Santa Claus Rally 2022?

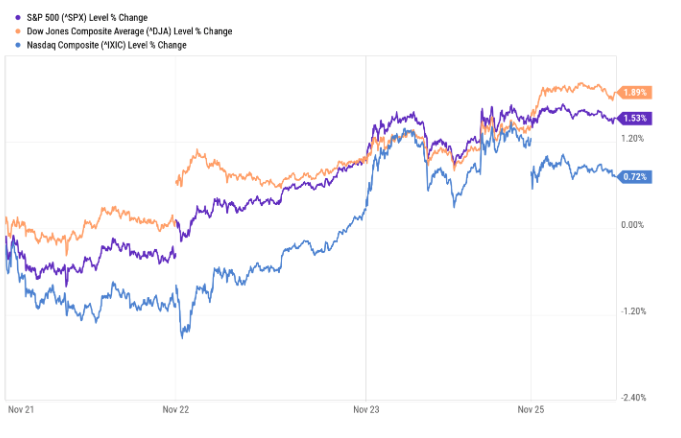

Markets were up last week in an abbreviated trading week (see chart below).

As we close November and ring in December, the debate among investors is whether we get a classical year-end “Santa Claus” rally. While a year-end rally has been reliable in the last many years, this year has been full of surprises. Consequently, the debate around this one is rancorous.

Could markets rally into year end? Sure. Earnings season is over, and the results were reasonably strong (see last week’s note). There will likely not be significant macro data surprises in the next month. Expectations are for the Fed to raise the Fed Funds rate by 50 basis points and for inflation to continue receding. Labor markets and employment remain robust. If things largely progress along these expectational lines, then a year-end rally seems plausible if not probable.

On the other hand, the yield curve is deeply inverted suggesting a high probability of recession in 2023. Additionally, stock valuations are still on the expensive side while forward earnings expectations are coming down. On top of this, there is burgeoning unrest in China and the war in Ukraine could lead to innumerable deeply negative outcomes. We could see further market declines into the year-end as investors begin to digest this more sobering reality. There are many factors that could potentially lead the market “zeitgeist” to tip toward bearishness in the next month.

For most investors, this is mostly just noise. Whether a December rally occurs or not, it is wise to keep the long-term in mind. What is your investment horizon and what is your risk tolerance? Is your portfolio appropriately positioned considering these things? As always, we advise having a conversation with your advisor if you are uncertain about whether your portfolio is correctly positioned to help you meet your goals. We are here to help you.

Advisory services offered through WealthPlan Group, a DBA for WealthPlan Investment Management, a subsidiary Registered Investment Advisor of WealthPlan Group, LLC. WealthPlan Group, LLC is not a registered investment advisor, but is the holding company for WealthPlan Partners LLC and WealthPlan Investment Management, LLC.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which Investment(s) may be appropriate for you, consult your financial advisor prior to investing. Information is based on sources believed to be reliable, however, their accuracy or completeness cannot be guaranteed.

No investment strategy can assure success or completely protect against loss, given the volatility of all securities markets. Statements of forecast and trends are for informational purposes and are not guaranteed to occur in the future. All performance referenced is historical and is no guarantee of future results. Securities investing involves risk, including loss of principal. An investor cannot invest directly in an index.

The information in this communication applies solely to the intended audience and in no way amends, revokes, or otherwise alters the existing agreements and relationships between WPIM and its clients. This communication is not a binding offer, expressed or implied. WPIM undertakes no obligation to update or revise the information herein or in any referenced third-party resource due to new information, future events or circumstances, or otherwise.

WealthPlan Investment Management (“WPIM”) uses data compiled and/or prepared by third parties (“Third Party Data”) in the delivery of Licensed Research and Data. Third Party Data is not owned by WPIM and user may be required to obtain permission directly from third parties for further use of Third-Party Data and may be required to pay a fee depending on the use contemplated by the user.