Listen to the Money Talk

In April of this year (2022), we wrote a piece called “Money Heaven” in which we discussed money creation and destruction in the US economy. Briefly, this was a treatise postulating that unprecedented excess money growth was a leading cause of inflation. Moreover, we discussed the various ways the economy eliminates “excess” money. To recap, we identified the mechanisms through which excess money is destroyed in the economy:

- Declines in asset values through market mechanisms (stocks, real estate, etc.),

- restrictive Fed policy (rising rates and balance sheet reductions), and

- Inflation.

These processes will continue until the excess money is destroyed. We believe these have all been at work this year since we wrote that note in April. Let’s look at current conditions.

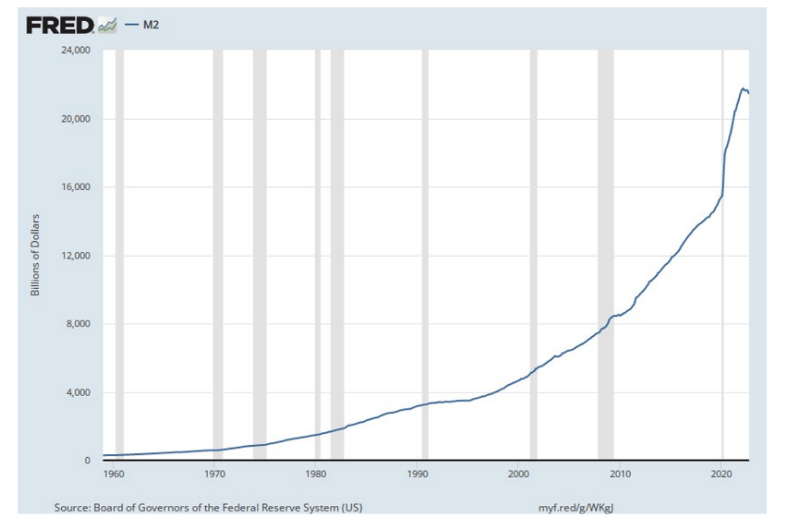

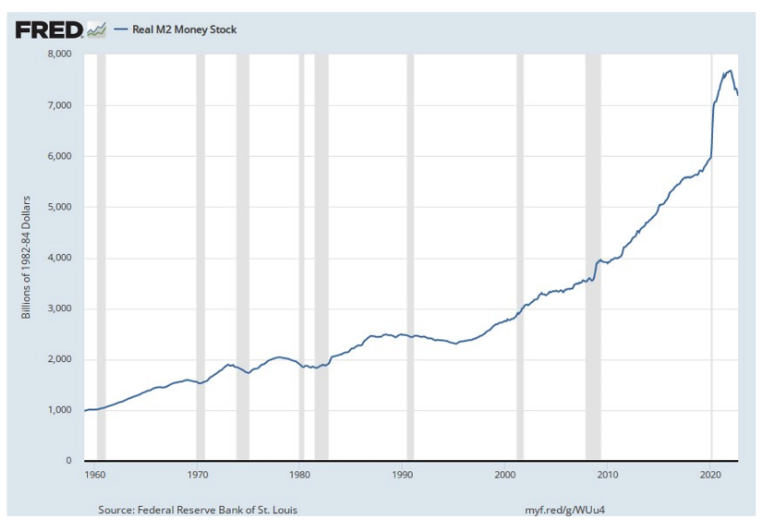

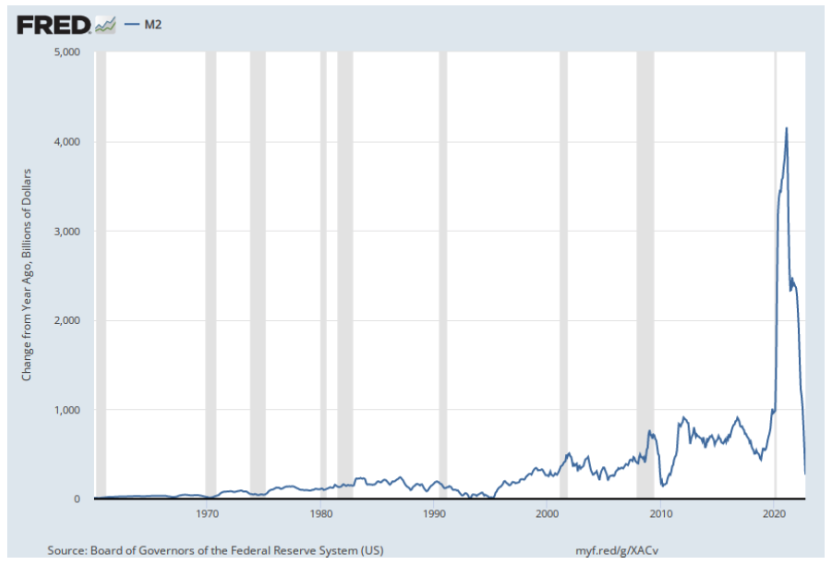

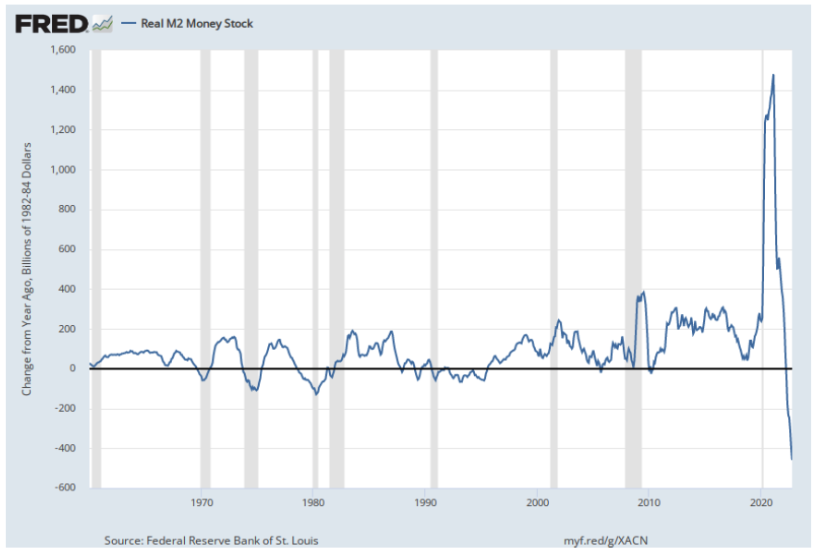

First, let’s look at the money supply. Below are two snapshots of M2; one “nominal” (i.e., before inflation) and one “real” (i.e., after inflation).

As can be seen, we have made some progress on the money supply front this year, especially after accounting for inflation. BUT, there is still a LONG WAY to go. Another way to look at the data in the charts above is to look at the percentage change from a year ago. If one looks at the data this way, the change looks dramatic. Here it is:

When looked at from this perspective, the change in money supply growth has been massively negative. The Fed should get some credit for a policy response to inflation (albeit late) that has been equally as aggressive as was the COVID-related support it provided. We note, however, there is still a long way to go to bring money supply to an inflation-neutral base. Please note, as we pointed out in April, inflation has a way of eliminating the buying power of “excess money.”

Now, let’s turn our attention to the two primary mechanisms through which the Fed influences money supply: 1) interest rates and 2) balance sheet policy.

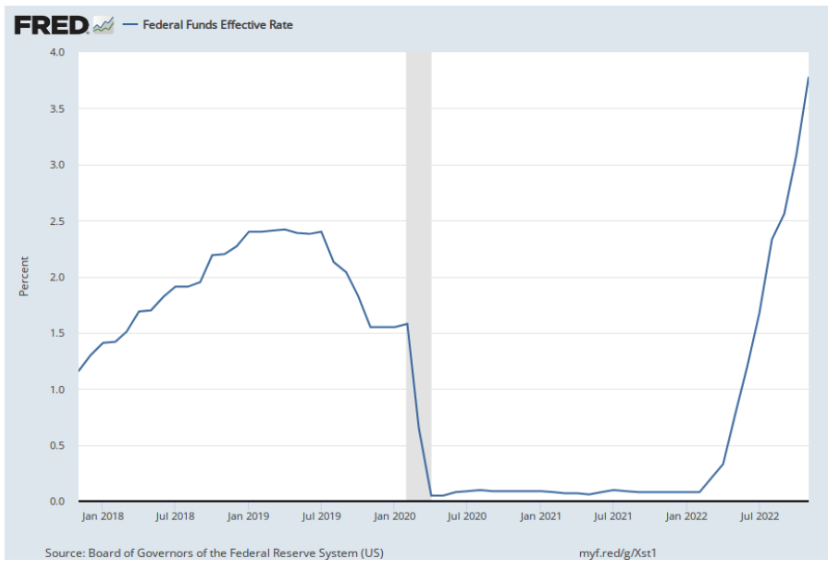

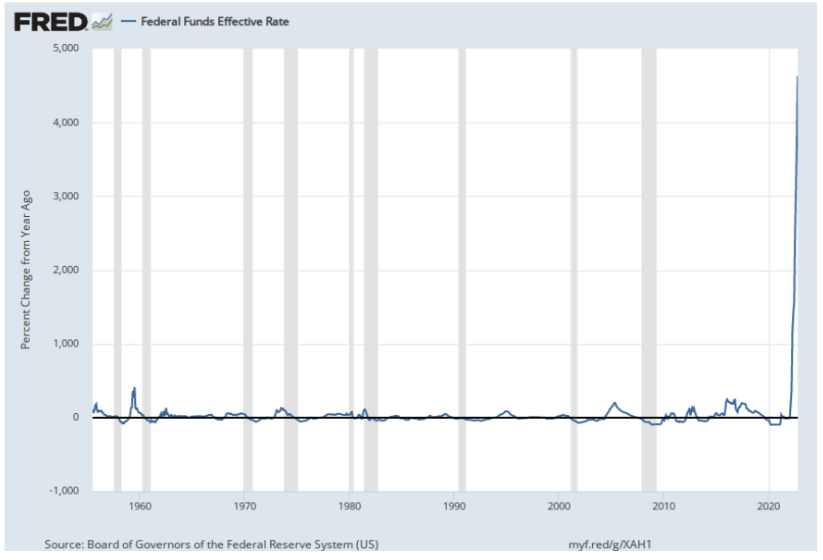

Interest Rates

The top panel shows the change the Fed Funds rate this cycle. This is a big change and reflects the hawkish stance toward inflation the Fed has now taken. Because we are coming off a base of zero interest rates, this is a massive and unprecedented increase as measured as a percentage change from a year ago. As can be seen in the bottom panel, a change of this magnitude as a percent off of base has NEVER been initiated by the Fed.

Also worthy of note, inflation is still high and while it remains elevated, real interest rates are still negative. Either inflation needs to come down so real rates are positive, or rates need to go higher; we can’t stay here in “no man’s land for too long.

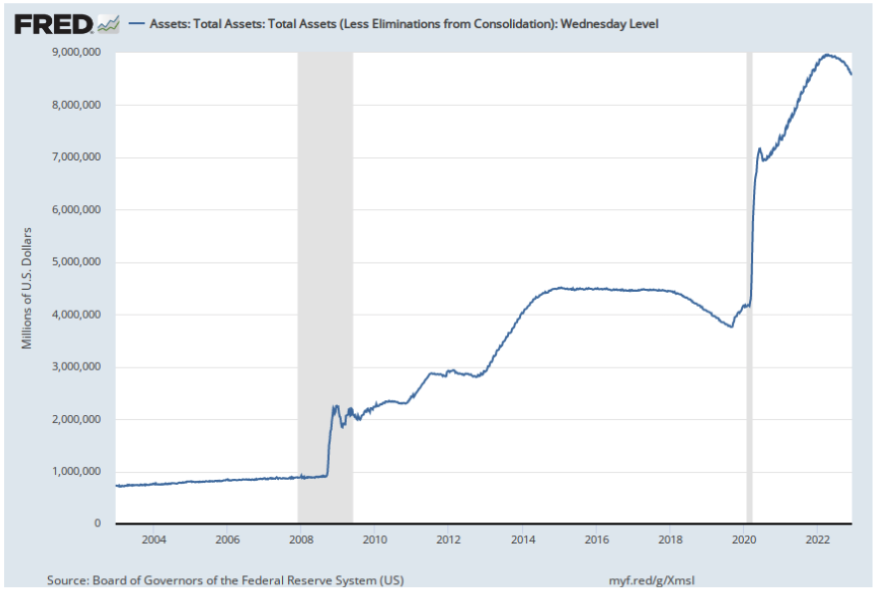

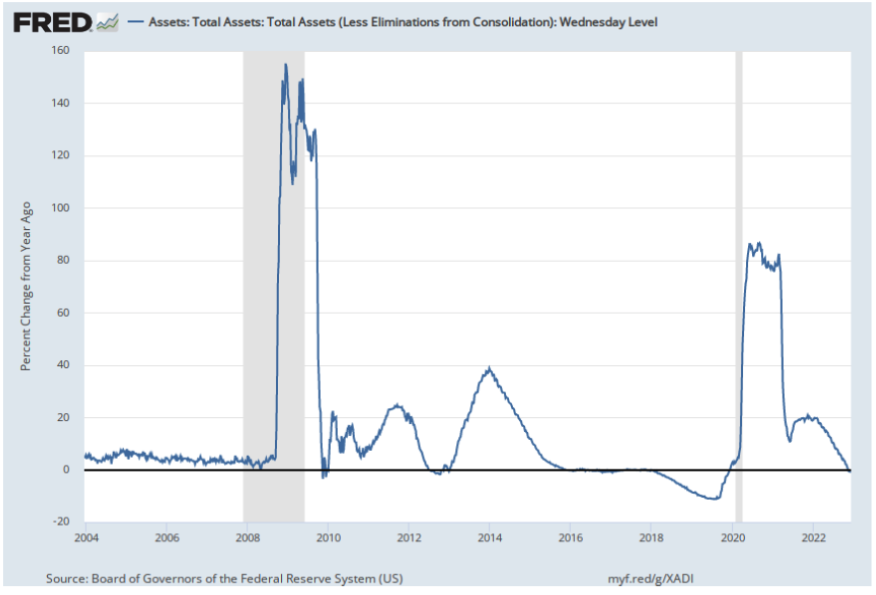

Balance Sheet

As can be seen in the top panel, the Fed has been reducing its balance sheet. On the bottom, we can see that recent reductions have just taken us back to balance sheet levels at which we started 2022. The Fed is clearly signaling interest rates are more of a policy focus than is the balance sheet. Nonetheless, the Fed is making strides on both fronts. We certainly see the balance sheet as a contributor to recent money growth and inflationary pressures. Thus, a continuation of balance sheet reductions seems prudent to us.

We believe that money supply is the primary cause of inflation. While economic supply chain issues have undoubtedly contributed, those supply constraints have largely subsided while inflation has persisted, lending credence to our view money supply is the root cause of inflation (not everyone agrees with us.) If we are correct in this assessment, then the Fed has made an earnest and good start, but still has a way to go to bring inflation under control. Thus, this week’s inflation report and the Fed’s response will be in focus. We still may have a Santa Claus rally to close out the year after the Fed announces its rate policy and recessionary assessment later this week. Nonetheless, we are not out of the woods. The threat of a recession and the ongoing inflation battle is likely to dominate headlines in the coming year. Until then, enjoy the holiday season.

Advisory services offered through WealthPlan Group, a DBA for WealthPlan Investment Management, a subsidiary Registered Investment Advisor of WealthPlan Group, LLC. WealthPlan Group, LLC is not a registered investment advisor, but is the holding company for WealthPlan Partners LLC and WealthPlan Investment Management, LLC.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which Investment(s) may be appropriate for you, consult your financial advisor prior to investing. Information is based on sources believed to be reliable, however, their accuracy or completeness cannot be guaranteed.

No investment strategy can assure success or completely protect against loss, given the volatility of all securities markets. Statements of forecast and trends are for informational purposes and are not guaranteed to occur in the future. All performance referenced is historical and is no guarantee of future results. Securities investing involves risk, including loss of principal. An investor cannot invest directly in an index.

The information in this communication applies solely to the intended audience and in no way amends, revokes, or otherwise alters the existing agreements and relationships between WPIM and its clients. This communication is not a binding offer, expressed or implied. WPIM undertakes no obligation to update or revise the information herein or in any referenced third-party resource due to new information, future events or circumstances, or otherwise.

WealthPlan Investment Management (“WPIM”) uses data compiled and/or prepared by third parties (“Third Party Data”) in the delivery of Licensed Research and Data. Third Party Data is not owned by WPIM and user may be required to obtain permission directly from third parties for further use of Third-Party Data and may be required to pay a fee depending on the use contemplated by the user.