Did We Just Have a Banking Crisis?

A mere three weeks ago we were confronting a run on Silicon Valley Bank followed by a bank bailout orchestrated by the FDIC, the US Treasury, and the Fed. The official response was swift and robust. The Fed opened the discount window, member banks took advantage of the liquidity, banks across the country took measures to reduce risk, and we all have apparently moved on. Presumably this one goes down as a “no harm, no foul” event. If you blink, you missed it. But is it really this simple?

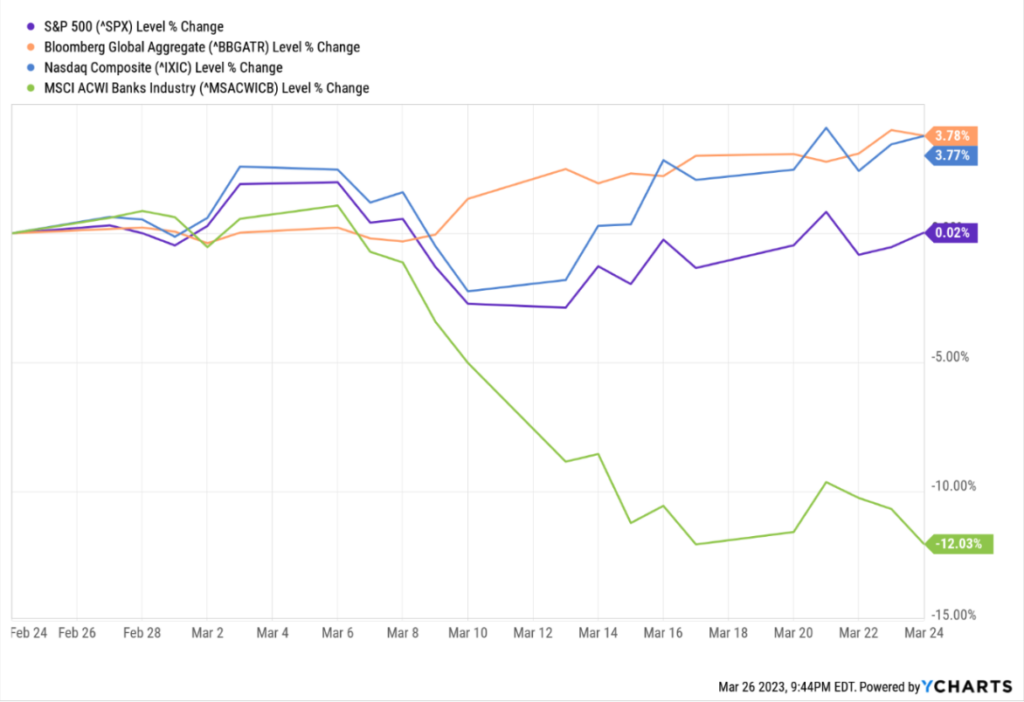

Here is a look at one month returns for stocks as measured by the S&P 500 Index (purple line) and the NASDAQ Index (blue line) and for bonds as measured by the Bloomberg Aggregate Bond Index (orange line). Looking at the broader indices, it would indeed appear the banking situation was a blip, and is now a thing of the past. Perhaps, but perhaps not. A look at banking stocks across the globe reveals that banking stocks have not rebounded (green line).

When we at WealthPlan survey the landscape, here’s our take.

- The crisis potential of this event has been circumvented by the swift actions of regulators and member banks

- The longer-term ramifications are still unresolved as banking stocks have not recovered.

- The Fed focus has shifted from crisis prevention back to the inflation fight.

- We are back to where we have been since March of 2022.

Thus, the two primary questions are once again:

- When will inflation abate?

- How deep and long lasting will any economic contraction be, because of the Fed’s aggressive rate hikes?

Unfortunately, the answers to these two questions continue to be uncertain and murky. So we really are stuck in a state of limbo. Given the uncertainty, equity markets have been profoundly stable—punctuating the wisdom of a long-term buy and hold strategy as opposed to market timing. Staying in the game is still the wise choice, in our view.

As has been the case for the entirety of the past twelve months, we remain prepared for more bouts of volatility as we gain clarity on the inflation and economic picture. We know how frustrating it can be to experience two years of sideways markets. While we caution that this state of affairs could last a few more quarters as things resolve, in the long term we have faith in the American industrial complex to innovate and grow. In the long run, stocks remain wonderful way to build wealth and meet your retirement objectives.