Earnings in Focus

Approximately 2,300 publicly traded companies will report earnings this week. As such, it is a big week for earnings and by the end of it, we should have a good read on the overall tenor of earnings for the quarter ended September 30th. This is a pivotal quarter because the aggregated analyst estimates for all S&P 500 companies are calling for a return to growth in earnings after three consecutive declining quarters.

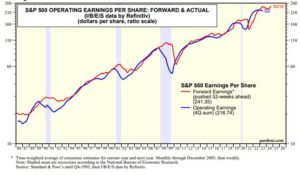

The chart below from Yardeni Research shows expected aggregate earnings for the current year (in blue) of $216.74 for the S&P 500 Index overall (combined size weighted earnings for the entire index). If this is correct, the S&P is trading at about 20 times trailing earnings. For 2024, the consensus expectation is for earnings to come in at $241.35. This implies a forward P/E multiple of 17.5. This becomes a great benchmark against which to compare actual earnings results as they come in over the next few weeks. If these earnings levels do, in fact, manifest for 2024, then a year from now a trailing PE of 20 would put the S&P at 4800 one year from today.

This, then, is the primary reason this specific earnings season is pivotal: if we get the earnings growth expected by analysts and it continues as expected into 2024, then there are 10-12% in potential equity returns to be had. Conversely, if those expected earnings fail to materialize, then we could be looking at delayed gratification when it comes to earnings and stock market returns. We will check in on the earnings reports for the third quarter sometime in late November. As always, we thank you for your business and the trust you place in us to manage your wealth.

============================================================================================

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S. The S&P 500 index is regarded as one of the best gauges of prominent American equities’ performance, and by extension, that of the stock market overall.

Indices are unmanaged. An investor cannot invest directly in an index. They are shown for illustrative purposes only and do not represent the performance of any specific investment.

Advisory services offered through WealthPlan Group, a DBA for WealthPlan Investment Management, a subsidiary Registered Investment Advisor of WealthPlan Group, LLC. WealthPlan Group, LLC is not a registered investment advisor, but is the holding company for WealthPlan Partners LLC and WealthPlan Investment Management, LLC.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which Investment(s) may be appropriate for you, consult your financial advisor prior to investing. Information is based on sources believed to be reliable, however, their accuracy or completeness cannot be guaranteed.

No investment strategy can assure success or completely protect against loss, given the volatility of all securities markets. Statements of forecast and trends are for informational purposes and are not guaranteed to occur in the future. All performance referenced is historical and is no guarantee of future results. Securities investing involves risk, including loss of principal. An investor cannot invest directly in an index.

The information in this communication applies solely to the intended audience and in no way amends, revokes, or otherwise alters the existing agreements and relationships between WPIM and its clients. This communication is not a binding offer, expressed or implied. WPIM undertakes no obligation to update or revise the information herein or in any referenced third-party resource due to new information, future events, or circumstances, or otherwise.

WealthPlan Investment Management (“WPIM”) uses data compiled and/or prepared by third parties (“Third Party Data”) in the delivery of Licensed Research and Data. Third Party Data is not owned by WPIM and user may be required to obtain permission directly from third parties for further use of Third-Party Data and may be required to pay a fee depending on the use contemplated by the user.