Fed Inflation Policy Shift

Inflation and the Fed’s actions to combat it will arguably be the main topic of discussion for the next ten days. On December 10th, the Bureau of Labor Statistics will release the November CPI data. Between May and September 2021, year over year CPI and Core CPI (CPI less Food and Energy) had stayed between 5.0-5.5% and 4.0-4.3% respectively. However, the October print showcased a jump to 6.2% and 4.6%, respectively.

This jump in inflation has been mirrored in PCE data, which the Bureau of Economic Analysis (BEA) releases at the end of each month. The October data, released November 24th, rose from 4.4% to 5.0%. It should be noted that the Fed chooses to monitor PCE data over CPI because PCE provides a better barometer of the nation’s economic status by incorporating prices from more goods and services and drawing its information from more sources than CPI does. Additionally, CPI tends to be more volatile; large individual price swings in products can have an outsized impact on readings.

Hot on the heels of the CPI data release, the Federal Reserve Board will sit for a two-day meeting December 14-15th. The Fed will likely decide on a new direction for their policy. Recently, Jerome Powell has signaled for a more hawkish stance, citing persistent inflation concerns as well as fears that the new Omicron variant could potentially increase supply chain disruptions. It is anticipated that the Fed will increase their tapering speed, doubling the reduction in purchases to $30B a month from the $15B announced in early November. This increased speed will see the Fed wrapping up their tapering a quarter sooner—by early spring 2022, rather than early summer. This would also provide the Fed the flexibility and capability to raise rates before summer— up until now the market had priced in a rate hike by late Q2 2022 to early Q3 2022.

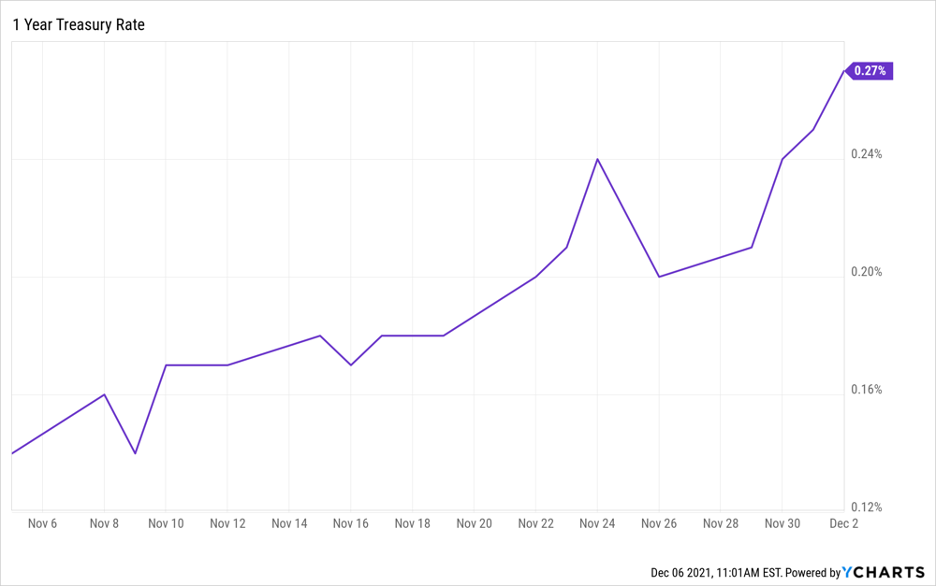

Looking at the Treasury Yield Curve, specifically the 2-Year Treasury note, the bond markets is anticipating at least 2 rate hikes by 2023. Additionally, after the PCE data release and Powell’s recent increased hawkish stance, the 1-Yr has fully priced in a rate hike—rising from 18 basis points on November 19th to ~25 basis points on November 24th.