A Market Pullback or Something More?

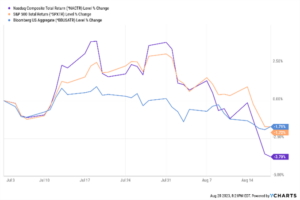

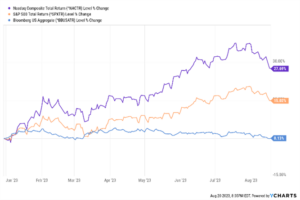

Here’s a chart below of the S&P 500 Index (in yellow), the NASDAQ Composite Index (in purple) and the Bloomberg Aggregate US Bond index (in blue) since the end of June. At the midway point of the third quarter and after most companies have reported earnings, the capital markets are retracing some of their YTD gains. The second chart shows those same indices on a YTD basis.

The trillion-dollar question is why is the pullback happening now?

Here are the contending causes:

1) The market got a little ahead of itself, with valuations too high and making the market susceptible to a pullback

2) The anticipated earnings recovery is delayed into the future

3) The Fed may continue raising rates because inflation is still present

4) The economic weakness manifesting in China is so severe that there is a worry this will spread and lead to global economic weakness

5) The US economy is on the verge of a recession as signaled by the stubbornly inverted yield-curve.

The reality is that the pullback is probably due to all these factors BUT their weights are not equal. The last two still seem currently to be much lower probability while the first two are very likely at work here. Could this develop into something more? Most certainly it could. It will take two to three more quarters to see whether we are dealing with broader recessionary problems or whether this is a “run of the mill” pause.

For now, the consensus expectation is in the driver’s seat, namely: earnings growth will resume, inflation will recede to the Fed’s target, GDP growth will accelerate, and we’ll all have a merry Christmas in December. That’s our baseline expectation until we see firm evidence to the contrary.

=====================================================================================

Advisory services offered through WealthPlan Group, a DBA for WealthPlan Investment Management, a subsidiary Registered Investment Advisor of WealthPlan Group, LLC. WealthPlan Group, LLC is not a registered investment advisor, but is the holding company for WealthPlan Partners LLC and WealthPlan Investment Management, LLC.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which Investment(s) may be appropriate for you, consult your financial advisor prior to investing. Information is based on sources believed to be reliable, however, their accuracy or completeness cannot be guaranteed.

No investment strategy can assure success or completely protect against loss, given the volatility of all securities markets. Statements of forecast and trends are for informational purposes and are not guaranteed to occur in the future. All performance referenced is historical and is no guarantee of future results. Securities investing involves risk, including loss of principal. An investor cannot invest directly in an index.

The information in this communication applies solely to the intended audience and in no way amends, revokes, or otherwise alters the existing agreements and relationships between WPIM and its clients. This communication is not a binding offer, expressed or implied. WPIM undertakes no obligation to update or revise the information herein or in any referenced third-party resource due to new information, future events or circumstances, or otherwise.

WealthPlan Investment Management (“WPIM”) uses data compiled and/or prepared by third parties (“Third Party Data”) in the delivery of Licensed Research and Data. Third Party Data is not owned by WPIM and user may be required to obtain permission directly from third parties for further use of Third-Party Data and may be required to pay a fee depending on the use contemplated by the user.