Welcome December!

As we await the arrival of December and a possible “Santa Claus” rally, here is what markets have produced year-to-date through Friday, November 24th:

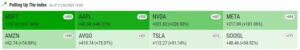

As you can see, large cap tech stocks (NASDAQ and S&P) have dominated the capital markets while small caps and bonds have substantially lagged. In a year like 2023, it is far more about what stocks you own than it is about asset allocation. Below are two tables showing which stocks have propelled the NASDAQ and S&P 500 Index higher. The first table is the NASDAQ and the second is the S&P 500 Index.

The same group of stocks is largely responsible for propelling both indexes higher. If you don’t own at least some of these names, then it has been extremely difficult (if not impossible) to keep pace with the broader stock market indices in 2023.

Looking forward, the month of December has been good for stocks. In fact, December has the highest average monthly return among the calendar months for the S&P 500 Index going back to the 1950s. Of course, every year is different, and the unique macroeconomic circumstances predominant in each year generally influence returns far more than do “average” calendar effects.

Nonetheless, knowing how things are presently unfolding, with corporate earnings strong, it seems plausible to us that the market this year could have an “average” positive return in December. As such, we welcome the arrival of a possible “Santa Claus” rally.

=======================================================================================================

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S. The S&P 500 index is regarded as one of the best gauges of prominent American equities’ performance, and by extension, that of the stock market overall.

The NASDAQ Composite is a stock market index of the common stocks and similar securities listed on the NASDAQ stock market. The composition of the NASDAQ Composite is heavily weighted towards information technology companies.

The NASDAQ-100, whose components are a subset of the NASDAQ Composite’s, accounts for over 90% of the NASDAQ Composite’s movement, and there are many ETFs tracking its performance.

The Russell 2000 tracks the roughly 2000 securities that are considered to be US small cap companies. The Russell 2000 serves as an important benchmark when investors want to track their small cap performances versus other sized companies. The Russell 2000 tends to have a larger standard deviation in comparison to the S&P 500.

The Dow Jones Industrial Average, or simply the Dow, is a stock market index that indicates the value of 30 large, publicly owned companies based in the United States, and how they have traded in the stock market during various periods of time. These 30 companies are also included in the S&P 500 Index. The value of the Dow is not a weighted arithmetic mean and does not represent its component companies’ market capitalization, but rather the sum of the price of one share of stock for each component company. The sum is corrected by a factor which changes whenever one of the component stocks has a stock split or stock dividend, so as to generate a consistent value for the index.

The Bloomberg US Aggregate Bond Index (^BBUSATR) is used as a benchmark for investment grade bonds within the United States. This index is important as a benchmark for someone wanting to track their fixed income asset allocation.

Indices are unmanaged. An investor cannot invest directly in an index. They are shown for illustrative purposes only and do not represent the performance of any specific investment.

Advisory services offered through WealthPlan Group, a DBA for WealthPlan Investment Management, a subsidiary Registered Investment Advisor of WealthPlan Group, LLC. WealthPlan Group, LLC is not a registered investment advisor, but is the holding company for WealthPlan Partners LLC and WealthPlan Investment Management, LLC.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which Investment(s) may be appropriate for you, consult your financial advisor prior to investing. Information is based on sources believed to be reliable, however, their accuracy or completeness cannot be guaranteed.

No investment strategy can assure success or completely protect against loss, given the volatility of all securities markets. Statements of forecast and trends are for informational purposes and are not guaranteed to occur in the future. All performance referenced is historical and is no guarantee of future results. Securities investing involves risk, including loss of principal. An investor cannot invest directly in an index.

The information in this communication applies solely to the intended audience and in no way amends, revokes, or otherwise alters the existing agreements and relationships between WPIM and its clients. This communication is not a binding offer, expressed or implied. WPIM undertakes no obligation to update or revise the information herein or in any referenced third-party resource due to new information, future events, or circumstances, or otherwise.

WealthPlan Investment Management (“WPIM”) uses data compiled and/or prepared by third parties (“Third Party Data”) in the delivery of Licensed Research and Data. Third Party Data is not owned by WPIM and user may be required to obtain permission directly from third parties for further use of Third-Party Data and may be required to pay a fee depending on the use contemplated by the user.