The US Federal Financial House: A Sobering Reality

This week we are taking the opportunity to examine the financial well-being of the US Federal Government. Considering Fitch’s recent downgrade on the financial rating of the US government as well as the upcoming potential for yet another government shutdown due to the ridiculous political process through which the US government is funded, this commentary is probably well-timed.

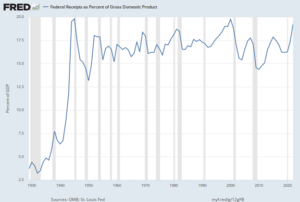

First consideration is total revenue, known as tax receipts. On its face, we should be in good shape, right? With tax receipts near record highs at about $2.9 trillion, the country does not appear to have a revenue challenge.

Another way to look at tax receipts is to view them as a percentage of GDP over time (see below). From this perspective, we can see that beginning in the mid 1940’s tax receipts have been between 15% and 20% of GDP. Presently, we are close to the highest ever reached in the year 2000. So clearly, the US government is in a relatively strong revenue position.

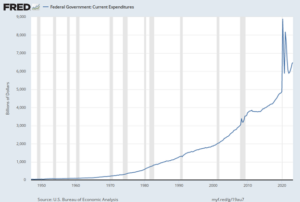

Next, let’s turn our attention to the expenditure side. As can been seen below, the US government spent record amounts in response to the Covid-related economic shutdown. After a spike in expenditures to nearly $9 trillion, expenditures are presently at $6.5 trillion, well above pre-Covid levels. Please recall from chart 1 that revenues are coming in at 2.9 trillion. This is deficit spending, which leads to the next chart.

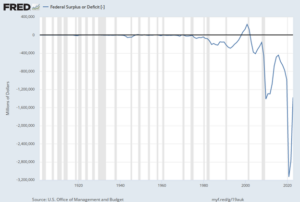

Below is a picture of the Federal Surplus/Deficit (Receipts minus spending). As can be seen, the US government spent much more than it took in during Covid, and the annual deficit is running at about $1.5 trillion. Please keep in mind this means every fiscal year we are ADDING to the total debt load the country is under.

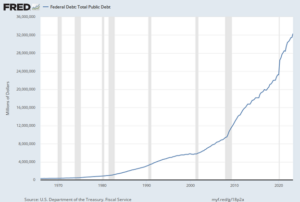

Next, let’s consider that total level of debt over time. One can see the total debt has risen to an all-time high of $32 trillion!

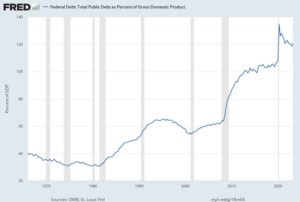

Next, let’s consider this total debt level as a percentage of GDP. One can see that the US government has accumulated a debt that exceeds the total economic output (GDP) of the US by 120%.

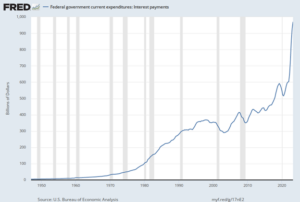

Finally, let’s consider the interest payments the US government makes on the accumulated debt. Presently, those interest payments (because interest rates have risen so dramatically in the past 18 months) are hovering at just under $1 trillion.

Remember the first slide presented here? It shows tax receipts of $2.9 trillion. This means the US government is spending a third of its receipts on interest payments! It also means the US government is spending over 6% of total GDP on interest expense. This is not sustainable. Period.

What are the potential ways out of this financial predicament? 1) Spend less (eliminating the deficit), 2) Print more money (inflationary), 3) Restructure the debt (lengthening maturity and trying to lower the rate or annual burden), 4) Default or renegotiate. It seems to me that potentially all of these things may be in play over the coming years as the US wrestles with its income statement and balance sheet challenges.

It seems to us at WealthPlan that an era of financial austerity will come to the United States and its citizenry, eventually. But we can’t say when and know from experience that things can continue along the present trajectory for longer than most expect. The investment implications are not disastrous, but there will be meaningful challenges and at times it may feel overwhelming. We are likely to see valuation compression in public equity prices along with heightened volatility. We may see higher taxes on corporations to help pay for the debt. But there is hope. Innovation and free capital markets are a hallmark of American growth and prosperity. Equity investments over the long-term will still be the source of innovation and wealth creation in the US economy.

=====================================================================================

Advisory services offered through WealthPlan Group, a DBA for WealthPlan Investment Management, a subsidiary Registered Investment Advisor of WealthPlan Group, LLC. WealthPlan Group, LLC is not a registered investment advisor, but is the holding company for WealthPlan Partners LLC and WealthPlan Investment Management, LLC.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which Investment(s) may be appropriate for you, consult your financial advisor prior to investing. Information is based on sources believed to be reliable, however, their accuracy or completeness cannot be guaranteed.

No investment strategy can assure success or completely protect against loss, given the volatility of all securities markets. Statements of forecast and trends are for informational purposes and are not guaranteed to occur in the future. All performance referenced is historical and is no guarantee of future results. Securities investing involves risk, including loss of principal. An investor cannot invest directly in an index.

The information in this communication applies solely to the intended audience and in no way amends, revokes, or otherwise alters the existing agreements and relationships between WPIM and its clients. This communication is not a binding offer, expressed or implied. WPIM undertakes no obligation to update or revise the information herein or in any referenced third-party resource due to new information, future events or circumstances, or otherwise.

WealthPlan Investment Management (“WPIM”) uses data compiled and/or prepared by third parties (“Third Party Data”) in the delivery of Licensed Research and Data. Third Party Data is not owned by WPIM and user may be required to obtain permission directly from third parties for further use of Third-Party Data and may be required to pay a fee depending on the use contemplated by the user.