Volatility as Markets Seek Equalibrium

In our year-end commentary just a month ago we observed that equity markets had experienced strong returns for many years primarily due to extremely supportive Fed policies. The consequent more-than-decade-long bull run resulted in extended equity valuation levels. While we acknowledged strong corporate earnings had contributed substantially to the equity bull market, we nonetheless made the case that investors should temper their return expectations AND expect more volatility.

The basis for this caution stemmed from our view that the Fed would need to become more aggressive with its monetary policies in order to fight a meaningful inflationary threat. This threat was made far more serious for stocks due to their high valuation levels. No sooner had the ink dried on that letter, than the tenor of market expectations had shifted dramatically to align with our view more closely.

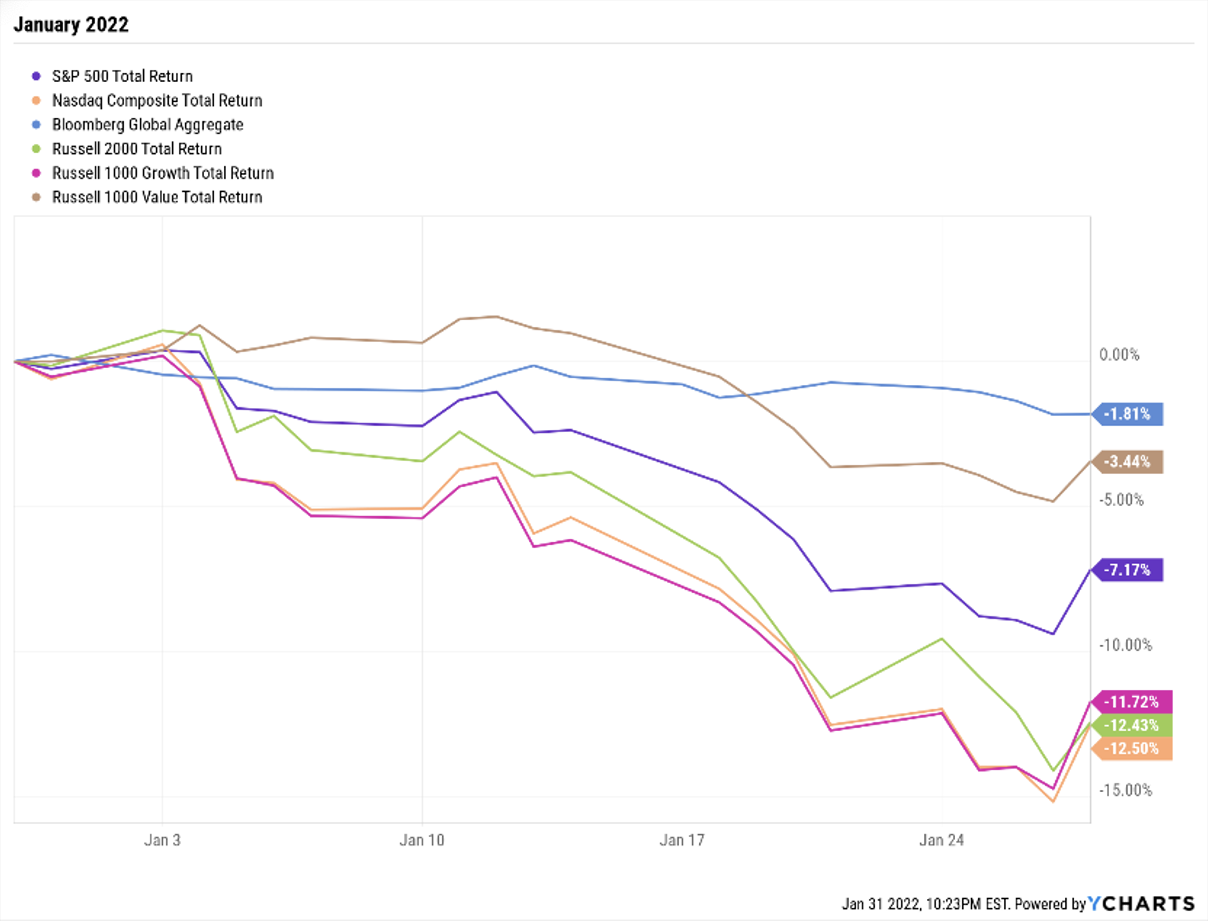

The return chart below shows the performance of capital market returns for the month of January. The tech heavy Nasdaq, with its high valuation profile, was the hardest hit in the month. There was really nowhere to hide, as even bonds retreated in the month in response to rising market interest rates.

While the market is off its lows for the month, we are not certain that the full weight of the inflationary threat nor the required policy response is fully understood. Given this uncertainty and combined with the fact that stocks remain expensive, we continue to advocate for tempered expectations.

In his 1994 investor letter, Warren Buffett attributed the following to his mentor, Benjamin Graham, “In the short-run, the market is a voting machine — reflecting a voter-registration test that requires only money, not intelligence or emotional stability — but in the long-run, the market is a weighing machine.” We think this is an apt description for what is happening in 2022 so far. The market’s wild intraday reversals, day-to-day reversals, and heightened volatility—the so-called short run voting—are likely to continue until the inflationary threat and Fed policy response are more clearly known. It could be during the longer-term weighing process the market finds a new equilibrium with lower valuation levels. Whatever the case, it is worth restating some foundational principles of your investment plan.

As markets sort all of this out, we remind you of the following:

- You have a long-term plan as devised by you and your financial advisor

- This long-term plan reflects long term expected returns from the capital markets

- The plan also accounts for the fact that even though all securities markets are inherently volatile, there are times when markets are more volatile, and sometimes markets go down in value because of this volatility—even a lot

- Ultimately, this plan seeks to deliver you the retirement income you require and desire

- If you need some reassurance or would like to revisit the elements of your plan to ensure you are still on target, we encourage you to have a conversation

Finally, rest assured we are considering market conditions—including inflationary threats, volatility levels, and policy implications—in our investment management program. If you would like to understand the nuances of investment management decisions, we welcome that conversation too.

Thank you for your continued faith and confidence.

Erik Ogard, CFA®, CIO