Don’t Fight the Fed

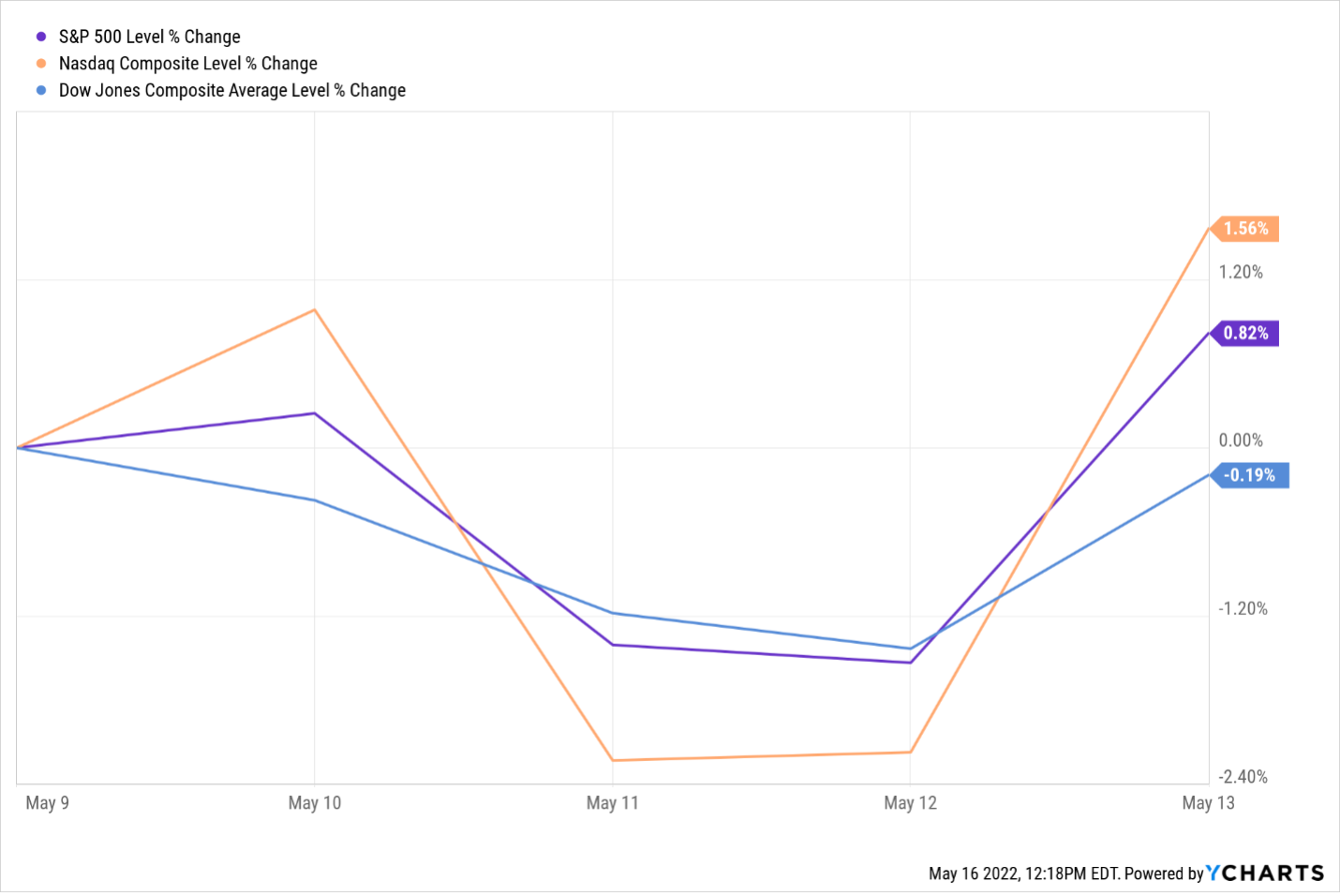

Stocks were mixed last week as the market narrative remains the same. Namely, the market is grappling with an increasingly hawkish Fed.

It is a relatively quiet week ahead for macro-economic and corporate earnings announcements as the market continues to digest the implications of continuing high inflation. At this juncture, there seems to be broad-based consensus that the Fed is substantially behind in its policy response to inflation. Fed chairman Jerome Powell’s remarks last week indicate the Fed will risk recession to bring inflation down. It is this posture that has the market in an uncertain state.

Forward earnings estimates for stocks continue to be strong and going higher, which creates a meaningful tension for the market as it balances the competing interests of rate increases with a sanguine outlook for corporate earnings. Whether the rate increases will cause downward earnings revisions remains to be seen. At this stage, uncertainty about these things reigns and the overall investor sentiment seems cautionary.

Our position remains the same; long-term investors can look through episodes like this one, knowing that corrections and bear markets happen, even as long-term wealth is accumulated. We encourage investors to expect continuing alarming headlines and market volatility as the inflationary threat works out over time. If you have questions or concerns, please contact your advisor.