Investor Mailbag: Inflation

What does it mean that the Fed is going to start tapering?

To keep the economy humming smoothly, the Fed has been practicing Quantitative Easing—providing liquidity to the market by purchasing $120B in Treasury bonds and mortgage-backed securities each month. The Fed announced that they would commence their tapering operations, reducing purchases by $15B per month, with operations wrapping up by June 2022. The market appears to have taken this information in stride as the S&P 500 is near all-time highs.

Will Fed Raise Rates?

Eventually, yes. With inflation on the rise—according to the Bureau of Labor Statics, headline CPI hit 5.4% for the 12-month September number. The October number should be released in the next week or so. The main job of the Fed is to combat inflation. Perhaps the idea of less liquidity in the system (via phase out of quantitative easing) is welcome news to the market. Once tapering has been completed and provided the economy is in a position that the Fed deems suitable, they would then also be free to start implanting rate hikes.

There are two informational resources to get a barometer of what the probability of rate hikes is, and at what level interest rate will be in the future. For predictions around interest rate levels—the Federal Reserve Board of Governors dot plot can be helpful. This plots the Fed Board’s feelings regarding the best rate policy for the current market conditions and the best policy moving forward given the information they have today.

The second goodie to look at is the 2-Year Treasury. As of the start of November, the ‘smart money’ of the bond market has almost fully priced in 2 rate hikes. Will that fix the inflation issue? Answer: Definitely Maybe.

Will Inflation get out of hand?

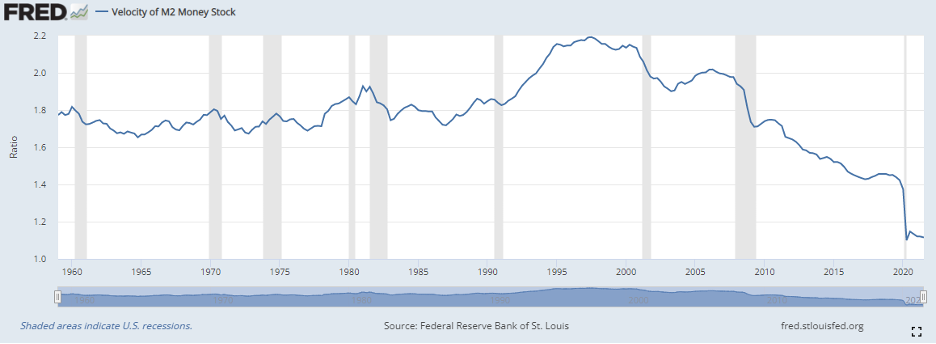

Talk to any freshman Econ major and the easy formula for inflation is when Demand > Supply. An easy corollary then is More Money à Greater Inflation. While potentially true, that is only half of the equation. More money can lead to higher inflation but only if the velocity of money is on the rise. Velocity of money is defined as how often a dollar is used to purchase a good in a set period of time—faster the velocity higher the odds of inflation. So, in theory if some entity printed a pile of money but households chose to not spend it, then inflation may not appear. According to the St. Louis Fed, the velocity of money has not gotten out of hand yet.

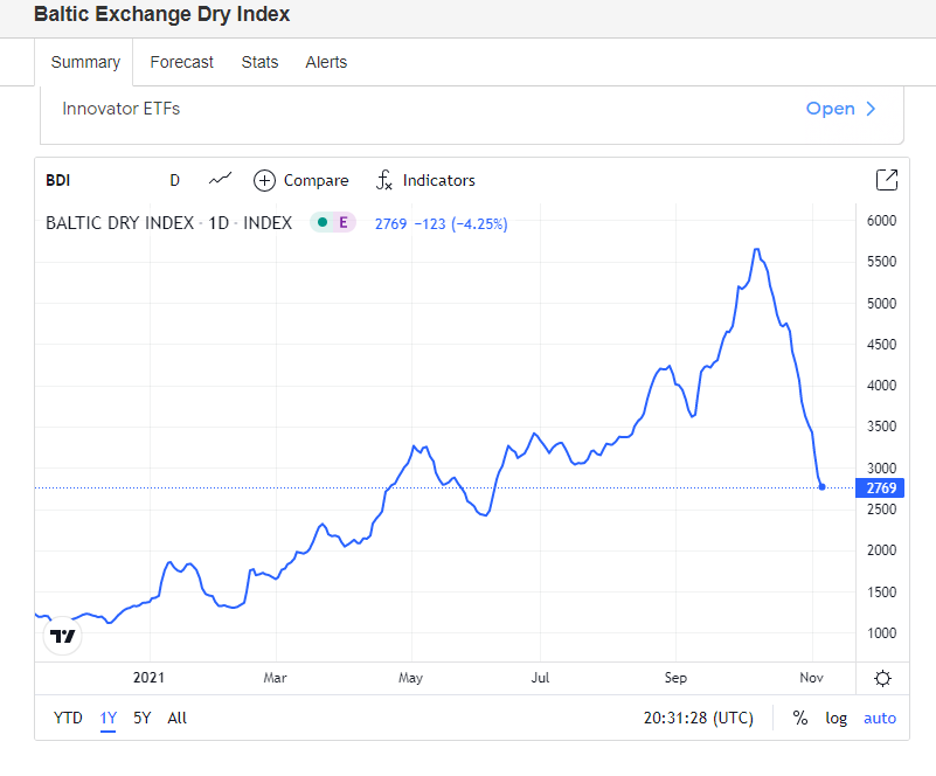

That argument is well and good but that doesn’t change the fact that prices for many goods are on the rise and at a historic pace. How sticky inflation will be is very dependent on how global supply chains move and the weather. If supply routes return to normal, it would be expected that inflation will be more on the transitory side. If supply routes can’t return to normal, or we have more weather-related issues—like a drought in Taiwan which reduces the semiconductor chip manufacturing rates due to its high-water usage, then higher inflation may stick around longer than we’d all like. The good news is that some areas that has seen prices surge this year have started to fall. For example, coal and shipping rates have all come down from their highs.

(https://tradingeconomics.com/commodity/baltic)

(https://markets.businessinsider.com/commodities/coal-price)

What about Stagflation?

Anyone living throughout the mid ‘70s to early ‘80s likely got a little triggered by that word. Thankfully, there doesn’t appear to be any signs that the US economy is headed in that direction right now. Keeping an eye out for the Purchasing Managers’ Index (PMI), an index which provides economic trends for manufacturing and service sectors. This index is a good barometer of US company health, and pairing that with the Bureau of Labor Statistics’ monthly CPI and PPI data will be important. So far, US PMI has been over 50 (bullish sign) for all of 2021.

There are some early indications that some other countries may be flirting with stagflation: China and Brazil both are experiencing higher inflation and their respective PMI Indexes are hovering in and around 50.

We here at WealthPlan continue to monitor the markets and the news abroad to build globally- diversified and balanced portfolios which are best positioned to benefit our clients for the curveballs that the market loves to throw.

Nick Codola, Sr. Research Analyst