Market Commentary – Volatility

In an increasingly volatile short-term environment, we have had several people ask us if we have any insight on what is going on as the Nasdaq is currently off over 2% midday (at the time of writing this). The largest mover in the market right now is DocuSign (DOCU), which has been trading at around -40% today.

Third quarter results, released Thursday, were the main reason for the stock being pummeled. What is unique is that quarterly revenue and earnings beat analyst estimates, but several factors suggest rapidly decelerating revenue growth.

For its fiscal 2022 third quarter (ended Oct. 31), DocuSign delivered revenue of $545.5 million, up 42% year over year, driven by subscription revenue of $528.6 million, up 44%. This resulted in adjusted earnings per share (EPS) of $0.58, surging 163% from EPS of $0.22 in the prior-year quarter. CEO Dan Springer said the weakening demand was particularly disappointing after the “exceptionally high growth rates at scale” DocuSign has delivered since the beginning of the pandemic. “After six quarters of accelerated growth, we saw customers return to more normalized buying patterns,” Springer said. (Motley Fool)

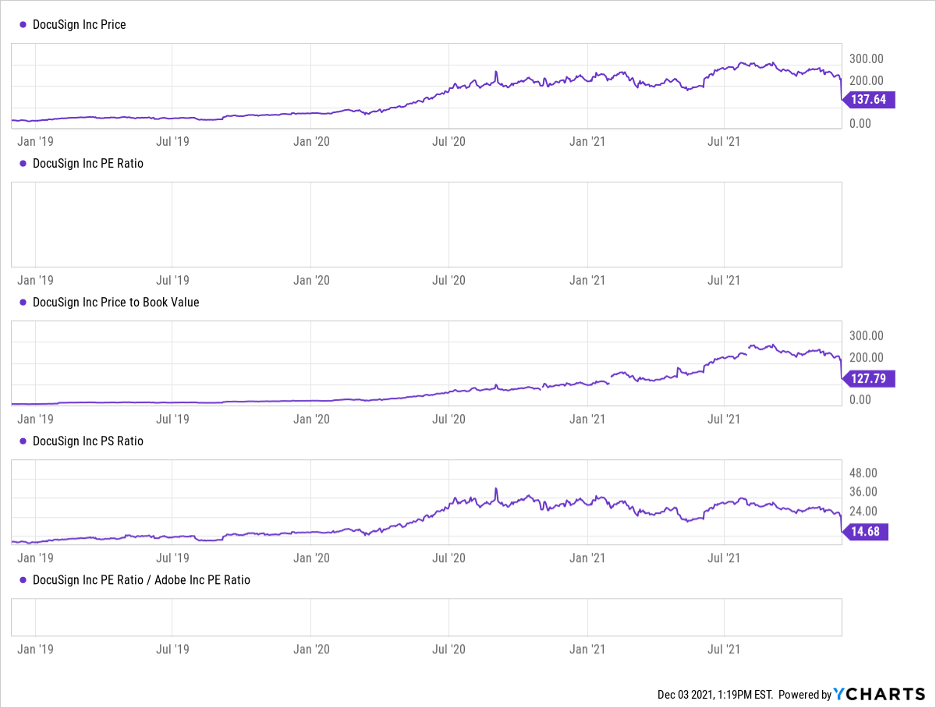

Some interesting takes from our side were that for the last 12 months, DocuSign showed revenues of $1.8 billion and a gross profit (not to be confused with net) of $1.38b. However, sales and marketing expenses ate up $930 million dollars of the gross. After several fiscal years of losses, analysts now feel less optimistic about the growth estimates and several high-profile banks downgraded the stock. Even after the current drop, the stock is still trading at over 14x sales. For context, according to Morningstar, the trailing 12-month price-to-sales ratio of the SPDR S&P 500 ETF (SPY) is around 3x.

DocuSign has a weight of 0.3% in the ETF that tracks the Nasdaq Index (QQQ). So, some quick back-of-the-napkin math would say that a holding in an index, that had a weight of 0.3%, and had a return of -40%, would cause the index to be down -1.2%, all else equal.