Historical Perspective and Realistic Expectations

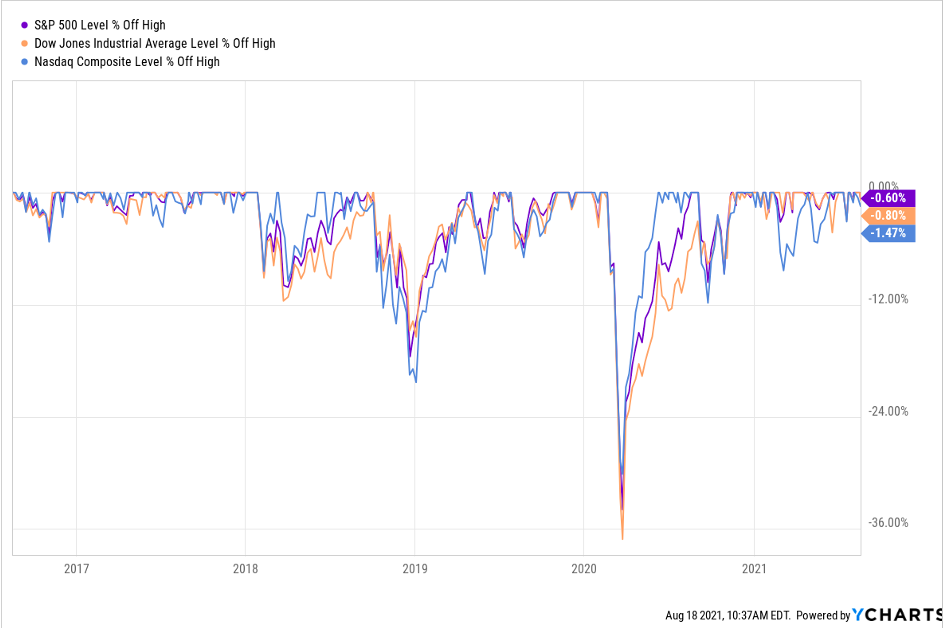

Investors have become somewhat complacent over the last decade as supportive government policies have led to strong stock market returns. Not only have investors become accustomed to strong positive returns with minimal drawdowns, but they are also largely unaware of what kinds of expectations might be reasonable. This is evidenced by the mania around recent “sell-offs”.

The purpose of this missive is to help ground the reader in long-term stock market dynamics to encourage more realistic expectations.

First, let’s establish what the stock market generally produces over the long term. This is more easily said than done because the stock market is never consistent even over periods of a couple decades. If we take returns on average over the long-term (100 years) the stock market produces a return of about 10% per year. There have been decades where it is higher than that, and decades when it is lower. But 10% is a pretty good long-term expectation.

Now let’s deconstruct what tends to happen over the course of yearly trading days ON AVERAGE to help provide context for how that 10% return is generated. There are 252 trading days every calendar year. To get a 10% return, you are looking at an average daily return of approximately 4 basis points (4/100’s of a percent per day). But, as almost every investor understands, not all days are up. In fact, over the long term, the US stock market produces positive returns approximately 52% of all trading days. So, 52% of 252 trading days is 131 up days and 121 down days per year on average. We, on average, get 10 more positive days than we get negative days.

Interestingly, the average down day tends to be down by 5 basis points more than the average up day is up. So, on one hand you get ten more positive return days per year than you get negative, but the down days are a little worse than the up days are good. You add it all up, and you end up with 10% a year. These are razor thin margins. We humans are incapable of watching daily returns and deciphering these patterns without the aid of computers. I promise no one can see this through observation. I’ve tried it. It looks random, messy, and noisy. What I’ve described using data is described by economists as a random walk around an upward drift.

To put this in perspective, in the Great financial crisis, between May of 2008 and March of 2009, the US stock market lost 55%. In retrospect, it seems obvious to us what happened. But the reality is, as it was happening, no one really had a clue what was happening. The stock market just isn’t that easy. Even despite losing 55%, during the sell off, 48% of the days produced positive returns. Hardly a departure from normal, and one that is indiscernible to a human observer. Moreover, as this sell off occurred, the biggest one-day gain was 11% while the biggest one-day loss was about 10%. The truth is the stock market is never easy as things are happening. It is generally only obvious after the fact.

So, what are we to do? Even though everyone’s situation is different, for most investors, it turns out, the old buy and hold strategy combined with diversification across asset classes and investment strategies is a good starting place. Combining that with specific consideration of each investor’s needs and risk tolerance helps manage this wild stock market. Reacting to daily ups and downs and trying to time the market is generally a losing strategy that results in disappointment.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which Investment(s) may be appropriate for you, consult your financial advisor prior to investing. Information is based on sources believed to be reliable, however, their accuracy or completeness cannot be guaranteed. Statements of forecast and trends are for informational purposes and are not guaranteed to occur in the future. There is also no assurance that any investment strategy will assure success or protect against loss.