The Rising Tide of Advisor Independence

Not many people watch the headlines like advisors. Especially in recent days, some of these headlines have stirred up controversy in the financial planning world. In addition to the normal clamor of investing news, this new controversy is talking about the business model of financial planning.

At the center of this disruption: an accelerated movement away from the big brand wirehouses and toward advisor independence. Today, we dig into why this is happening and the reaction it’s creating.

The Fastest Growing Advisor Business Models

It’s no secret that the fastest-growing business model for advisors is the Hybrid RIA model. Add to this the fee-only independent model, and you see an exodus-like movement toward independence.

While it’s not exactly surprising that advisors are being drawn towards independence, it’s still remarkable considering the meaningful workload involved in making the switch. Something is motivating advisors to make the change despite the transitional effort required.

Even more noteworthy is that an incredible 90% of advisors who switch to an RIA model are glad they made the change. Let’s look at the animating factors driving this industry trend.

Advisors Want More Control Over Their Business

It has become increasingly clear that this movement is not just a “grass is always greener” sensation. Advisors are being motivated to move their practices in response to the lack of control in their current environment.

One example that made headlines recently came from Merrill Lynch, shooting into the trending column on LinkedIn. AdvisorHub ran an article titled “Merrill Raises Grid And Growth Hurdles, Shrinks Payout on Brokerage”, highlighting Merrill’s decision to adjust their compensation grid. The result? Brokers were required “to produce more to maintain their same payouts”.

It served as a stark reminder that advisors under the Merrill umbrella had little to no control in their relationship with the brand. More challenging was the fact that Merrill, like most larger wirehouses, was already requiring large fees. One example in the article cited a $1 million producer receiving only a 41% payout, a drastic difference from the payout rates of independent advisors. (In contrast, WealthPlan Group advisors can get 80% or more.)

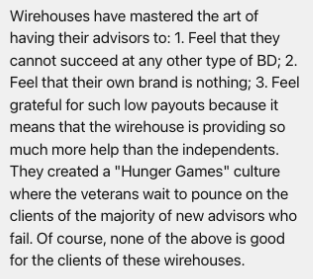

Here are a few of the responses from advisors as the news made the rounds.

With headlines emphasizing the lack of control advisors have over their businesses, another data point is added to the scales in favor of independence.

Advisors Want More Freedom in Selecting Products for Their Clients

In addition to the advisor’s lack of control over their business, they also are restricted in their ability to provide their clients with products they feel are the best fit for their needs. There is a natural logic to the wirehouse model, which builds a business model with the purpose of promoting its products. For the advisor though, the strain of those limitations can create frustration.

The alternative appeals to these advisors on a moral fiduciary level as well as a business level. Being independent affords you far more leeway to serve your clients as your fiduciary role allows.

This element alone is not usually the straw that breaks the camel’s back, but it’s a notable factor in the decision for many independent advisors.

Advisors Want More Influence Over Their Brand

Many advisors aren’t just financial – they’re entrepreneurial as well. You take a sense of ownership in your work and your relationships. As a result, you tend to want your business to reflect the values that drive you and the sense of connection you create. In a wirehouse setting, the marketing tends to focus heavily on the brand, not the people. It creates a scenario in which your vision as an advisor gets placed on the back burner in exchange for corporate vision.

For the advisor who is already feeling friction in the first two areas (lack of control over your business and your advice), this is another wedge in the growing divide between your career and your corporate environment.

The freedom independence provides advisors to pursue their vision is not inconsequential. It resonates with that entrepreneurial core that fuels many advisors. Becoming an independent advisor gives you the freedom to craft a brand that aligns with the values, specializations, and heart behind your business.

And this is far from being just an emotional draw. It’s a permission slip to build your branding and marketing around the facets of your business that drive your unique success. It’s the ability to hold up a magnifying glass to your differentiated strengths and attract more ideal clients.

Exploring a Transition to Independence?

At WealthPlan Group, we provide an ecosystem for advisors that are looking for supported independence. With access to an industry leading tech stack, responsive compliance, and innovative tools like our Outsourced CIO, advisors are equipped with the support they need to succeed.

If you’re interested in making the switch, here are two actions you can take:

Continue Researching