Some Longer-Term Perspective

It’s easy to get caught up in the short-term market action. What happened to stock markets this week? Are earnings better or worse than expected? Are we headed into recession? It is presently an admittedly interesting time with the economic uncertainty about inflation, recession, and the Fed’s tightening policies. Also, we have the fervor and excitement related to the AI euphoria. It’s easy to lose sight of the purpose of investing in stocks in light of all of the current clamor; thus, we find it can be helpful on occasions to introduce some longer-term perspective.

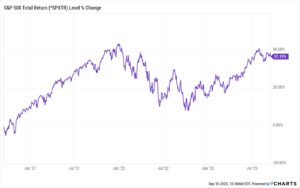

Below is a three-year chart of the S&P 500 Index through Friday. Since the beginning of 2022, stocks have gone nowhere. The reasons are simple: 1. Stocks rallied too much in 2021 in response to all the post covid stimulus, which led to, 2. Stock valuation multiples that were too high, and 3. An inflation problem, which led to 4. Fed tightening and an inverted yield curve, which then led to 5. A market correction, and 6. an earnings trough. These are the basic ingredients that led to the chart below. But where does this leave us presently?

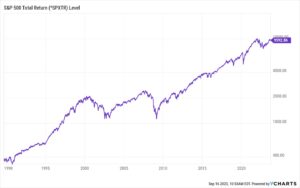

The next chart below is a long-term logarithmic scaled chart of the S&P 500 Index beginning in 1990. One can see the basic pattern from the chart above on the extreme right side of the chart below. The point in showing the long term is to put the present experience (and last three years) into proper perspective. The basic direction and slope of the chart over the long-term is undeniable. For investors with a horizon of at least ten years, they really don’t need to worry too much about what’s happening in the economy or markets presently–this month or even the next year! The point of being a stock investor is to capture the long-term slope associated with stocks to build wealth over time.

Even with some heightened uncertainty today, economic progress and industrial innovation is actively at work in the capitalist machinery of our economy. If you are an owner of stocks, simply sit back at let time in the market work in your favor. Stocks are a little on the expensive side currently, but that doesn’t mean much needs to be done. Time and forward economic progress will lead to higher corporate earnings and higher stock prices over time. If you are a WealthPlan client, rest assured we are evaluating the companies we own and one’s we might like to own on a daily basis, seeking to place our clients’ assets into a portfolio of high-quality stocks that align with their long-term objectives and risk tolerance. We thank you for your business and the confidence you place in us.

=====================================================================================

Advisory services offered through WealthPlan Group, a DBA for WealthPlan Investment Management, a subsidiary Registered Investment Advisor of WealthPlan Group, LLC. WealthPlan Group, LLC is not a registered investment advisor, but is the holding company for WealthPlan Partners LLC and WealthPlan Investment Management, LLC.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which Investment(s) may be appropriate for you, consult your financial advisor prior to investing. Information is based on sources believed to be reliable, however, their accuracy or completeness cannot be guaranteed.

No investment strategy can assure success or completely protect against loss, given the volatility of all securities markets. Statements of forecast and trends are for informational purposes and are not guaranteed to occur in the future. All performance referenced is historical and is no guarantee of future results. Securities investing involves risk, including loss of principal. An investor cannot invest directly in an index.

The information in this communication applies solely to the intended audience and in no way amends, revokes, or otherwise alters the existing agreements and relationships between WPIM and its clients. This communication is not a binding offer, expressed or implied. WPIM undertakes no obligation to update or revise the information herein or in any referenced third-party resource due to new information, future events or circumstances, or otherwise.

WealthPlan Investment Management (“WPIM”) uses data compiled and/or prepared by third parties (“Third Party Data”) in the delivery of Licensed Research and Data. Third Party Data is not owned by WPIM and user may be required to obtain permission directly from third parties for further use of Third-Party Data and may be required to pay a fee depending on the use contemplated by the user.