The Goldilocks Outcome: The Relationship Between Money Supply, Output and Inflation

August 1, 2023

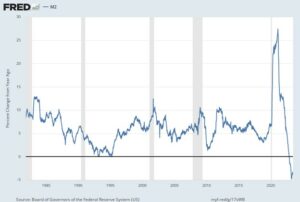

Let’s do some careful and thoughtful inquiry into the relationship between money supply and key economic data. First, let’s isolate the money supply and see what the rate of change from the prior year over time has been, beginning in 1980. Here’s what it looks like:

One can see that M2 money supply growth since 1980 has averaged about 6% (6.36% to be exact). While it has been variable, ranging most of the time between 2% and 10%, it has had this upward bias. The money supply is substantially influenced by Fed policy through interest rate policy, banking reserve requirements, and, more recently, Fed Balance Sheet management. One can see that until recently, the Fed has maintained a bias toward money supply growth. Importantly, the money supply growth rate has been negative only during the present period. Something is clearly going on here, which we will revisit in a bit.

The logical inference is that the Fed must believe that there is a relationship between money supply growth and economic growth. Further, because the Fed’s employment rosters are filled with intellectual talent, we can deduce they’ve studied this and have some idea about the desired money supply growth rate to achieve optimal economic output. So, let’s look at that relationship next.

Below is a graph of that same money supply data with the added Gross Domestic Product in red. One can see that when GDP drops, money supply tends to grow. It appears money supply growth is the mechanism through which GDP stalls are corrected by the Fed through the policies mentioned above. Since 1980, GDP dips or slowdowns have been met with money supply growth increases. When growth dips, money supply increases help growth to resume. Every time!

We can also see the unprecedented dip in GDP associated with the COVID-related economic shutdown and the unprecedented growth in money supply to fix it. The fed clearly did enough, but did it do too much? The answer seems to be “yes” based on the sharp reversal in money supply.

The final piece to be evaluated here is inflation. We have written extensively about our belief that the excess money growth has been inflationary, which has caused the Fed to eliminate money. So, let’s take a look at it below.

One can see that we witnessed in 2021 the first material spike in inflation in forty years. It seems obvious that this was driven by one primary thing: The huge increase in money supply as the Fed, Treasury, and Congress injected the economy with a “geyser” of money. Should we have expected inflation? Given the spike in money it seems obvious we should have. Much of the inflation gets blamed on “supply shocks” during covid, which seems like a false flag to us. We think the real cause of the inflation is money growth. And judging from the recent negative money growth, we think the Fed agrees. Hopefully the “fervor” of the Modern Monetary Theorists has been moderated by this monetary dose of reality.

The only question remaining is what the optimal level of money growth is going forward to keep a lid on inflation while lubricating positive GDP growth. So far, the Fed is threading the needle nicely with inflation coming down while economic growth remains above it. This is truly a “goldilocks” outcome!

=====================================================================================

Advisory services offered through WealthPlan Group, a DBA for WealthPlan Investment Management, a subsidiary Registered Investment Advisor of WealthPlan Group, LLC. WealthPlan Group, LLC is not a registered investment advisor, but is the holding company for WealthPlan Partners LLC and WealthPlan Investment Management, LLC.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which Investment(s) may be appropriate for you, consult your financial advisor prior to investing. Information is based on sources believed to be reliable, however, their accuracy or completeness cannot be guaranteed.

No investment strategy can assure success or completely protect against loss, given the volatility of all securities markets. Statements of forecast and trends are for informational purposes and are not guaranteed to occur in the future. All performance referenced is historical and is no guarantee of future results. Securities investing involves risk, including loss of principal. An investor cannot invest directly in an index.

The information in this communication applies solely to the intended audience and in no way amends, revokes, or otherwise alters the existing agreements and relationships between WPIM and its clients. This communication is not a binding offer, expressed or implied. WPIM undertakes no obligation to update or revise the information herein or in any referenced third-party resource due to new information, future events or circumstances, or otherwise.

WealthPlan Investment Management (“WPIM”) uses data compiled and/or prepared by third parties (“Third Party Data”) in the delivery of Licensed Research and Data. Third Party Data is not owned by WPIM and user may be required to obtain permission directly from third parties for further use of Third-Party Data and may be required to pay a fee depending on the use contemplated by the user.