Talk Is Cheap?

We’ve all heard the phrase, “Talk is cheap.” Lately, Fed chair Jerome Powell has been giving inflation fighting a great deal of “lip service.”

“What we need to see,” Powell said, “is clear and convincing evidence that inflation pressures are abating, and inflation is coming down. And if we don’t see that, then we’ll have to consider moving more aggressively. If we do see that, then we can consider moving to a slower pace.”

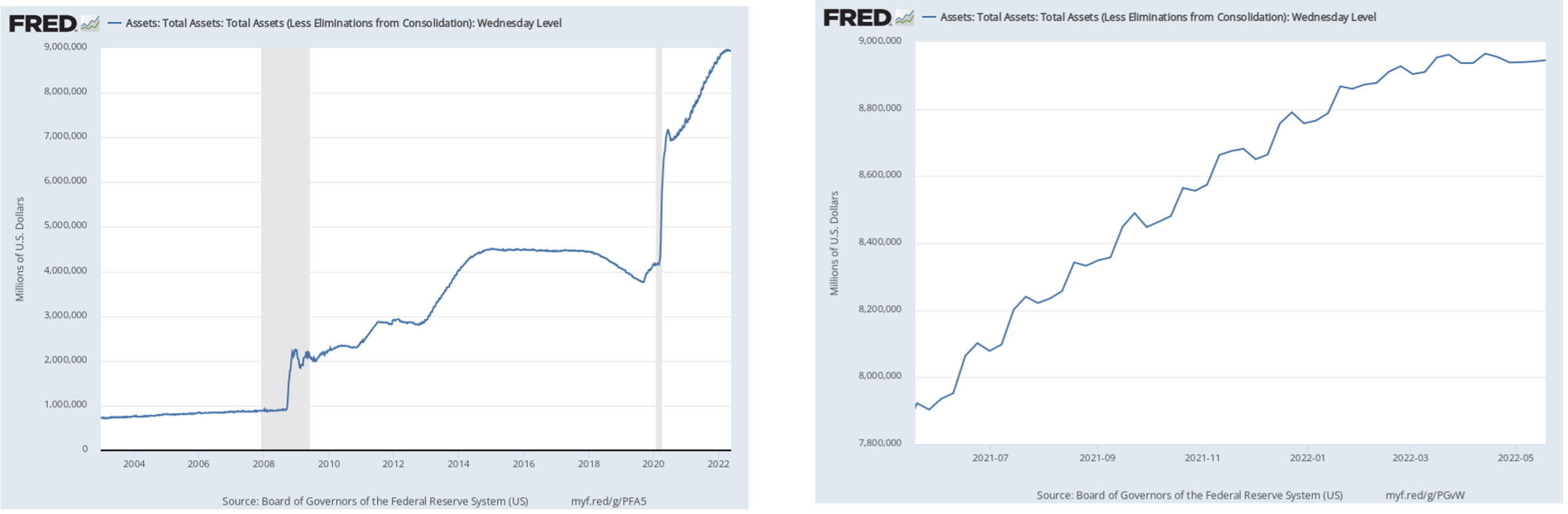

But, for all the tough rhetoric, here is what the Fed has actually done in response to inflation so far (long term panels on left, short-term on right).

The Fed Balance Sheet:

Fed Funds:

For all its talk about inflation fighting, the Fed has barely even moved on its two primary mechanisms for fighting inflation—to the point where it’s almost laughable. But it’s not laughable, because the rhetoric hasn’t gone without effect. Market interest rates are up substantially (and bond valuations have dropped) and stocks are down dramatically. People are experiencing real wealth declines! So, all the talk isn’t necessarily cheap. But other than moving markets, is the talk doing anything to stop inflation?

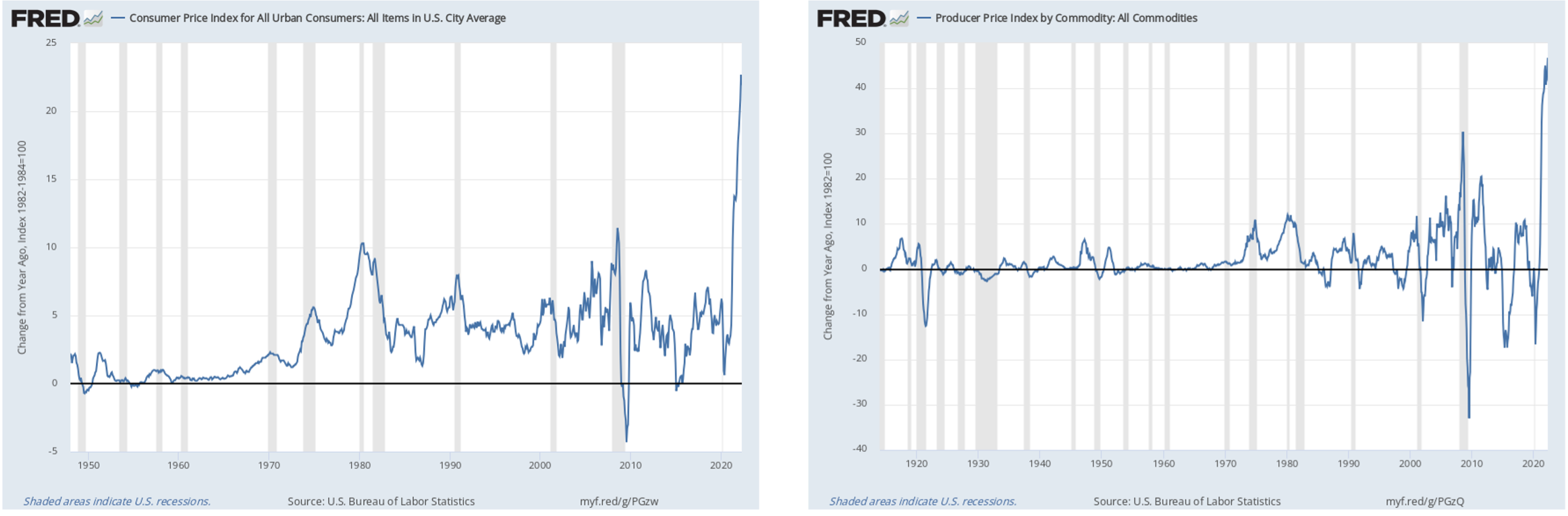

Below are two ways to measure inflation within the US economy: Consumer Prices and Producer Prices. In both cases inflation still rages. It appears that it’s going to take actual policy shifts, and potentially aggressive one’s to tame the inflationary impulse in the economy. Words might move markets, but it’s doubtful they can stop inflation.

One can’t help getting the feeling the Fed is buying time, hoping inflation abates without requiring the “Volckeresque” policy moves of the late 1970’s and early 1980’s. But one thing seems clear from the two charts above, this is a BIG inflation problem, and it makes sense a similarly BIG policy response is likely necessary to bring it under control. To turn a phrase, talk isn’t necessarily cheap, but at this stage it appears misguided. The Fed needs to roll up its sleeves and get on with the unpleasant task of aggressively raising rates and reducing its balance sheet to bring down inflation, because the talk alone isn’t cutting it.

We’ve been saying all year to prepare for heightened volatility and continuing uncertainty as the markets grapple with inflation. We don’t know when this episode will end so it is wise to continue to expect more of the same. Whether or not a recession comes is still anyone’s guess. The odds of recession are certainly increasing. However, corporate earnings remain strong despite the challenges. We have continued to infuse a more cautious posturing, at the margin, within our investment portfolios as conditions unfold. However, we are not materially altering our course. Our investment strategies are structured to meet their long-term risk/reward targets and they remain true to those objectives.

For investors seeking to build wealth over the long-term, such conditions we are currently facing come with the territory. This is what investing for the long-term sometimes entails. Calling market tops and bottoms and moving large sums is never part of a long-term wealth creation strategy. We don’t know when the market will bottom. But, we do know that with a carefully designed strategy including savings, investing, and spending polices, the types of volatility and uncertainty we are currently facing is entirely manageable. A good plan and the will to stick with it during times like these is the difference maker. When we finally clear the current economic uncertainties, markets will move higher—they always do. If you are wishing to revisit the elements of your wealth plan, we always welcome your questions.