New Kid on the Block[Chain]

Mark Twain is often attributed the adage, “History doesn’t repeat itself, but often rhymes.” Wise words that have been reinforced again in the financial world.

I read an article recently that spoke of a hamster, one Mr. Goxx, who has outperformed both Warren Buffett, and the market by investing in various cryptocurrencies. This reminds me of one of the greatest tech investors of his day—the good chimpanzee, Raven Thorogood III, who in 1999 picked a basket of tech stocks which outperformed the market.

While these two esteemed asset allocators have different methodologies—one runs through tunnel A to sell an asset and tunnel B to buy, while the other threw darts at names to select his portfolio of assets—I find the parallels uncanny.

Many tech stocks of that era were not profitable but had big dreams. Most of the stocks launched in this era briefly burned brightly before burning up, yet it was also the crucible that saw companies like Amazon and eBay survive and flourish.

It could be argued that cryptos are in a similar boat today—a massive proliferation of coins, big dreams, and questionable avenues to success.

I am not saying I am like Paul ‘Maud’Dib’ Atreides from the classic book Dune–gifted with prescience–and prognosticating a giant crash (apologies for the sci-fi reference, I just re-read the book in anticipation of the new movie release). I am trying to draw the parallel between the two eras regarding education.

The average investor in 2000, did not know much about the internet, tech, and what these companies did. A lot of these companies talked a big game, couldn’t back it up and pursued some aggressive accounting to fund their wax wings and fared as well as Icarus.

At one point, merely adding ‘.com’ to a company’s name saw prices soar, much like adding ‘blockchain’ did not too long ago. It took the adolescent tech and internet sector, and the NASDAQ, a good deal of pain and some time to grow into the expectations of 2000; but grow they did.

Cryptocurrencies could be in a similar situation. Thankfully, the crypto industry may be gearing up for a step forward.

The Crypto Landscape

Looking at the landscape–Crypto markets are largely up over the last week, and according to coinmarketcap.com, the global market cap is sitting at $2.4T—that is a lot of money sloshing around.

While Bitcoin and Etherium command the lion’s share of the market cap, ~$1.5T between them, the remaining ~$1T are in almost 6600 alternative coins with names like TABOO TOKEN, Soda Coin, and ApeSwap Finance. Also, for you fans of Athletico Madrid FC—there is an Athletico De Madrid Fan token out there!

But which of these are going to be the Amazon or eBay, and which are the Pet.coms? Hard to tell, and those investing in the space right now are making those bets every day.

Thankfully, investors could see the advent of the first ever crypto ETF. Invesco and ProShares each have an ETF that could potentially launch as early as this week.

This will provide the retail investor with an opportunity to invest in various cryptocurrencies without needing to make those individual bets or invest in trusts which have lock-up periods, and large deviations from NAV, that until now were necessary to gain access to the space.

Just as mutual funds in the early 1900s and ETFs in the 1990s helped democratize the stock market, unlocking both affordable exposure and the returns of various markets, I think these crypto ETFs will do the same for crypto investors.

Possible Impact of Crypto ETF

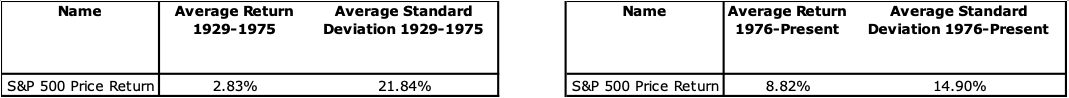

Looking from 1929 to 1975, the S&P 500 from its price appreciation returned modest 2.83% a year while the following 45 years witnessed an average return of 8.8% (Source: Morningstar Direct).

Source: Morningstar Direct

During that time mutual fund assets went from roughly $0 in 1929, with that year witnessing the birth companies such as MFS Investment Management, as well as mutual funds like Vanguard’s Wellington fund.

Interest and assets would steadily grow, reaching ~$2.5B by the end of 1975, and flourish to $22T as of the end of this September (Morningstar). These vehicles helped investors ride out the bad times, enjoy the good, while providing more stability to the market as evidenced by the fall in volatility from 22% to about 15%.

All this occurred during a period which saw the average lifespan for a company in the S&P 500 decline from 32 years to 21 between 1965 and now (statistica). An additional fun little factoid—the failure rate for a small business was 90% in 2019 (Investopedia).

While I am by no means saying that an ETF is the magic bullet to solve all issues people have regarding cryptos, it should help reduce the fear and the accompanying volatility that has been endemic in the space.

Readers should note that this is NOT a recommendation to purchase any specific ETF or, any specific cryptocurrency.

I started with a quote, so I find it only appropriate to end with one. Frank Herbert wrote in Dune a catechism which I think is just as appropriate when dealing with finance as his characters (spoilers!) found it for overthrowing intergalactic empires:

I must not fear.

Fear is the mind-killer.

Fear is the little-death that brings total obliteration.

I will face my fear.

I will permit it to pass over me and through me.

And when it has gone past, I will turn the inner eye to see its path.

Where the fear has gone there will be nothing. Only I will remain

By Nick Codola, Sr. Research Analyst