Investment Team Notes – Market Comments and Rebalancing Notice

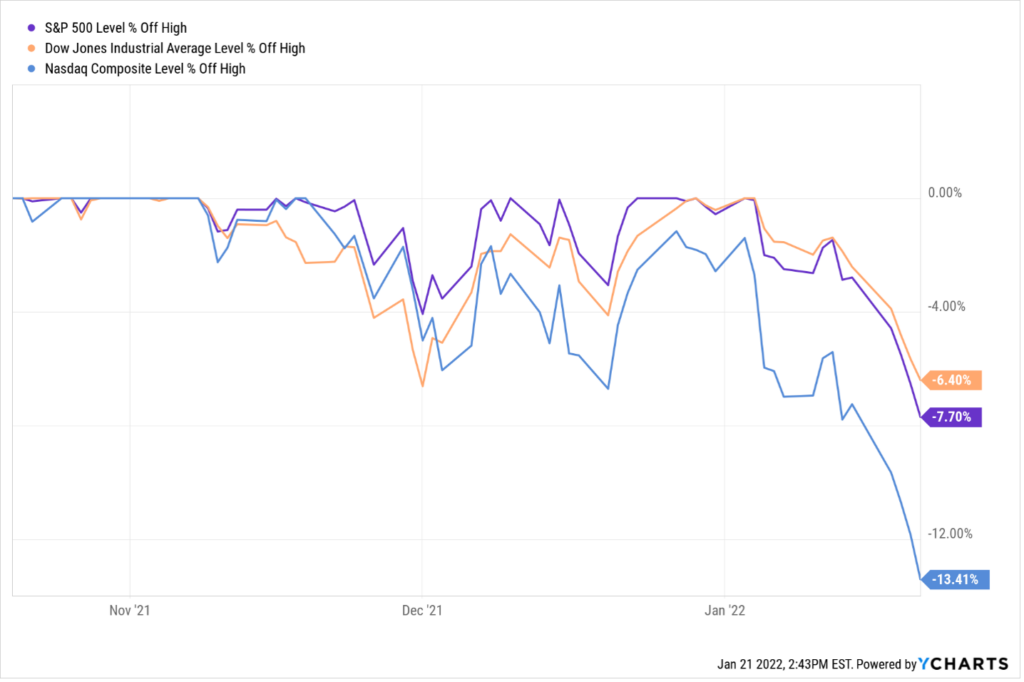

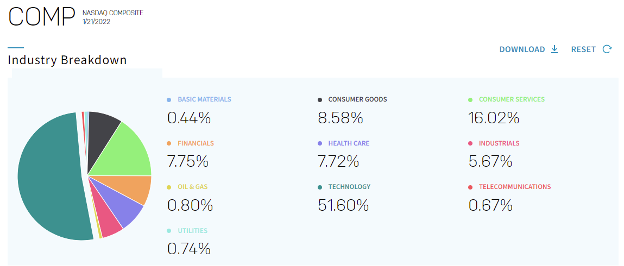

Many folks are glued to the screen today watching some interesting market moves. We are too, but we’ve also built the Smarter Portfolios to insulate against some of the micro drama that happens day-to-day. We’ve been speaking recently of the concentration within many of the major indices and are seeing pullback in some big technology names that have been carrying high valuations. All else equal, an outsized valuation can make a stock even more sensitive to interest rate movements, if for nothing else than just the math behind very basic valuation models.

As we’ve pointed out in some of our recent notes, the effect of a drastic move on a larger holding within an index has contributed to a larger move of said index. At the time of writing, Amazon (AMZN) is down over 4% for the day and makes up 6.75% of the Invesco QQQ Trust (QQQ), which tracks the Nasdaq 100 index. A smaller holding at 1.64% of QQQ, Netflix (NFLX) is down over 20% after providing disappointing earnings information. Actually, a number of names within the Nasdaq 100 are actually in the positive midday Friday, but of course it’s more exciting news to look at the large individual moves. We certainly aren’t downplaying what is happening in the markets with a broad price adjustment but wanted to add a little color from the perspective of a broadly diversified portfolio. We have some in-depth commentary on strategy diversification and portfolio holdings coming up in the near future along with the recap of our quarterly investment committee.

Source: https://indexes.nasdaqomx.com/index/Breakdown/COMP