The AI Goldrush

The Generative AI ERA is upon us. With Microsoft Corporation’s acquisition of OpenAI and the company’s ChatGPT Generative AI language model then being infused into Microsoft’s software suite this year, an AI competitive race has begun. Companies and solutions that harness AI and introduce large scale efficiency and productivity into the economic landscape are coming out daily in almost all industries. Free market mechanisms combined with entrepreneurial capitalism are unleashing an onslaught of new AI services and solutions.

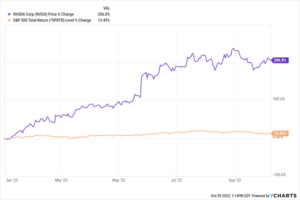

The technologies that enable mass application of Generative AI are the early beneficiaries of the AI footrace. So far, Nvidia Corporation is the perceived first beneficiary of the AI Goldrush. Since the beginning of 2023, Nvidia stock has been on a TEAR! Here’s the Nvidia chart as compared to the S&P 500 Index year-to-date:

This is happening primarily because Nvidia’s proprietary chip technologies and computational capacities are perfectly aligned with the computing demands of GAI models. The demand for Nvidia’s chips far exceeds supply at present. Consequently, other firms are entering the foray with announcements of new chip technology ventures. Just this week, Microsoft and OpenAI announced their plans to design and build proprietary AI chips. Existing chip makers Intel Corporation and Advanced Micro Devices are ramping up competitive responses.

Intel is building a multi-thousand-chip cluster internally based on its Gaudi AI accelerator, which could be even bigger competition for Nvidia down the road. AMD is set to ramp up production of its flagship MI300 artificial-intelligence chips in the fourth quarter. The accelerator chips, which are in short supply, are designed to compete against the advanced H100 chips already sold by Nvidia. The race is on!

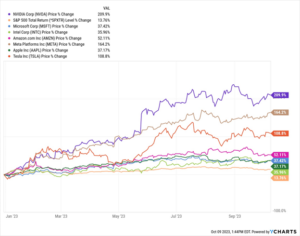

Other large tech companies are embracing larger scale AI efforts including Apple, Amazon, Alphabet, Tesla, and Meta, to name a few. These companies are betting incorporating Generative AI solutions into their products will lead to new product and growth cycles. All these names are substantially outpacing the S&P 500 Index:

And then there are the emerging companies that are introducing new AI solutions into new markets and new applications. These are the most speculative investments to consider because they are unproven and, in many cases, are not yet profitable. But rest assured, there will be new billionaires created within this legion of new AI entrants.

We at the WealthPlan Group are actively researching the entirety of the AI investment landscape. We already hold many of the large cap beneficiaries listed above in our existing model portfolios. We are also conducting research into the emerging companies and technologies that will produce tomorrow’s great stock rewards. It’s an exciting time to be an investor. Rest assured we will be doing the work that leads to new investment recommendations as this burgeoning technology takes hold. We are excited to make those determinations and introduce them to our clients over the coming months and years. We thank you for your patronage.

=====================================================================================

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S. The S&P 500 index is regarded as one of the best gauges of prominent American equities’ performance, and by extension, that of the stock market overall.

Indices are unmanaged. An investor cannot invest directly in an index. They are shown for illustrative purposes only and do not represent the performance of any specific investment.

Advisory services offered through WealthPlan Group, a DBA for WealthPlan Investment Management, a subsidiary Registered Investment Advisor of WealthPlan Group, LLC. WealthPlan Group, LLC is not a registered investment advisor, but is the holding company for WealthPlan Partners LLC and WealthPlan Investment Management, LLC.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which Investment(s) may be appropriate for you, consult your financial advisor prior to investing. Information is based on sources believed to be reliable, however, their accuracy or completeness cannot be guaranteed.

No investment strategy can assure success or completely protect against loss, given the volatility of all securities markets. Statements of forecast and trends are for informational purposes and are not guaranteed to occur in the future. All performance referenced is historical and is no guarantee of future results. Securities investing involves risk, including loss of principal. An investor cannot invest directly in an index.

The information in this communication applies solely to the intended audience and in no way amends, revokes, or otherwise alters the existing agreements and relationships between WPIM and its clients. This communication is not a binding offer, expressed or implied. WPIM undertakes no obligation to update or revise the information herein or in any referenced third-party resource due to new information, future events, or circumstances, or otherwise.

WealthPlan Investment Management (“WPIM”) uses data compiled and/or prepared by third parties (“Third Party Data”) in the delivery of Licensed Research and Data. Third Party Data is not owned by WPIM and user may be required to obtain permission directly from third parties for further use of Third-Party Data and may be required to pay a fee depending on the use contemplated by the user.