Third Quarter 2021: Market Commentary and Analysis

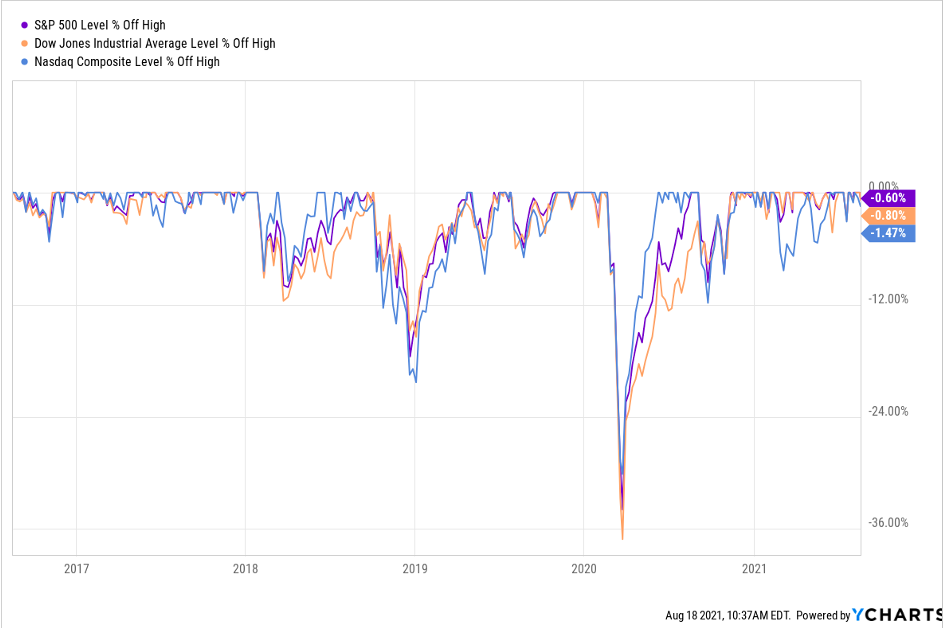

While US equity markets made all-time highs during the quarter; a September pullback erased gains and left markets flat-to-down for the quarter. Bonds provided no reprieve, also selling off in the quarter as rates ticked up in response to inflationary pressures. 3rd Quarter 2021 Capital Market Returns Bloomberg Barclays Global Aggregate -0.80%…

Evergrande Cheat Sheet

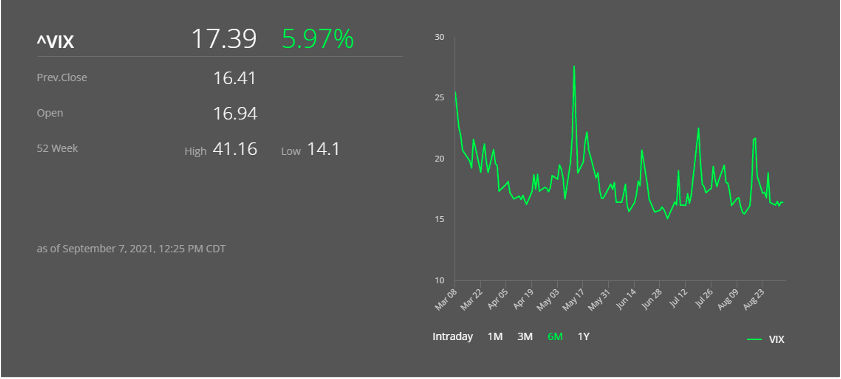

Evergrande Cheat Sheet Financial Markets had one of the worst days in months and also saw the VIX cresting just over 25. While many issues are percolating such as Delta variant fears, the Fed’s tapering to start later this year, friction around the US debt ceiling, and overall concerns of an overheated equity market,…

Bulls Vs Bears: Where We Are & Where We Might Go

Join CIO, Erik Ogard, CFA, and Steve Wruble in this month’s Bulls Vs. Bears: Market Commentary as they discuss current market trends, how markets have been historically, and where they might lead in the future.

September Blues

The Bureau of Labor Statistics released their Non-Farm Payroll number on Friday indicating the US added an estimated 235k jobs in September, much less than the consensus forecast of 733k. While areas such as private education and warehouses saw notable increases in employment, retail sales saw a contraction in jobs mostly in the hospitality and…

With the End of Summer Ahead

The S&P 500 index rose 1.5% last week in a rally that sent the market benchmark above the 4,500 level for the first time as investors were relieved by comments from Federal Reserve Chairman Jerome Powell that they interpreted as a sign the central bank isn’t rushing to begin tapering its bond buying stimulus program. The S&P…

“Investment Errors” with Erik Ogard, CFA®

My investment career began over thirty years ago. I have spent time on both the retail side and the institutional side of the business. Now I find myself in a position of leadership providing investment guidance and advice to Registered Investment Advisors and their clients. For many years, I have been contemplating the topic of…

Historical Perspective and Realistic Expectations

Investors have become somewhat complacent over the last decade as supportive government policies have led to strong stock market returns. Not only have investors become accustomed to strong positive returns with minimal drawdowns, but they are also largely unaware of what kinds of expectations might be reasonable. This is evidenced by the mania around recent…

Market Politics

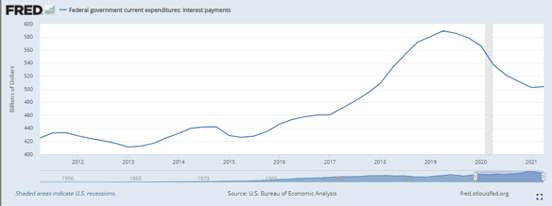

The Senate adopted a bipartisan infrastructure bill that outlines $550B in new infrastructure spending. After decades of talk, and failed attempts by governments led by both sides of the aisle, this newly passed infrastructure spending bill is one the likes of which we have not witnessed in most of our lifetimes. While people may have…

Investment Analyst Dustin Dorhout – Market Overtime

“When you look at mechanics like inflation in the market, we like to think of companies that can pass on the price of their goods to the consumer therefore allowing them basically earn more, and as a result that be able to continue to pay a higher rate to the shareholder.” Watch as Investment Analyst,…

CIO Erik O’Gard on Diversifying Your Portfolios – Market Overtime

Erik O’Gard, our Investment Committee Chairman of WealthPlan Group, was recently featured on TD Ameritrade Network‘s Market Overtime to discuss the importance of diversification in long-term investing. He mentions the 10-Year Treasury Index (TNX), as well as talks about how inflation impacts portfolio allocation. “In hindsight, we can always look at the stocks that performed…

August: Summer Soporific

We are in the thick of things this week with about 60% of companies in the S&P 500 already reporting their Q2 results, with some of the bigger players like Apple and Amazon having reported last week. Beyond the remaining 40% of the S&P 500 yet to release earnings, upcoming is government data on payrolls,…

New Kid on the Block[Chain]

Mark Twain is often attributed the adage, “History doesn’t repeat itself, but often rhymes.” Wise words that have been reinforced again in the financial world. I read an article recently that spoke of a hamster, one Mr. Goxx, who has outperformed both Warren Buffett, and the market by investing in various cryptocurrencies. This reminds me…