Mixed Messages: A Review of the First Quarter 2023

April 3, 2023

There were many eye-grabbing headlines related to the economy and capital markets in the first quarter. We continue to face uncertainty in the inflation outlook. The Fed’s rhetoric continues to be hawkish as it views inflationary pressures as the most significant threat to the economy and prosperity currently. Thus, during the quarter, the Fed raised rates twice, by 25 basis point each time. While it appears inflationary pressures are abating, and many expect the Fed to conclude its tightening process soon, there is still some uncertainty about the inflationary threat.

While it is uncertain whether the Fed’s rate tightening endeavors will bring about an economic recession, this outcome is a material possibility. We certainly witnessed some economic stresses in the quarter which are the consequence of higher interest rates. Chief among these stresses was the “mini crisis” we faced in the banking sector, with the failure and bailout of two US banks and one European bank.

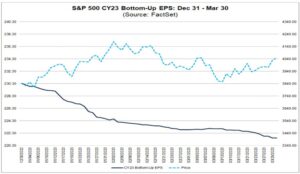

As these macro-economic factors played out during the quarter, Wall Street analysts were revising their bottoms-up corporate earnings outlooks for 2023 and 2024 downward. This is a picture of 2023 earnings expectations and the stock market performance during the quarter:

This chart is revealing and somewhat shocking. While earnings expectations dropped consistently throughout the quarter, the stock market went up! It went up even despite inflation, increasing interest rates, the rising risk of recession, and severe stress in the banking sector! You may ask, how is this possible? It seems to us the stock market is an unpredictable system that is looking ahead for marginal improvement even during times that are presently ugly. Certainly, all these things are “known” and priced within markets; and yet markets went up.

So, what gives? How should we conduct ourselves in the face of such vexing contradiction? We at WealthPlan can’t think of a better example of why we advise taking a long-term view of your investments and why we advocate for holding your investments for the long-haul to meet your long-term objectives. The short-term can be noisy, confusing, and even scary. So, don’t let the short-term derail your long-term strategy. As we have been saying, be prepared for continuing volatility and uncertainty as we transition through this more challenging macro-economic time. Things will get better over time. In the meantime, we continue to manage assets on your behalf considering the information available to us as we make new investments and rebalance portfolios. As always, we thank you for your business and the trust you place in us.

===========================================================================================

Advisory services offered through WealthPlan Group, a DBA for WealthPlan Investment Management, a subsidiary Registered Investment Advisor of WealthPlan Group, LLC. WealthPlan Group, LLC is not a registered investment advisor, but is the holding company for WealthPlan Partners LLC and WealthPlan Investment Management, LLC.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which Investment(s) may be appropriate for you, consult your financial advisor prior to investing. Information is based on sources believed to be reliable, however, their accuracy or completeness cannot be guaranteed.

No investment strategy can assure success or completely protect against loss, given the volatility of all securities markets. Statements of forecast and trends are for informational purposes and are not guaranteed to occur in the future. All performance referenced is historical and is no guarantee of future results. Securities investing involves risk, including loss of principal. An investor cannot invest directly in an index.

The information in this communication applies solely to the intended audience and in no way amends, revokes, or otherwise alters the existing agreements and relationships between WPIM and its clients. This communication is not a binding offer, expressed or implied. WPIM undertakes no obligation to update or revise the information herein or in any referenced third-party resource due to new information, future events or circumstances, or otherwise.

WealthPlan Investment Management (“WPIM”) uses data compiled and/or prepared by third parties (“Third Party Data”) in the delivery of Licensed Research and Data. Third Party Data is not owned by WPIM and user may be required to obtain permission directly from third parties for further use of Third-Party Data and may be required to pay a fee depending on the use contemplated by the user.