A Nice Relief Rally

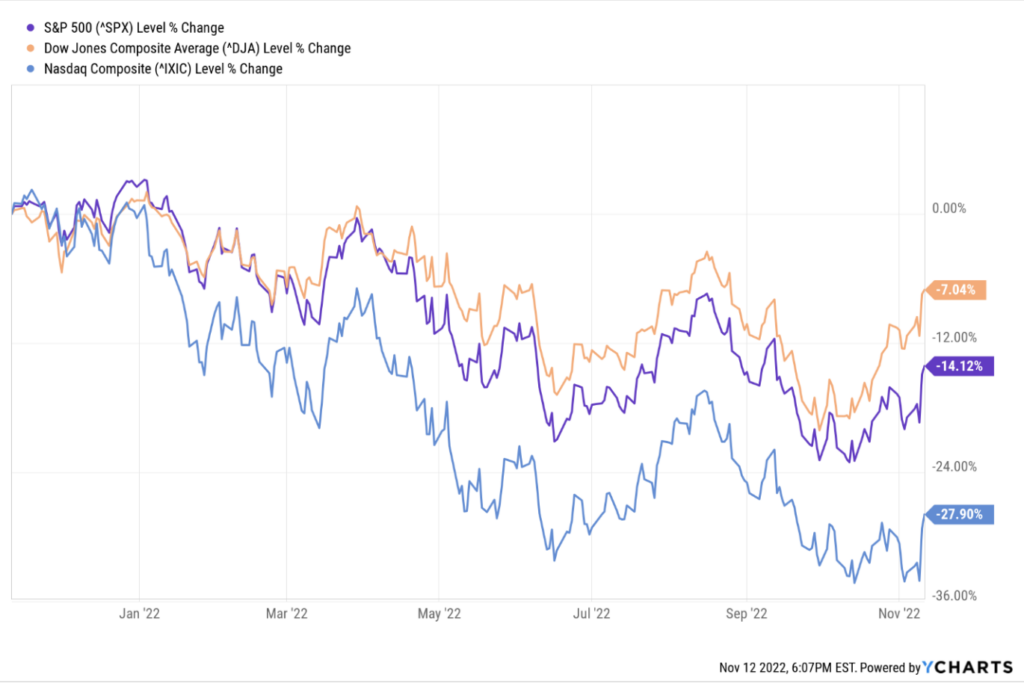

Here is what the major US stock market indexes did last week:

Thursday’s return was a larger one-day upward move that has many proclaiming the worst of the bear market is over. The move on Thursday and the follow-through on Friday are largely a response to the annualized CPI reading of 7.7%, which was better-than-the-expected 7.9%. That print versus expectations has many believing the Fed’s campaign to raise interest rates is nearly over and the so called “Fed pivot” is soon forthcoming. While possible, we think it is too soon to be breaking out the champagne and declaring victory. Bear markets are full of such rallies: this is all part of the process.

To put this recent move into perspective, consider October 2008. In that month, the S&P 500 Index was down 16%. Even so, on two separate days in that month, the market gained more than 10%. While today is not like 2008 on many dimensions, the point is big up days happen during bear markets.

For context, the following chart shows the prior three indexes on a one-year basis. Given the macro-economic uncertainties that have caused this downturn in equity markets, it is hard to see things improving rapidly given the high levels of inflation and the likely recession to follow the Fed’s aggressive rate increases. We think this is going to play out over many more months. While it’s possible the market could advance and the lows are in, we need to see more data to gain additional perspective. Until that time comes, it is best to gird oneself and mentally prepare for additional volatility.

On the bright side of the equation, interest rates have moved up sufficiently this year to make an allocation to bonds an income producing proposition. There are wonderful short-term to intermediate-term income options to produce a known return as we wait for the economic uncertainties to resolve. In fact, many institutional investors are sanguine about the going forward prospects for bonds. We still need to see how this current rate cycle plays out in the broader economy specifically as it relates to credit and default risk. Nonetheless, short -term high credit quality is an interesting place to consider as we wait for things to stabilize.