Burning questions Into the New Year

As we enter 2024, here are the predominant questions related to the economy and capital markets: Will the economy avoid recession as presently expected? Will the Fed cut interest rates as presently expected? Will corporate earnings grow 10% as presently expected? Will equity market participation broaden away from the “Magnificent 7”? We could list more,…

Let’s See How Far We’ve Come

As we close out the year 2023 and anticipate the arrival of 2024, it seems appropriate to look back and then look forward in anticipation of the New Year to come. Currently, stocks are yet again experiencing a textbook “Santa Claus Rally,” taking the US stock market within a whisper of all-time highs. The last…

Financial Fitness Part II

Last week we wrote about financial fitness, drawing parallels between physical fitness and financial fitness. With physical health, achieving fitness comes from a combination of discipline in both diet and exercise. Even if one is diligent with physical fitness, all that hard work can be undone with poor eating habits. With financial health, achieving…

Financial Fitness

Many people think of the December holiday season as a time for family, loved ones, celebration, and good food and drink. Especially this time of year, discipline seems to take a back seat to enjoyment, much to the chagrin of fitness experts and medical professionals. If you have spent some time in your life…

Welcome December!

As we await the arrival of December and a possible “Santa Claus” rally, here is what markets have produced year-to-date through Friday, November 24th: As you can see, large cap tech stocks (NASDAQ and S&P) have dominated the capital markets while small caps and bonds have substantially lagged. In a year like…

Thanksgiving Week

As we enter a trading week interrupted by Thanksgiving, it is a good time to take a pause and survey the broader economic picture. Here are the important drivers: Inflationary pressures continue to recede; but there is some stubbornness to it. The Fed continues to be vigilant with its tightening policies and rhetoric. The…

U.S. Credit Rating Downgrade by Moody’s

We wrote about the U.S. financial situation a few weeks ago. We have been concerned about total U.S. debt levels, the cost of servicing that debt as interest rates rise, continued and ballooning deficit spending, and the percentage of total tax revenues used to cover interest expenses. The reality is things are not good.…

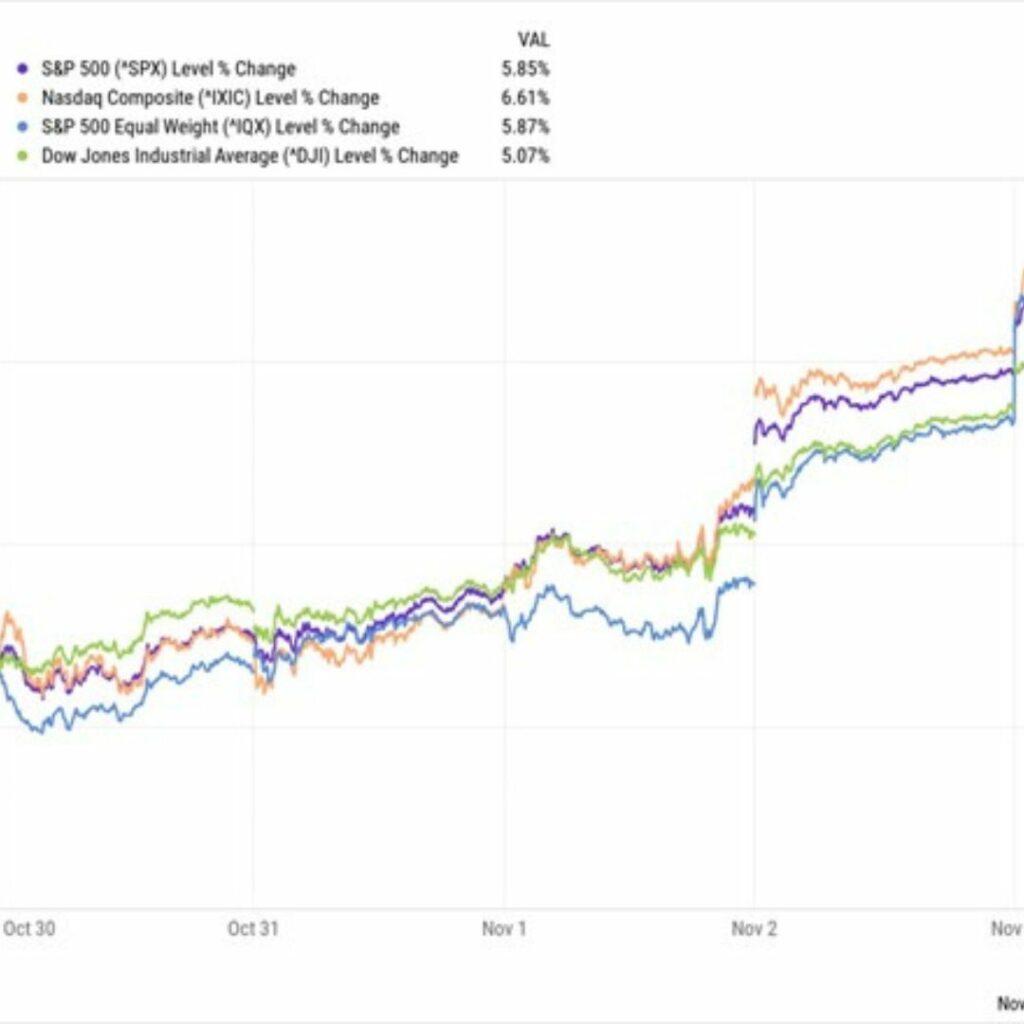

Things Are Looking Up

Eighty percent of S&P 500 Index companies have now reported earnings for the third quarter and things are looking constructive from a corporate earnings perspective. According to FactSet, earnings are up year over year for the first time since 3rd quarter 2022—by over 3%. The stock market this week reflected this rosy earnings report,…

Inflation, Interest, and Investing with Erik Ogard

CIO Erik Ogard recently sat down with financial advisor Wayne Wagner Jr., of Vizionary Wealth Management to discuss investment questions like: Portfolio construction Labor unions Housing market dynamics The impact of rising interest rates Join us as we explore alternative investment strategies, analyze the performance of different asset classes, and provide valuable insights into how…

Market Valuations and Big Cap Tech

At the midway point of this current earnings season, FactSet has reported that both earnings and revenue are up over 2% from a year ago. This resumed growth lends credence to arguments that—after a shallow earnings recession—corporate earnings growth has resumed. We will be monitoring earnings as they come in over the next couple of weeks but…

Earnings in Focus

Approximately 2,300 publicly traded companies will report earnings this week. As such, it is a big week for earnings and by the end of it, we should have a good read on the overall tenor of earnings for the quarter ended September 30th. This is a pivotal quarter because the aggregated analyst estimates for…

More Confounding Mixed Signals

We concluded 2023 on a hopeful note, seeing a fourth quarter broadening of equity market participation with solid returns to former laggards: Namely, small/mid cap stocks and dividend growers broadly participated in the fourth quarter market rally. The markets were trading on the view that inflation was conquered, the soft landing was a done deal,…