Thanksgiving Market Recap

Stocks jumped Monday morning to recover some losses after Friday’s slide, when uncertainty over a new coronavirus variant stoked volatility across global markets. After staging a significant recovery year to date, Oil prices shed about 10% on Friday based on the potential for lockdowns on travel.

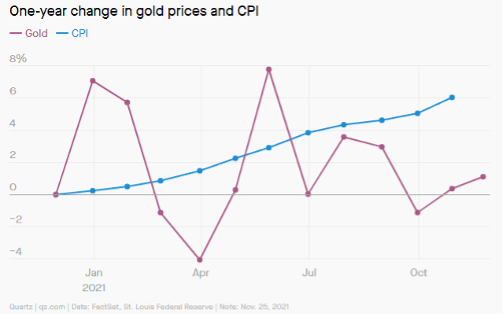

A paper released over the weekend from Duke University questioned the long-standing claim that gold is an effective inflation hedge, which has proven to be accurate, at least over the last year. “One of the reasons gold is seen as an inflation hedge may go back to August 1971, when US president Nixon closed the “gold window.” Until then, central banks around the world had been able to convert US dollars to gold at a fixed rate of $35 an ounce. Inflation took off after Nixon severed that link, and the price of gold also rocketed higher.” (Quartz).

While inflation has been one of the main themes recently, The federal reserve published the November Financial Stability report last week that highlighted one of the things that we’ve also been watching: asset valuations. To summarize the report available HERE, the fed sees that high valuations on assets as being a concern. While businesses and households aren’t over-leveraged right at the moment, expiration of government support programs and the uncertainty of the current/future pandemic pose “significant risks to households”.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which Investment(s) may be appropriate for you, consult your financial advisor prior to investing. Information is based on sources believed to be reliable, however, their accuracy or completeness cannot be guaranteed. Statements of forecast and trends are for informational purposes and are not guaranteed to occur in the future. All performance referenced is historical and is no guarantee of future results. Stock investing involves risk, including loss of principal. An investor cannot invest directly in an index. There is

no guarantee that a diversified portfolio will improve returns or that it will always protect against loss, given the inherent volatility of securities markets. Advisory services offered through WealthPLAN Partners. Securities offered through Securities America, Inc., Member FINRA/SIPC. WealthPLAN Partners and Securities America are separate and unaffiliated entities.