Leaning Into Q4

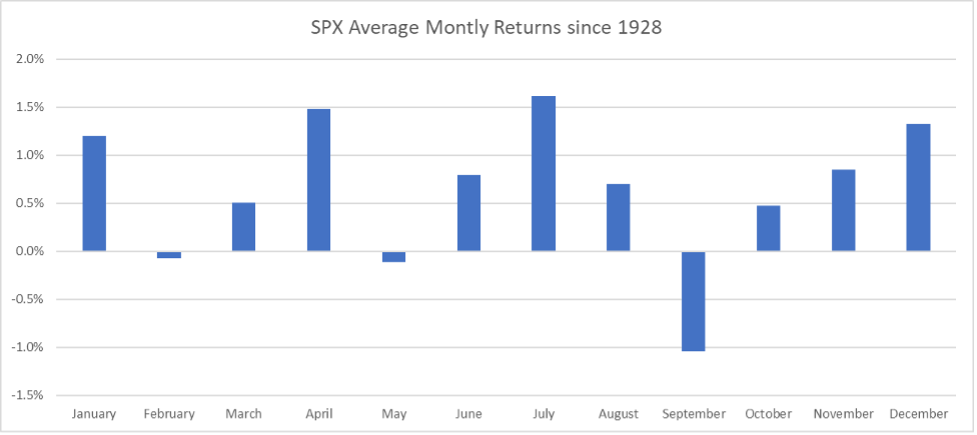

It looks like winter is upon us. For those of you not in the Omaha area, the first snowfall of the year occurred this past Friday. With about 45 days left in 2021, the markets are entering into a seasonally strong period. Historically, people have attributed the good market returns to the ‘Santa Claus Rally’– strong returns in the second half of December. While good ole Saint Nick certainly plays a part, I would make a potentially needlessly picky contention that it is more of a general holiday euphoria—Thanksgiving, Chanukah, Christmas, Halloween, and any other holiday (Festivus?) during this period all contribute. To back up that potentially contentious claim, are some hopefully fun charts. Pulling monthly returns of the S&P 500 “Price Return” going back to 1928; the strength of December is head and shoulders above almost every other month in the second half of the year. As we wrote about previously, you can see that September has historically been an awful month for the market.

Data from Morningstar Direct. SPX Index Monthly Returns from 1928-2021

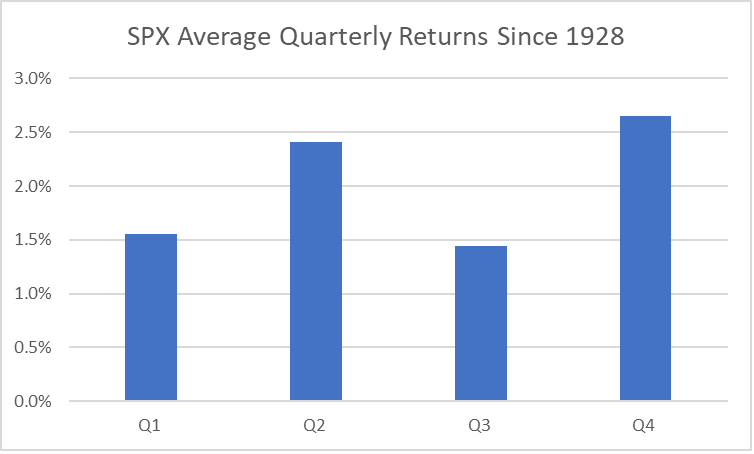

Looking at returns from a quarterly basis, a similarly rosy picture arises for the holiday quarter:

Data from Morningstar Direct. SPX Index Quarterly Returns from 1928-2021

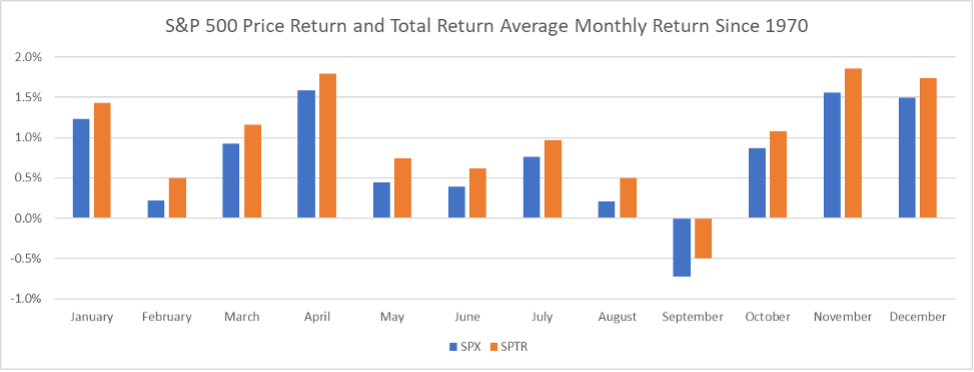

However, one could argue that the holiday season / quarter is fine, but not that amazing. Look at Q2—April to June looks strong too! The inflection point appears to hinge around America’s growing love of Halloween, Black Friday, and all those holiday movies that have made us fall further in love with the heretofore less popular holidays! According to National Retail Federation, popularity of Halloween has been on the rise over the past couple decades, with more people participating in the festivities, and spending more. Regarding Black Friday, the general consensus is that Black Friday started becoming the deal-fueled bonanza it is today somewhere in the 1960s-1970s. Looking at S&P 500 Price and Total Return numbers (Total Return includes dividends), the holiday months start to really take off.

Data from Morningstar Direct. SPX Index and S&P 500 TR Monthly Returns from 1970-2021

Collectively, no quarter has returned that strong. While December saw a slight rise, its October and especially November which really take off.

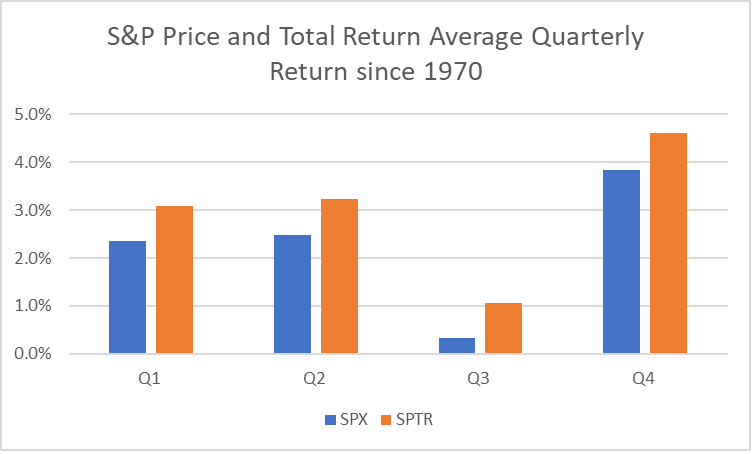

Data from Morningstar Direct. SPX Index and S&P 500 TR Quarterly Returns from 1970-2021

Bam. No contest. The holiday quarter has a return nearly 50% higher than the next highest quarter. While there are times when the holiday season isn’t foolproof—look no further than 2018—for the long-term investor a saying to append to ‘Don’t Fight the Fed’ might be ‘Lean into Q4’. Regardless of which exact holiday plays the biggest role, one thing is for sure—the holiday season brings smiles not only to people and but also their wallets, and to quote Buddy the Elf, “Smiling is my favorite.”

Nick Codola, Sr. Research Analyst