Pre-Turkey Day Market Recap

Stocks ended last week weighed by growing concerns over nationwide COVID-19 lockdowns in Europe which pressured US stocks, oil, and the broader market. The markets were unsettled to start this week as the Austrian government announced a full lockdown starting on Monday, in response to cases of COVID-19 surging in Europe. The lockdown will include both those vaccinated and unvaccinated, it will last for 10 days minimum, but could be extended for 10 days further.

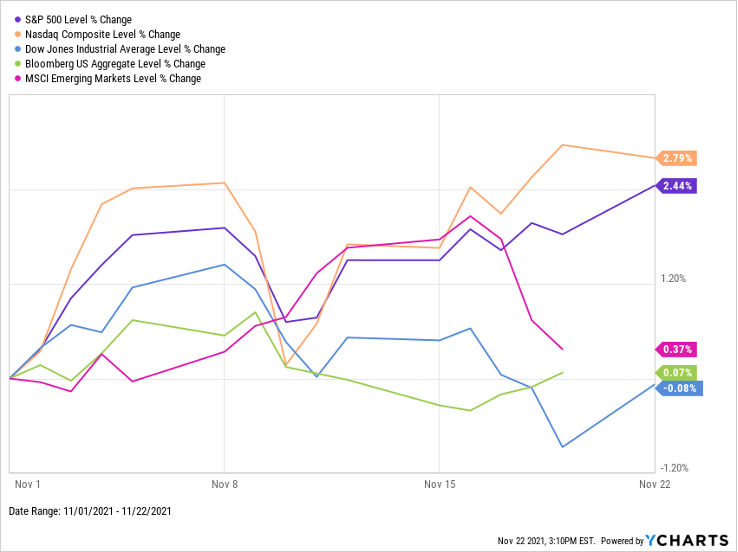

The start of a holiday-shortened week, the markets rallied on the announcement of Jerome Powell being renominated as the head of the Federal Reserve. However, the rally didn’t last throughout the entire day as markets sold off into the close. Month to date, the S&P 500 and the Nasdaq have both provided positive returns, while blue-chip stocks have been essentially flat. From a year-to-date perspective, US equities have notched a stellar return, while one of the classic placeholders for “higher risk”, emerging markets, has continued to drastically underperform.

More data on the inflation front is set to be released this week, which will further provide further clues about when the Fed may act from an interest rate perspective. The core personal consumptions expenditures (PCE) index from the Bureau of Economic Analysis, one of the primary inflation gauges used by the fed, will be released on Wednesday and is expected to be a significant increase. The PCE calculation differs from the CPI calculation in a few different ways. To put it simply, CPI is based upon the prices of a basket of goods, while the CPE takes into account that the basket may differ as prices change.

For more detail on that, you can click HERE.