Courage

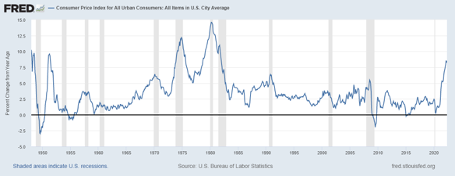

The Fed meets again this week to determine its policy track with respect to interest rates and its balance sheet. What is clearer, heading into this week’s meeting than it has been before prior meetings, is that the inflation problem is WAY WORSE than the Fed has acknowledged up to this point. Inflation is not transitory. Inflation has not peaked. It’s not even close. Here’s a picture of CPI through May and published Friday. All of us are feeling this via higher prices in everything but probably nothing hurts worse than the gas pump. Ouch.

So, we all see the problem and the policy response is going to need to be way more aggressive than it has been to bring inflation under control. The time of waiting and hoping is over. Hoping for a soft landing and abatement of inflationary forces without collateral damage at this stage seems like fanciful thinking. And hoping for such probably leads to an ineffective rate policy. Now is the time for action. Aggressive action.

Jerome Powell is on record saying that IF inflation comes in hotter than expected, the Fed will act decisively. Well, this week we will test the Fed’s resolve. We are going to see if there is policy follow through to support the rhetoric. And it’s going to take courage. Why courage? Because the risks are great. And the type of policy change required to bring inflation under control is way outside the Fed norm. The Fed cannot remain incremental. Rate increases will need to be far more abrupt than normal…and their magnitude will need to be much, much larger. 25 basis points won’t cut it. Neither will 50 or even 75.

This requires courage because the stakes are very high. There will be collateral damage which will include the potential for a more severe market sell-off, the potential for an economic recession, and the potential for unemployment. I believe that it’s all possible and that it could be disastrous. However, not doing enough with inflation raging could be even more disastrous. The Fed really has no choice. To delay aggressive policy response is tantamount to delaying chemotherapy when confronting cancer. There is no benefit and only harm with delay. Now is the time for decisive action and it will require courage from Mr. Powell and the Fed Board of Governors. We wish them well, Godspeed, and all the courage they can muster to do what we believe must be done. It could prove to be their finest hour if they rise to the challenge before us.

What are investors to do? Making huge asset allocation moves is always problematic and we never advise it. Investing and building wealth over the long haul is never about market timing. Market timing is just too difficult, fraught with error, and prone to disappointment. What can be done other than market timing? Our advice continues to be to revisit your risk tolerance in the context of your unique circumstances and your financial plan. How far are you from retirement? What are your savings? Do these things align with your risk posture within your portfolio? A conversation with your advisor will determine whether changes are in order. Also, know this: we will get through this period —no matter how challenging—and American prosperity will advance along the path, as it has for 246 years. We Americans have always come back over the course of all the episodes like this and worse in our history. We look forward to the day when we can begin thinking about America’s next great growth companies. We are closer to that day now than we were in December. We can’t wait to write about it!