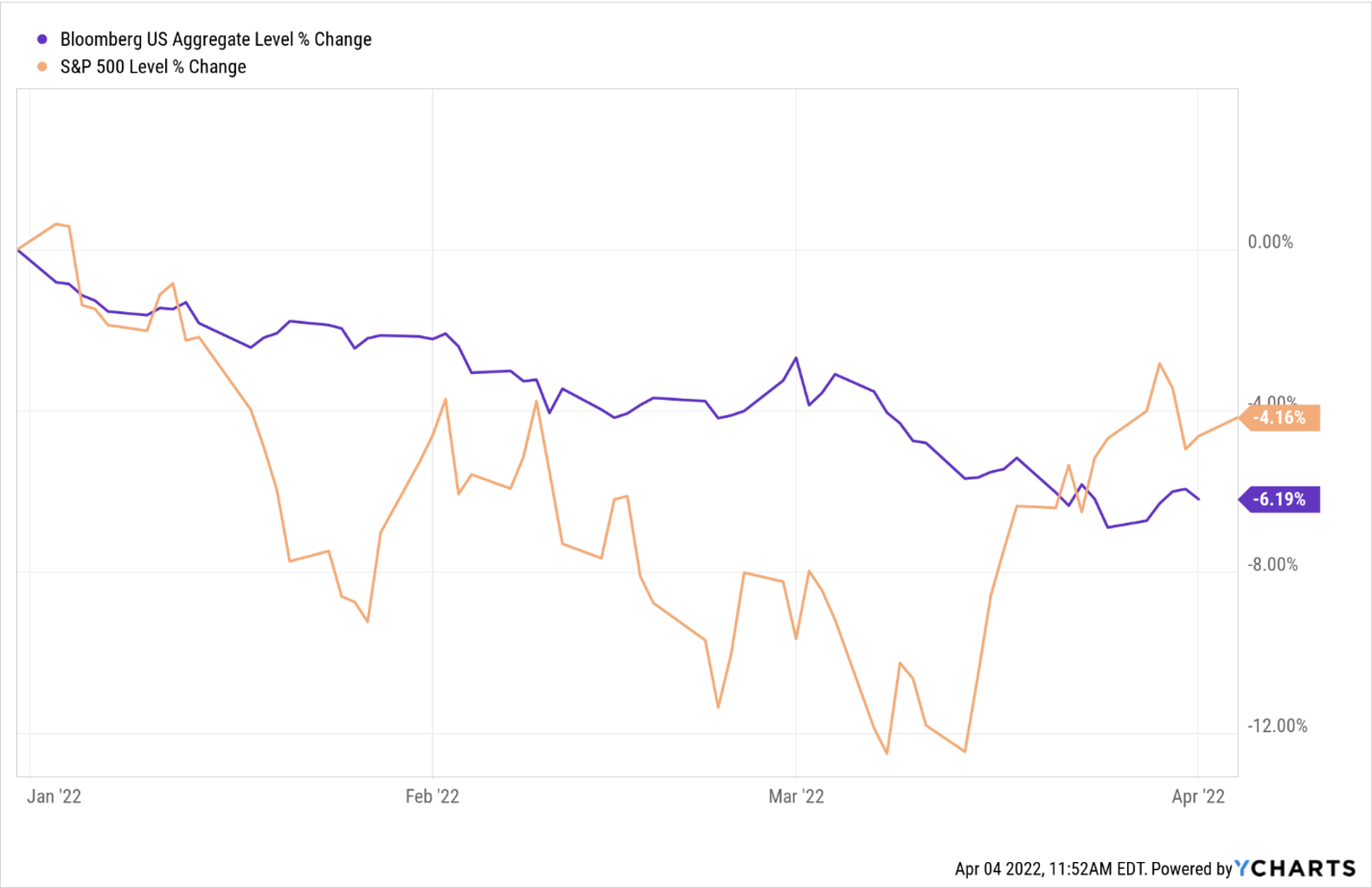

Add to this New Year’s set-up a Russian invasion of Ukraine, bringing additional pricing pressure to oil and gasoline, and we had the ingredients for a market sell-off. Despite all this, the market demonstrated surprising resiliency. Here is what the quarter looked like for stocks (orange) and bonds (purple):

We know that typically the stock market is more volatile than the bond market, as can be seen in the two series above. The real story for the markets right now is on the bond side. A -6.19% for the Bloomberg Aggregate Bond index is an exceptionally large magnitude sell off. Moreover, while stocks rallied in the quarter, bonds continued to slide. Thus, we are going to dig deeper into bonds.

We know that typically the stock market is more volatile than the bond market, as can be seen in the two series above. The real story for the markets right now is on the bond side. A -6.19% for the Bloomberg Aggregate Bond index is an exceptionally large magnitude sell off. Moreover, while stocks rallied in the quarter, bonds continued to slide. Thus, we are going to dig deeper into bonds.

The first observation is that bonds are down meaningfully because interest rates are up meaningfully. Here is a look at what rates did in the quarter:

The magnitude of this move and its downward pressure on bond prices cannot be understated. This move in three months is at least a 1 in 100 event. What are we to make of this given the Fed’s tepid 25 basis point rate increase in the quarter? The bond market is forecasting the Fed will need to become much more aggressive. The term for this coined in the 1970’s was “bond market vigilantism.” The idea here is that the bond market is forcing the Fed’s hands because the Fed has been slow to react. We think this is what is happening now and caution bond investors that there could be more similar pain ahead. We will be watching the bond vigilantes closely in the coming quarter

The primary challenge remains two-fold. Firstly, we still face record inflation; and the conditions causing it remain firmly in place. Secondly, stocks are still expensive relative to historical norms. Along with these, the yield curve has now inverted—signaling a potential recession could be on the horizon. Therefore, our advice remains the same as it was at the beginning of the year: lower your expectations, expect more volatility, expect more downward prices in stocks and bonds, and talk to your advisor if you feel your risk profile might need to be revisited.

We at WealthPlan Group feel like our portfolios are well positioned within our Smarter Portfolio framework to navigate the challenges of the current economic and market conditions. We are broadly diversified; we have allocated to certain strategies that have the potential to fare well under these conditions, and we are generally conservatively positioned in higher yielding stocks. Please do not hesitate to contact us if you would like to discuss things in greater detail.