October Recap

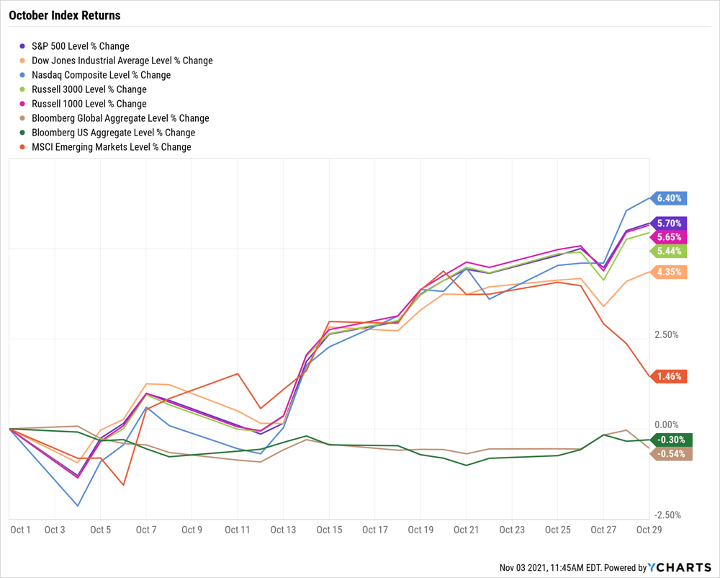

After a September pull-back, risk assets resumed their upward trajectory in October, with several equity indices recording record highs at month-end. Bonds posted losses in the quarter as interest rates moved up in response to continuing inflationary pressures.

October 2021 Capital Market Returns

The magnitude of these moves over one month is large. The rise of risk assets continues to be driven by two primary factors: 1) A continuing recovery in corporate earnings as economies continue to “reopen”, and 2) The highly supportive monetary policies of the US Federal reserve. While the Fed is meeting this week, we expect the near-term consequences of any policy announcements will be muted. The current state of the markets continues to be marked by strong corporate earnings and large amounts of money sloshing around in the economy. The likely consequence of these are higher stock markets and higher stock valuations.

We expect we will continue along this path BUT are closely monitoring developments in the areas of inflation, interest rates, and signaled changes in Fed policy. We are not altogether comfortable with equity valuation; but continue to believe these conditions can persist for many more months. If any negative developments manifest, we will take appropriate actions. For now, we are maintaining current investment positioning.

Erik Ogard, CFA