Buy and Hold Investing: The Why and The How

June 5, 2023

Great Companies and the Power of Doing Nothing!

Over 30 years ago, I entered the investment business after a two-year stint in graduate school. During these formative years, I developed a list of companies I thought were great growth opportunities based on their business models, brands, and competitive advantages. What follows is a look back at a handful of such stocks that have proven their worth over time.

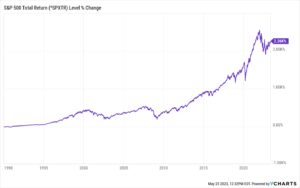

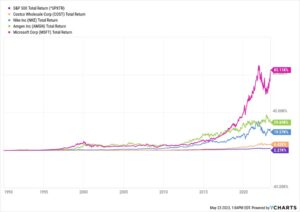

But first, let’s look at what the S&P 500 index has produced in total return over this 33-year period. One can see the S&P produced a 2,260% return over the period. This means a $10,000 investment into the S&P 500 Index would have grown to $226,000. Not bad…not bad AT ALL! Now, let’s turn our attention to some of the growth companies with the characteristics I highlighted above.

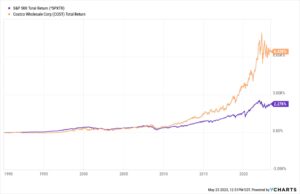

First up is Costco Wholesale. Since 1990, Costco Wholesale has grown into a dominant retailer. It has done this by focusing fiercely on competitive pricing through volume and cost management. Costco is known for limiting its gross margins to a razor thin amount…passing it’s cost advantages on to the consumer. This has been a magical formula, driving a $10,000 investment in 1990 to a whopping $642,000, and outperforming the S&P 500 Index by a massive 3 times.

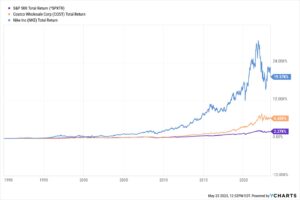

Next up is Nike, Inc. Nike is a famous sports apparel and footwear company. It has developed into a dominant global brand known for affiliating its brand with the best athletes in the world and for its imperative slogan “Just Do It.” From a company with about a billion in sales in 1990, Nike is now selling about $46 billion in goods per year with a market cap of $165 billion. A $10,000 investment in 1990 would be worth $1.95 million.

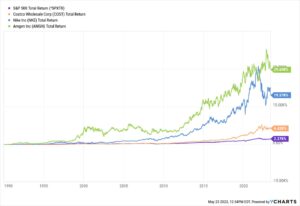

Next up is Amgen. Amgen is a biotech company that is at the forefront of combining big data, the mapping of the human genome, and drug trials in innovative fashion. The result has been phenomenal. Amgen has grown into the world’s largest pure play biotechnology company with annual sales of $26 billion and a market cap of $116 billion. A $10,000 investment in Amgen in 1990 would have grown into a $3 million value today.

Last up is Microsoft. Microsoft in 1990 was a relatively new start-up that had yet to develop Windows 95, its knock off of Apple’s operating system that led to meteoric growth. In 1990 many of my college peers were working at Microsoft. Many of them are now multi-millionaires today due to the stock. Microsoft has grown into one of the largest and most successful companies in history (along with a handful of others like Apple and the rest of the tech giants.) Apple and Microsoft have performed similarly over this period. A $10,000 investment in Microsoft in 1990 would have grown to $8.5 million today.

Conclusion

This is admittedly an exercise in looking back when hindsight is 100% accurate. Nonetheless, these were companies I had studied in graduate school and all companies I liked a lot due to their brands, business models, and products. Could I have known how they would perform or the magnitude of their outperformance? No. But did I know these were differentiated companies that were leading their industries and innovative in their growth and execution strategies? Yes. The lesson here is to work on the business model differentiators. Decide which companies have sustainable long-term advantages and buy them. Then do nothing.

=====================================================================================

Advisory services offered through WealthPlan Group, a DBA for WealthPlan Investment Management, a subsidiary Registered Investment Advisor of WealthPlan Group, LLC. WealthPlan Group, LLC is not a registered investment advisor, but is the holding company for WealthPlan Partners LLC and WealthPlan Investment Management, LLC.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which Investment(s) may be appropriate for you, consult your financial advisor prior to investing. Information is based on sources believed to be reliable, however, their accuracy or completeness cannot be guaranteed.

No investment strategy can assure success or completely protect against loss, given the volatility of all securities markets. Statements of forecast and trends are for informational purposes and are not guaranteed to occur in the future. All performance referenced is historical and is no guarantee of future results. Securities investing involves risk, including loss of principal. An investor cannot invest directly in an index.

The information in this communication applies solely to the intended audience and in no way amends, revokes, or otherwise alters the existing agreements and relationships between WPIM and its clients. This communication is not a binding offer, expressed or implied. WPIM undertakes no obligation to update or revise the information herein or in any referenced third-party resource due to new information, future events or circumstances, or otherwise.

WealthPlan Investment Management (“WPIM”) uses data compiled and/or prepared by third parties (“Third Party Data”) in the delivery of Licensed Research and Data. Third Party Data is not owned by WPIM and user may be required to obtain permission directly from third parties for further use of Third-Party Data and may be required to pay a fee depending on the use contemplated by the user.