A Time for Patience

A Market Commentary by WealthPlan Group || Written July 25th, 2022

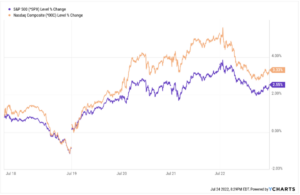

The stock market has rallied some which has some people believing the market low has been set. Here’s a chart below of stock prices for this past week. We certainly aren’t going to complain because rallies after losses are nice, much like a refreshing rain after a dry spell. We’ll take them! While it is tempting to see this rally as an indication that the market low is in, we are cautious about concluding this currently for three reasons:

- The Fed is still raising rates to fight inflation

- The amount of economic slowing is accelerating in the economic data

- Stock valuations are still on the higher side

So rather than focusing on a five-day chart, we’d like to extend the reference frame. Below is a technical chart of the S&P 500 Index on a year-to-date basis:

One can see from this chart the degree of the rally since the June low in a broader context. What probably has some observers claiming the bottom is in is that stock prices are once again trading above their 50-day moving average (the blue line). Interestingly, this has happened once already this year back in March. Much of this current rally is technical in our view. The market has been backfilling some prior gaps down in the chart that occurred in early June. This is normal; markets like to fill gaps.

What of the longer-term prospects? In this regard, even when conviction is high, we are really talking about degrees of possibility. It is certainly possible that the lows are in. But we think this is not likely for the three reasons listed earlier. Plus, we haven’t yet seen what looks like a capitulatory low with VIX levels rocketing upward. Whether or not this happens remains to be seen but usually market lows are set in a capitulatory crescendo.

So it is against this backdrop that we enter this week, a Fed week. By the close of this week, we will have learned a great deal about the macro factors this market cares about. We will see what the Fed does on Wednesday with interest rates in response to the inflationary threat even as hundreds of earnings announcements are made. We will also learn a little more about the likelihood of recession as the Fed seeks to quell inflation. This week is important.

Whatever the short-term market gyrations may be, we continue to focus on long-term capital market return drivers. Stocks will recover from this episode and our clients will be positioned to benefit from those gains when stocks again resume their long-term upward trajectory. In the meantime, this is a period where “thoughtfully doing nothing” (as we like to say) will provide dividends well into the future.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which Investment(s) may be appropriate for you, consult your financial advisor prior to investing. Information is based on sources believed to be reliable, however, their accuracy or completeness cannot be guaranteed. No investment strategy can assure success or completely protect against loss, given the volatility of all securities markets. Statements of forecast and trends are for informational purposes and are not guaranteed to occur in the future. All performance referenced is historical and is no guarantee of future results. Securities investing involves risk, including loss of principal. An investor cannot invest directly in an index.

Advisory services offered through WealthPlan Investment Management, a subsidiary Registered Investment Advisor of WealthPlan Group, LLC.