Play The Long Game

Monday, May 9th, 2022

“He who stands on his tiptoes does not stand firm; he who stretches his legs does not walk easily…Thus it is that the Great man abides by what is solid, and eschews what is flimsy; dwells with the fruit and not with the flower.” –Assorted passages from The Tao Te Ching

Most advisors have probably fielded the question ‘Is now a good time to get into the market?’ at least once in their career. That question implicitly asks, ‘Can I get the best return now, and how can I do that’? While having ambition can be laudable, unreasonable ambition, namely market timing, is certainly a folly. Instead of asking whether now is a good time to get into the market, better questions might be: ‘Is the long term expected return sufficient for my needs?’, ‘Do I have a long enough time horizon to see this through?’, and ‘is this investment and the people running it reliable?’

Provided one can answer those three questions affirmatively, the answer about when to get into the market is ‘Yes’.

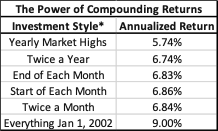

To better establish healthy expectations, we ran a study on the S&P 500 over the last 20 years, utilizing a few different calendar investing styles. Setting unrealistic market timing expectations requires near prescient ability to forecast optimal moments to deploy cash and is a sure-fire way to create disappointments.

To help allay investor concern, we decided to run a thought experiment—“What if we were the absolute worst investors?” What if, through a combination of horrible judgement and bad luck, we managed to invest an equal amount of money in every calendar year at the market top from 2002 to 2022. What would have happened is outlined in the graph below:

*Net purchases of $1 in the S&P 500 per year in each strategy type. All returns calculated on the S&P 500 TR Index sourced from Morningstar Direct

People may want to be number one in life, investing, sports, etc, but when the goal is to be #1 what does #2 mean? That person is the first loser. Shifting the goal posts, what does #2 mean in a competition to not be the ‘Worst Investor Ever’? That person is the first winner. Someone who set a portion of their paycheck to automatically investment into the market earned at least additional 1% more per year over that supremely unlucky fellow who hit every market high. The key here is a long investment horizon which enabled investors to unlock the power of compounding returns.

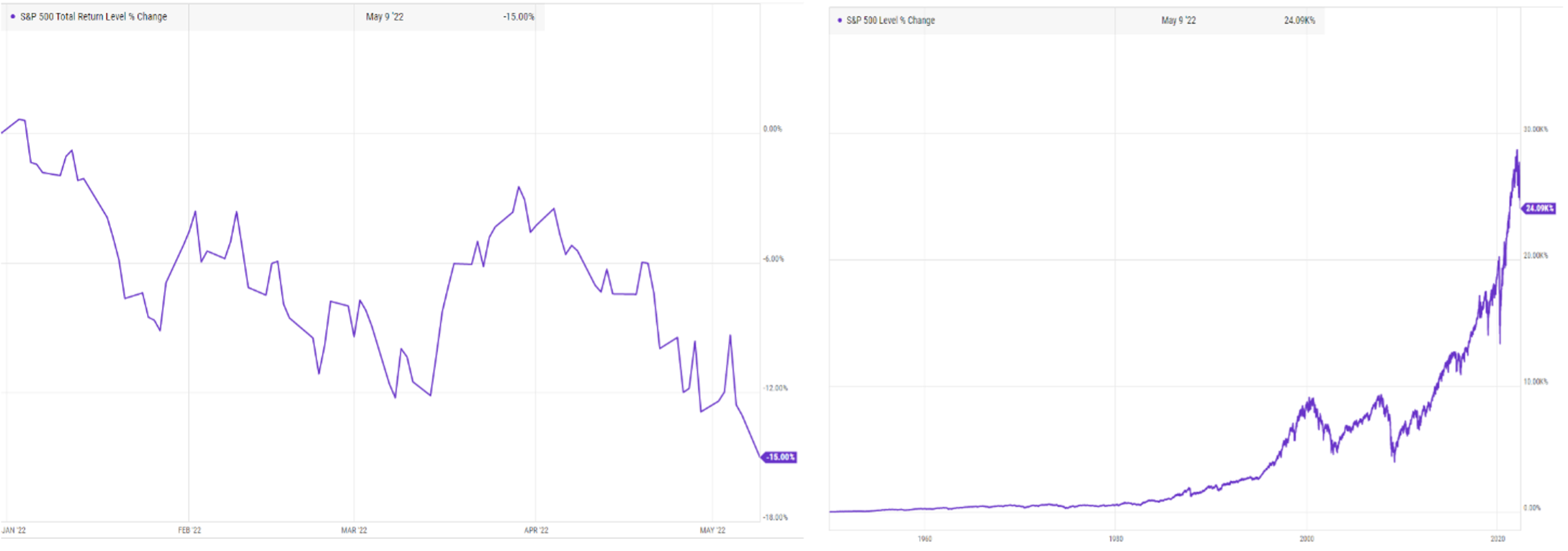

The longer the time horizon, the higher the odds that the market will return a positive return for an investor, though certainly there will be bumps along the way. In finance we describe this behavior of the markets as a random walk with an upward drift. That is a $5 phrase, so let’s unpack that. Random Walk—a math term characterizing that the individual steps or increments can be unpredictable, or random in its motion. Upward Drift—a description of the longer-term 10,000-foot view of the behavior indicating it generally goes up. Throw it all together: in the short-term the market can be random, and we couldn’t tell you what it will do, but in the longer-term it will be higher than it is now. The below graphs from YCharts, visualize the S&P 500’s movements, year-to-date, and since inception, respectively. There are points throughout the graph if viewed too closely where its movements seem random, making it difficult to discern an overall pattern. However, when stepping back, in the long-term it is easy to see the upward drift.

In another extreme example, what if someone dumped all the money they would ever make in the S&P 500 back in Jan 2002. That time was not dissimilar to today—it was a period marked by volatility and declining markets with lots of associated uncertainty. Taking a long-term view and not selling in the uncertainly, namely a buy-and-hold investor who took advantage of the upward drift, would have been successful. The chart below shows some select forward returns from that investment date in the shorter-term. Note: periods longer than one year are annualized.

All returns are from Morningstar Direct

As you can see, an investment can start off badly but still work out OK in the long run. Hopefully, during these volatile and uncertain times, this perspective has provided you with some comfort that a long-term horizon will very likely produce good results and help you meet your long-term investment goals. Our job as advisors is to make sure we help our clients achieve their financial goals in a prudent manner; to ensure that they don’t spend their whole life’s journey walking on their tiptoes.