A Macroeconomic Check-In

June 26, 2023

Macroeconomic conditions usually provide excellent context for understanding the earnings picture for stocks. However, lately, there has been a lot of uncertainty about how the macro-economic picture is likely to unfold and how it is affecting the corporate earnings outlook. Mixed messages with maximum uncertainty is a decent way to describe it. Let’s look at some of the data to contextualize this statement.

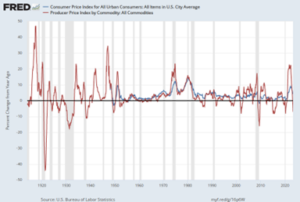

On the positive side, inflation is abating. Below is a picture of the percentage change year over year in both PPI (in red) and CPI (in blue). You can see year-over-year changes in producer prices have gone negative, while changes in consumer prices are headed toward the Fed’s long-term inflation target. This bodes well for future rate increases with the thought the Fed may be close to finishing its rate campaign, having paused at the June meeting. They may even be finished raising rites despite the hawkish rhetoric.

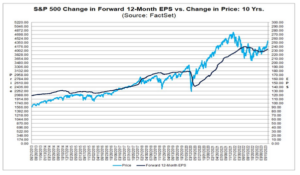

The declining inflation backdrop appears to be leading to a more constructive outlook for prospective earnings. Below is a picture of consensus earnings expectations provided by FactSet.

One can see that after a period of decline (in dark blue), expectations are for a return to earnings growth. The stock market (light blue) is clearly rallying in anticipation of corporate earnings growth returning to a growth trendline. Will this optimism continue, or will the Fed tightening cycle throw a wet blanket on the nascent rally and expected recovery?

One way to answer this question is to look at the yield curve. Here is the current picture. The image on the left is a five-year view and the image on the right goes back to the 1970s. The long-term perspective is helpful because we can see when the yield curve inverts, it is always a precursor to recessions. But so far in this cycle, the economy has proven resilient in the face of rate increases. Hence, the confusion and or uncertainty being experienced by many.

So, the 40 trillion-dollar question is: will it be different this time? Will Wall Street analysts get is right as we resume earnings growth? Or will the yield curve inversion eventually be right and foretell of a deeper earnings recession? This is the primary question to be answered over the remainder of the year.

=====================================================================================

Advisory services offered through WealthPlan Group, a DBA for WealthPlan Investment Management, a subsidiary Registered Investment Advisor of WealthPlan Group, LLC. WealthPlan Group, LLC is not a registered investment advisor, but is the holding company for WealthPlan Partners LLC and WealthPlan Investment Management, LLC.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which Investment(s) may be appropriate for you, consult your financial advisor prior to investing. Information is based on sources believed to be reliable, however, their accuracy or completeness cannot be guaranteed.

No investment strategy can assure success or completely protect against loss, given the volatility of all securities markets. Statements of forecast and trends are for informational purposes and are not guaranteed to occur in the future. All performance referenced is historical and is no guarantee of future results. Securities investing involves risk, including loss of principal. An investor cannot invest directly in an index.

The information in this communication applies solely to the intended audience and in no way amends, revokes, or otherwise alters the existing agreements and relationships between WPIM and its clients. This communication is not a binding offer, expressed or implied. WPIM undertakes no obligation to update or revise the information herein or in any referenced third-party resource due to new information, future events or circumstances, or otherwise.

WealthPlan Investment Management (“WPIM”) uses data compiled and/or prepared by third parties (“Third Party Data”) in the delivery of Licensed Research and Data. Third Party Data is not owned by WPIM and user may be required to obtain permission directly from third parties for further use of Third-Party Data and may be required to pay a fee depending on the use contemplated by the user.