Two Inflation Prints and Earnings Expectations

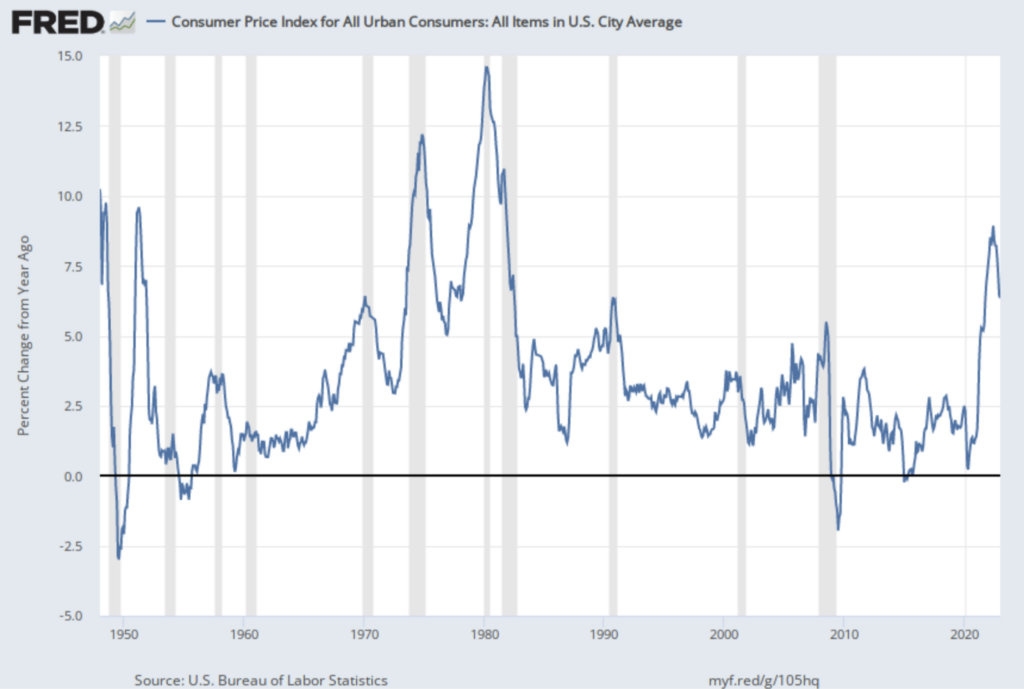

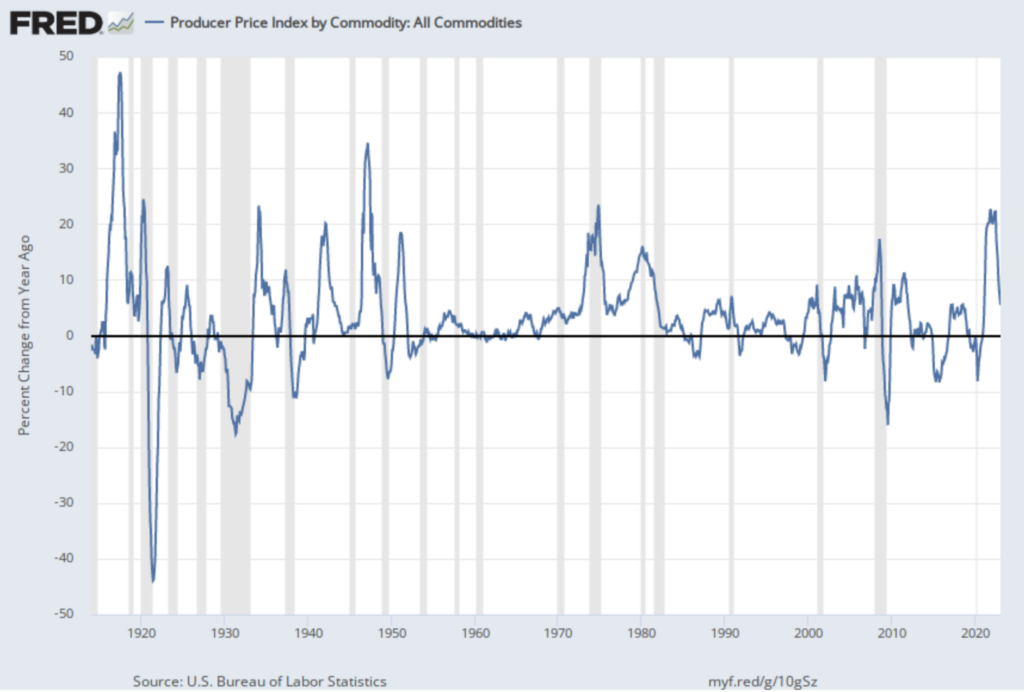

Last week we had two inflation prints: one for the Consumer Price Index (CPI) and one for the Producer Price Index (PPI). While the headline grabber was that the monthly prints were above expectations (and they were) the Fed is nonetheless making considerable progress in its inflation fight as evidenced by both the CPI and PPI on a percent change from a year ago basis.

It seems to us that the trend is down even as we confront some stubbornness in the monthly releases. These things are always choppy, which creates some uneasiness. It might take longer than many expect, but we think in a year, the Fed will be declaring victory over inflation. The bigger threat at this stage is probably the effect of tighter financial conditions on broader economic activity and corporate earnings. So, let’s turn our attention to earnings.

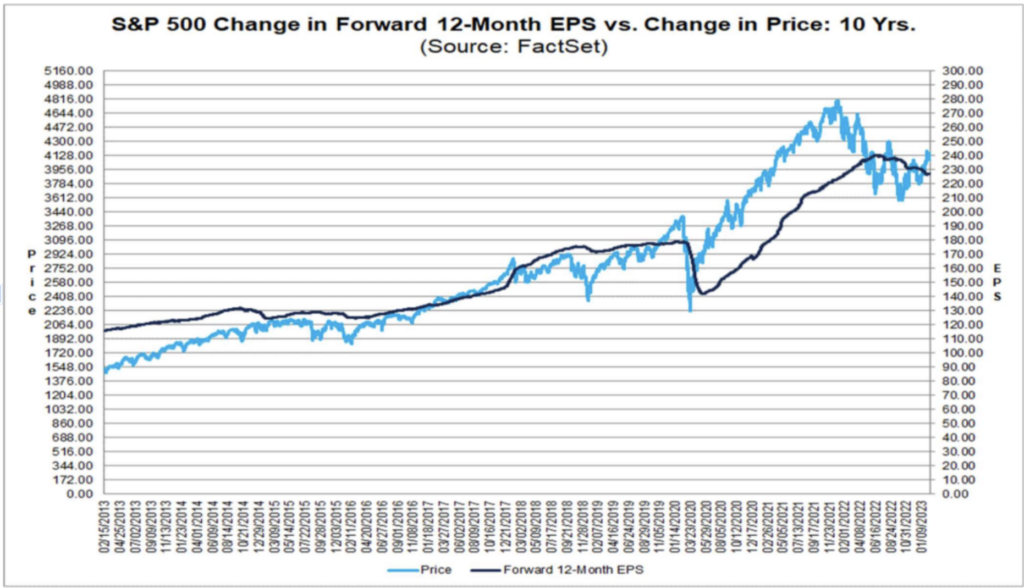

Below is a chart showing the S&P 500 12-month forward earnings expectations (dark blue line) combined with the S&P 500 Index value (light blue line). As one can see, earnings expectations are declining even as the market is advancing. The central question is: will earnings expectations turn as the market seems to be presently predicting or will the market rollover as a deeper earnings problem sets in?

This is the central focus of almost all market pundits and strategists right now. The reality is no one has a clue what will unfold on the economic and earnings front if they are brutally honest with others and themselves. It could go either way. Things are murky right now.

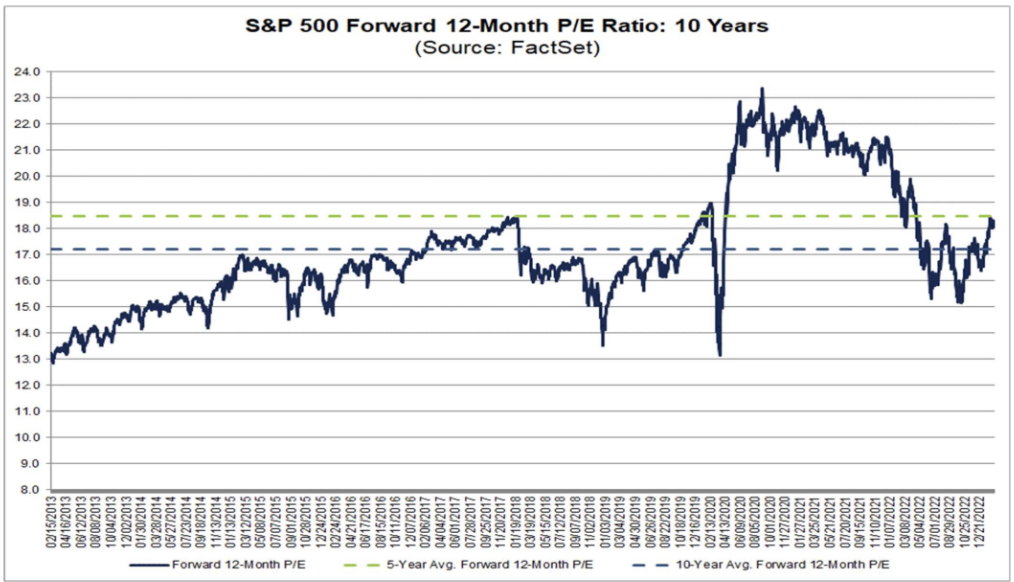

But what we do know is that the market is expensive after the recent rally. Here is a picture of PE on forward earnings expectations:

The implication of an earnings cycle that appears to be in a downtrend combined with an advancing stock market is that, at the least, some caution is in order. We think the market has gotten a little ahead of reality. Our position is that we need to see hard evidence the economy has found level footing — the housing market should show signs of stabilizing while earnings and earnings expectations should stop going down. Also, importantly, the Fed should signal that its rate increases are over. Until these things happen, the uncertainty is high.

We continue to encourage caution during the intervening period. During this time, we are evaluating where we want to add to marginal risk when things improve. For the time being, we are maintaining our more defensive posture. As always, seek the counsel of your advisor if you want to assess your positioning in light of your goals and risk tolerance. We appreciate your business.

Advisory services offered through WealthPlan Investment Management, LLC.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which Investment(s) may be appropriate for you, consult your financial advisor prior to investing. Information is based on sources believed to be reliable, however, their accuracy or completeness cannot be guaranteed.

No investment strategy can assure success or completely protect against loss, given the volatility of all securities markets. Statements of forecast and trends are for informational purposes and are not guaranteed to occur in the future. All performance referenced is historical and is no guarantee of future results. Securities investing involves risk, including loss of principal. An investor cannot invest directly in an index.

The information in this communication applies solely to the intended audience and in no way amends, revokes, or otherwise alters the existing agreements and relationships between WPIM and its clients. This communication is not a binding offer, expressed or implied. WPIM undertakes no obligation to update or revise the information herein or in any referenced third-party resource due to new information, future events or circumstances, or otherwise.

WealthPlan Investment Management (“WPIM”) uses data compiled and/or prepared by third parties (“Third Party Data”) in the delivery of Licensed Research and Data. Third Party Data is not owned by WPIM and user may be required to obtain permission directly from third parties for further use of Third-Party Data and may be required to pay a fee depending on the use contemplated by the user.