Positive Indicators for Prospective Inflation

April 10, 2023

Inflation has been with us for over two years and a central focus of the Fed since March of 2022. We have held the view that inflation is mostly a monetary phenomenon, meaning that excess money supply has been the primary cause of inflation.

Thus, we’ve seen the Fed’s interest rate increases as necessary to reduce and eliminate the excess money, and hence, the inflationary impulse from the economy.

On this front, there is indeed good news! Let’s look at some charts demonstrating the Fed is beginning to get a handle on inflation.

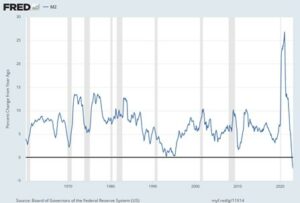

Since we view excess money as the primary inflation driver, let’s review this first. Here is a picture of the latest M2 money supply reading:

One can see that money supply skyrocketed in response to the COVID-related economic shutdown. We saw the drivers of this at work at the time: with the Fed aggressively lowering rates to zero, and aggressively growing its balance sheet; and with the US congress deploying so-called “helicopter money” by sending checks directly to the American consumer.

While these measures undoubtedly saved the economy from depression, this increase in money is most certainly the root cause of the inflationary impulse.

We think they over did it, especially on the balance sheet by staying with it way too long as inflation persisted. Nonetheless, we view the year-over-year change in money supply (depicted above) turning negative as a very constructive indicator that the Fed’s tightening policies (begun a year ago and a little late) to reduce inflationary impulses are working.

Given this change in money supply, we would hope to see a change in prices. So, let’s see what is observable in price-level data. First up are the so-called producer prices, which are the cost of goods in the form of commodities that producers use to make end-products for consumers.

Below is a picture of the year-over-year price changes in producer prices. Note we have dropped from a high year-over-year change of over 20% a year ago to just under 2.5% today! This is indeed good news and consistent with the view that money supply reductions should translate into lower prices.

Given that these producer costs discussed above directly translate into the costs of consumer goods, we would eventually expect these lower costs to lead to a reduction in consumer prices IF (and this is a big if) consumer demand is sufficiently stifled due to a generalized decline in economic conditions.

This is why the jobs market has been in focus. Some weakness in employment will translate to a reduction in aggregate consumer demand, and a reduction in consumer price inflation. So, let’s turn our attention to consumer prices next.

Below is a picture of the year-over-year percent change in consumer prices. As can be seen, we are also making downward progress in the rate of inflation for consumer prices. While current readings are just below 6% and down from a high of about 9%, the level still far exceeds the Fed’s 2% target.

However, if one accepts that money supply drives inflation and producer prices lead consumer prices, then the Fed’s inflation battle is almost over: it’s only a matter of time.

Could we experience a resurgence in the generalized price level if the Fed pivots too soon as was experienced in the 1970s? It would seem that the answer is yes and that this is a non-trivial risk.

This is why we have heard Fed chairman Jerome Powell utter the phrase “keep at it” with respect to the inflation fight. Pivoting too soon could be a policy mistake. Nonetheless, we think inflation will dissipate dramatically over the next six months.

As the inflation risk recedes, the threat of recession will come to the foreground of economic and capital market attention. In fact, recession risk is now more of a focus than inflation, and rightfully so.

Whether we experience recession, and the depth and diffusion of any recession, will determine the returns to stocks for the remainder of the year. It might be a soft landing, or it could be a hard one. Be prepared at this stage for either.

In the meantime, if you have questions or concerns, please contact us. We can provide perspective on the current conditions and the way forward. Thank you for the trust you place in us.

=====================================================================================================================================

Advisory services offered through WealthPlan Group, a DBA for WealthPlan Investment Management, a subsidiary Registered Investment Advisor of WealthPlan Group, LLC. WealthPlan Group, LLC is not a registered investment advisor, but is the holding company for WealthPlan Partners LLC and WealthPlan Investment Management, LLC.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which Investment(s) may be appropriate for you, consult your financial advisor prior to investing. Information is based on sources believed to be reliable, however, their accuracy or completeness cannot be guaranteed.

No investment strategy can assure success or completely protect against loss, given the volatility of all securities markets. Statements of forecast and trends are for informational purposes and are not guaranteed to occur in the future. All performance referenced is historical and is no guarantee of future results. Securities investing involves risk, including loss of principal. An investor cannot invest directly in an index.

The information in this communication applies solely to the intended audience and in no way amends, revokes, or otherwise alters the existing agreements and relationships between WPIM and its clients. This communication is not a binding offer, expressed or implied. WPIM undertakes no obligation to update or revise the information herein or in any referenced third-party resource due to new information, future events or circumstances, or otherwise.

WealthPlan Investment Management (“WPIM”) uses data compiled and/or prepared by third parties (“Third Party Data”) in the delivery of Licensed Research and Data. Third Party Data is not owned by WPIM and user may be required to obtain permission directly from third parties for further use of Third-Party Data and may be required to pay a fee depending on the use contemplated by the user.