It’s Now Really All About Earnings

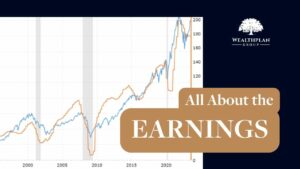

Below is a graph of two data series going back thirty years.

The first series in blue is the S&P 500 Index level valued on the left-hand axis. The second series in orange is the S&P 500 Index earnings valued on the right-hand axis. The relationship between stock prices and their earnings is well established and evident in the graph.

Overall, we can see throughout this history stock prices tend to be out in front of earnings, moving higher in advance of higher earnings being delivered. This makes sense as stock prices tend to be driven by anticipation of future events.

Now focus on the right side of the graph. We can see that stock prices moved down in advance of the earnings declines experienced in 2022. And, importantly, we can see that in 2023 the stock market has advanced even while earnings are flat.

From this, we could infer that the stock market is anticipating a return to earnings growth soon.

It is against this backdrop that we are entering the second quarter earnings reporting season which will pick up intensity soon.

This week, about 800 companies will report earnings. In the three weeks that follow, an additional 5,000 companies will report earnings.

By early August, we should have a very good idea of whether the stock market correctly called an earnings recovery or whether the market got a little ahead of itself.

=====================================================================================

Advisory services offered through WealthPlan Group, a DBA for WealthPlan Investment Management, a subsidiary Registered Investment Advisor of WealthPlan Group, LLC. WealthPlan Group, LLC is not a registered investment advisor, but is the holding company for WealthPlan Partners LLC and WealthPlan Investment Management, LLC.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which Investment(s) may be appropriate for you, consult your financial advisor prior to investing. Information is based on sources believed to be reliable, however, their accuracy or completeness cannot be guaranteed.

No investment strategy can assure success or completely protect against loss, given the volatility of all securities markets. Statements of forecast and trends are for informational purposes and are not guaranteed to occur in the future. All performance referenced is historical and is no guarantee of future results. Securities investing involves risk, including loss of principal. An investor cannot invest directly in an index.

The information in this communication applies solely to the intended audience and in no way amends, revokes, or otherwise alters the existing agreements and relationships between WPIM and its clients. This communication is not a binding offer, expressed or implied. WPIM undertakes no obligation to update or revise the information herein or in any referenced third-party resource due to new information, future events, or circumstances, or otherwise.

WealthPlan Investment Management (“WPIM”) uses data compiled and/or prepared by third parties (“Third Party Data”) in the delivery of Licensed Research and Data. Third Party Data is not owned by WPIM and user may be required to obtain permission directly from third parties for further use of Third-Party Data and may be required to pay a fee depending on the use contemplated by the user.