Inflation Readings This Week

Below are the inflation readings through the end of June, 2023. The blue line represents the year-over-year change in consumer prices while the red line represents the change in producer prices (commodities). One can see progress has been made on the inflationary front since the Fed began its tightening campaign in March of 2022 designed to bring down inflation.

While the progress on inflation has been highly constructive, the Fed has nonetheless maintained a hawkish tone in its inflation policy rhetoric in recent weeks. The reason for this hawkish tone can be found in a history lesson. Below is a chart of the CPI over the period 1970 to 1990. One can see in the decade of the 1970’s, after inflation dropped, it then resurged. A resurgence of inflation was caused by the Fed declaring victory on inflation and lowering rates too soon. It then had to clean up the mess with a massive rate increase managed by the gutsy then Fed Chairman Paul Volcker.

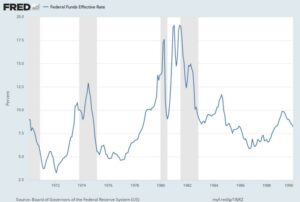

Below is a picture of the effective Fed Funds rate over the same period as represented in the inflation data above. One can see the Fed moved rates down rapidly as inflation came down, which then triggered a resurgence in inflation. The Fed has stated this time it will “stay higher for longer.” This is clearly an effort not to repeat the policy errors of the 1970’s with respect to inflation.

This week’s inflation data will tell us whether continued progress is being made. But don’t expect the Fed to change its hawkish stance until inflation has reached its 2.0% target. This is a high stakes game and an important time. So far, current Fed Chairman Jerome Powell is proving to be a student of history and is playing it correctly.

==========================================================================================

Advisory services offered through WealthPlan Group, a DBA for WealthPlan Investment Management, a subsidiary Registered Investment Advisor of WealthPlan Group, LLC. WealthPlan Group, LLC is not a registered investment advisor, but is the holding company for WealthPlan Partners LLC and WealthPlan Investment Management, LLC.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which Investment(s) may be appropriate for you, consult your financial advisor prior to investing. Information is based on sources believed to be reliable, however, their accuracy or completeness cannot be guaranteed.

No investment strategy can assure success or completely protect against loss, given the volatility of all securities markets. Statements of forecast and trends are for informational purposes and are not guaranteed to occur in the future. All performance referenced is historical and is no guarantee of future results. Securities investing involves risk, including loss of principal. An investor cannot invest directly in an index.

The information in this communication applies solely to the intended audience and in no way amends, revokes, or otherwise alters the existing agreements and relationships between WPIM and its clients. This communication is not a binding offer, expressed or implied. WPIM undertakes no obligation to update or revise the information herein or in any referenced third-party resource due to new information, future events or circumstances, or otherwise.

WealthPlan Investment Management (“WPIM”) uses data compiled and/or prepared by third parties (“Third Party Data”) in the delivery of Licensed Research and Data. Third Party Data is not owned by WPIM and user may be required to obtain permission directly from third parties for further use of Third-Party Data and may be required to pay a fee depending.