What’s the S&P Worth?

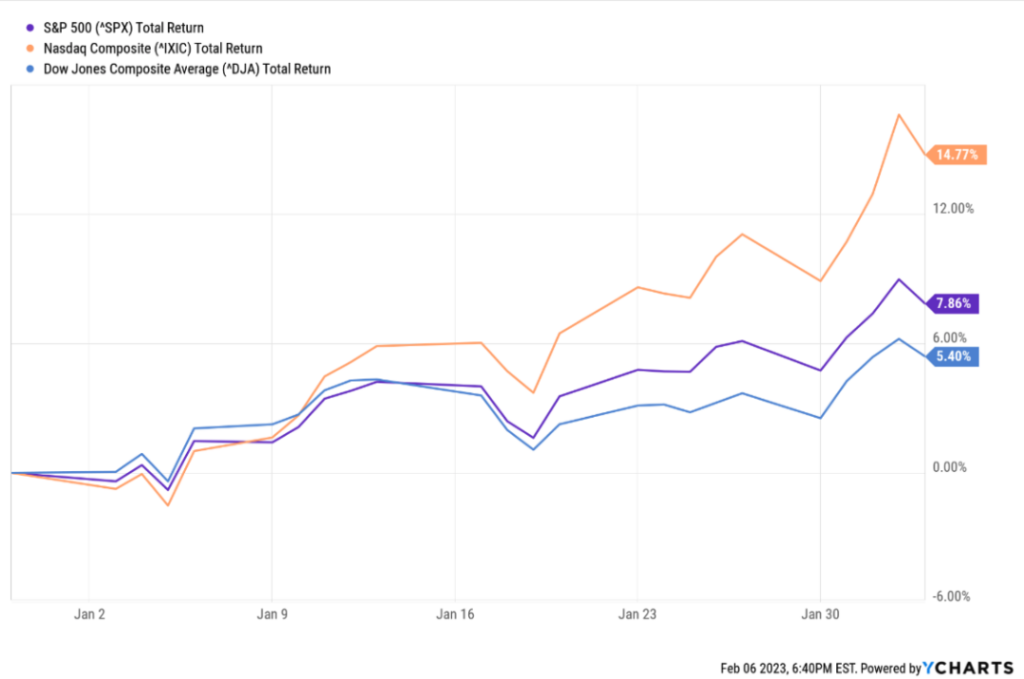

The rally in stocks so far this year has been impressive. Here are the year-to-date returns for broad market averages through February 3, 2023: Nasdaq Index 14.77%, S&P 500 Index 7.86%, and Dow Jones Industrial average 5.40%. The hotly debated question is: at what level “should” stocks be trading given the Fed’s ongoing inflation battle, the prospects for a recession, and the current corporate earnings environment?

We said last week the market rally would make sense to us only if the Fed was done raising rates AND the US economy avoided recession. Right now, neither of these seems even close to a clear-cut call. The Fed may have finished raising rates, or it may not have. While there is a generalized “hope” inflationary pressures are receding, last week’s blockbuster jobs report certainly calls that prevailing wisdom into question.

It seems plausible the Fed will need to stay with its interest rate hikes for longer than people currently expect. Whether or not the US economy enters an “official” recession, it seems extremely likely earnings will come in lower than previously expected. So, let’s get more granular with some S&P data to help frame the discussion.

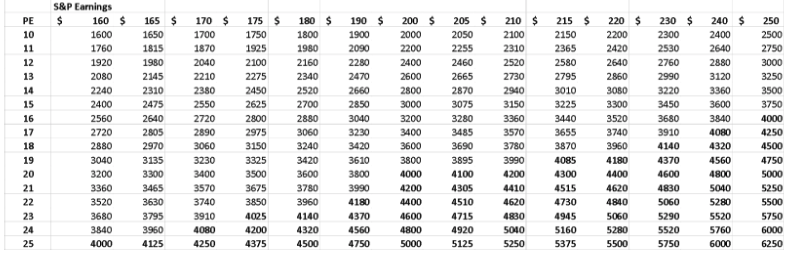

There are two primary factors that help answer “what is the S&P worth?” The first is the level of earnings generated by the S&P companies, and the second is what those earnings are “worth” as measured by market multiple. Let’s take earnings first. According to FactSet, midway through 2022, consensus analyst expectations for 2023 earnings on the S&P 500 Index were coming in at $250. Since that time, earnings expectations have come down to $225.

With each passing week, those numbers are coming down further with many expecting them to settle in at $210. If we get a recession, it could be substantially lower than that. But let’s go ahead and take $210 as the final level for 2023.

If the S&P earns $210 in 2023, then the forward P/E multiple the market is currently putting on those earnings is 19.7 times. Considering the fact that the last time the Fed went on a rate hiking spree from 2016-2018, the market multiple went from 18.5x to 13.5x, the current multiple is very hard to reconcile with the prevailing macroeconomic conditions and interest rates. The only way the current multiple makes sense is if rates are being aggressively cut or earnings are accelerating rapidly. Neither of those is happening.

Rather than play the game of where the market “should” be, it might be more helpful for readers to help them “frame” the question so they can do some thinking about what an appropriate market level might be. In the matrix below, you can scan across various potential levels for S&P earnings across the top of the matrix. You can identify the earnings levels you think are likely and then identify the corresponding multiple from the far left column to see what index level would correspond to the earnings and multiple you have selected. This is what makes a market: there are myriad opinions about all this stuff and more. Where do you think is the most appropriate level for the S&P?

Wide expectational ranges for the market are the norm as it seeks to weigh up all the factors at play ranging from inflation, rate hikes, earnings compression, to a full blown recession. There are bearish cases and bullish cases. Our view is that the market today has probably gotten a little ahead of itself. If you take $210 base case for 2023 S&P earnings, and put a more modest multiple of 16 x on those earnings, then you get an index level about 20% lower than we presently have.

We continue to caution investors to expect more volatility and bouts of selling pressure as market participants come to grips with the economic reality that is presently unfolding. It is possible we are being overly cautious and setting ourselves up for a positive surprise; but, right now, we suggest preparing for more challenging market conditions as the market finds stable footing. We encourage investors to exercise patience and a steady hand as these things play out. As always, we are here to discuss things with you—just give us a call or shoot us an e-mail.

Advisory services offered through WealthPlan Group, a DBA for WealthPlan Investment Management, a subsidiary Registered Investment Advisor of WealthPlan Group, LLC. WealthPlan Group, LLC is not a registered investment advisor, but is the holding company for WealthPlan Partners LLC and WealthPlan Investment Management, LLC.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which Investment(s) may be appropriate for you, consult your financial advisor prior to investing. Information is based on sources believed to be reliable, however, their accuracy or completeness cannot be guaranteed.

No investment strategy can assure success or completely protect against loss, given the volatility of all securities markets. Statements of forecast and trends are for informational purposes and are not guaranteed to occur in the future. All performance referenced is historical and is no guarantee of future results. Securities investing involves risk, including loss of principal. An investor cannot invest directly in an index.

The information in this communication applies solely to the intended audience and in no way amends, revokes, or otherwise alters the existing agreements and relationships between WPIM and its clients. This communication is not a binding offer, expressed or implied. WPIM undertakes no obligation to update or revise the information herein or in any referenced third-party resource due to new information, future events or circumstances, or otherwise.

WealthPlan Investment Management (“WPIM”) uses data compiled and/or prepared by third parties (“Third Party Data”) in the delivery of Licensed Research and Data. Third Party Data is not owned by WPIM and user may be required to obtain permission directly from third parties for further use of Third-Party Data and may be required to pay a fee depending on the use contemplated by the user.