The Inflation Threat is Receding

May 15, 2023

We had two important inflation releases last week for inflation data through April. Looking at inflation expressed as a percentage change from a year ago, we can see inflation readings receding.

The red line depicts the Consumer Price Index, and the blue line shows the Producer Price Index (commodities). Producer prices are the cost of the raw goods to produce consumer products; so, we can rationally expect consumer prices to come down in a manner resembling the move in commodities. It seems to us this is simply a matter of time. By the year end, we expect the Fed to declare victory over inflation.

What has caused inflation to decline?

To put it curtly: the Fed. How?

1.By raising interest rates. The chart below depicts the most rapid rate increase in history from a base of nearly zero. That move represents hitting the financial brakes hard.

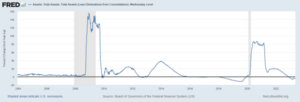

2.By reducing its balance sheet. In addition to raising rates, the Fed has rolled assets off its balance sheet, which has pulled money out of the economy. The two charts below depict the Fed’s balance sheet assets. The first shows the absolute level of balance sheet assets, the second shows the percent change from a year ago.

The effect of these two policy changes has caused the money supply to contract rapidly. We think this rapid reduction in money supply is the direct consequence of the Fed’s policies AND the direct cause of the receding inflation numbers.

The only significant remaining question for the coming months is whether the economy experiences a “soft landing” (a so-called earnings recession) or a full-blown economic recession-the dreaded “hard landing.” This is the subject that we will spend our time analyzing over the coming months.

==============================================================================

Advisory services offered through WealthPlan Investment Management, LLC.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which Investment(s) may be appropriate for you, consult your financial advisor prior to investing. Information is based on sources believed to be reliable, however, their accuracy or completeness cannot be guaranteed.

No investment strategy can assure success or completely protect against loss, given the volatility of all securities markets. Statements of forecast and trends are for informational purposes and are not guaranteed to occur in the future. All performance referenced is historical and is no guarantee of future results. Securities investing involves risk, including loss of principal. An investor cannot invest directly in an index.