Don’t Fight the Fed

Stocks were mixed last week as the market narrative remains the same. Namely, the market is grappling with an increasingly hawkish Fed. It is a relatively quiet week ahead for macro-economic and corporate earnings announcements as the market continues to digest the implications of continuing high inflation. At this juncture, there seems to be broad-based…

Play The Long Game

Monday, May 9th, 2022 “He who stands on his tiptoes does not stand firm; he who stretches his legs does not walk easily…Thus it is that the Great man abides by what is solid, and eschews what is flimsy; dwells with the fruit and not with the flower.” –Assorted passages…

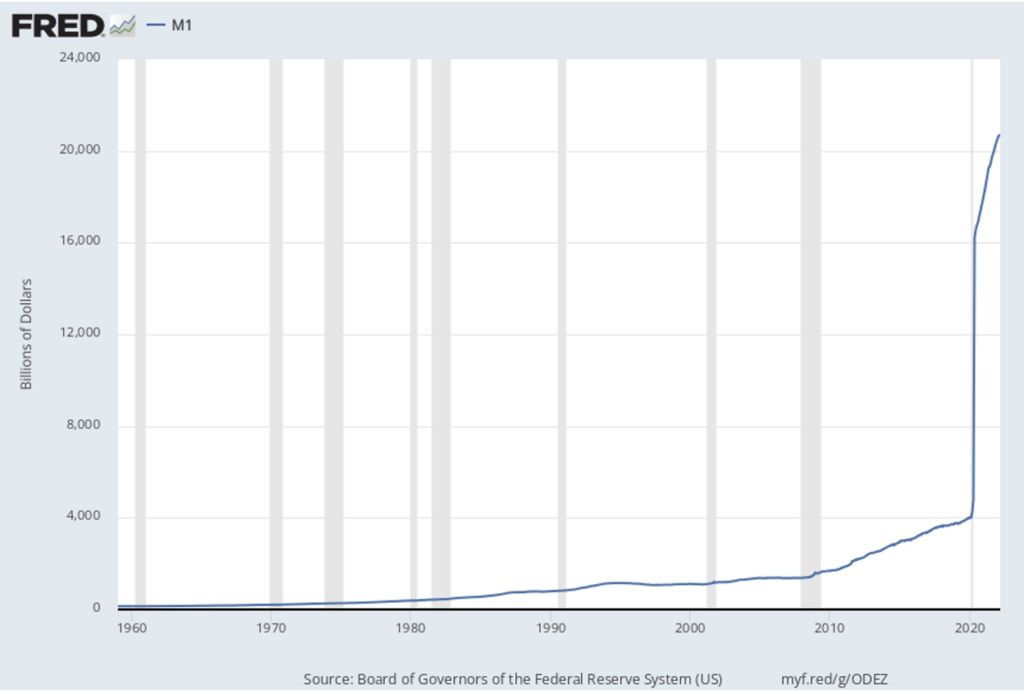

Money Heaven

Years ago, during the Great Financial Crisis of 2008-2009, a client asked me: “where does money go when the stock market declines?” I thought about it for a minute, and responded facetiously, “Money Heaven.” Meaning that it vanishes and leaves this world. Literally. Since I uttered those words, the idea of money heaven resonates with…

An Important Week for Gaining Perspective

It’s a big week for corporate earnings announcements with approximately 2,500 companies reporting earnings. We will have a good idea by the end of the week how rising costs are affecting trailing earnings as well as forward earnings guidance. On the economic data front, it is also a big week. Over the course of the…

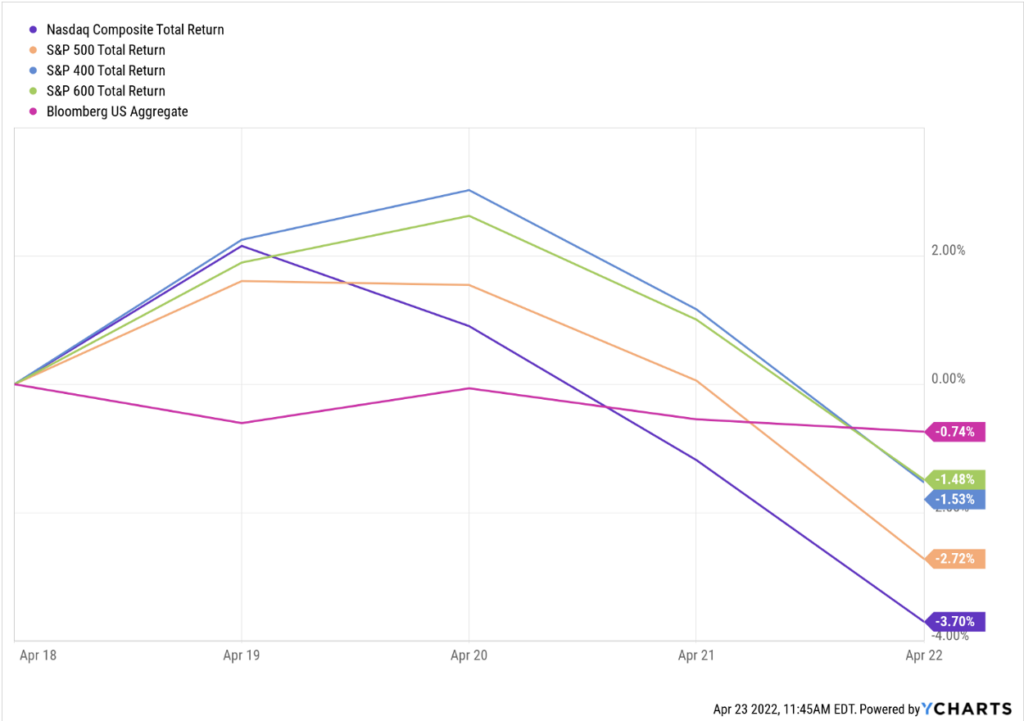

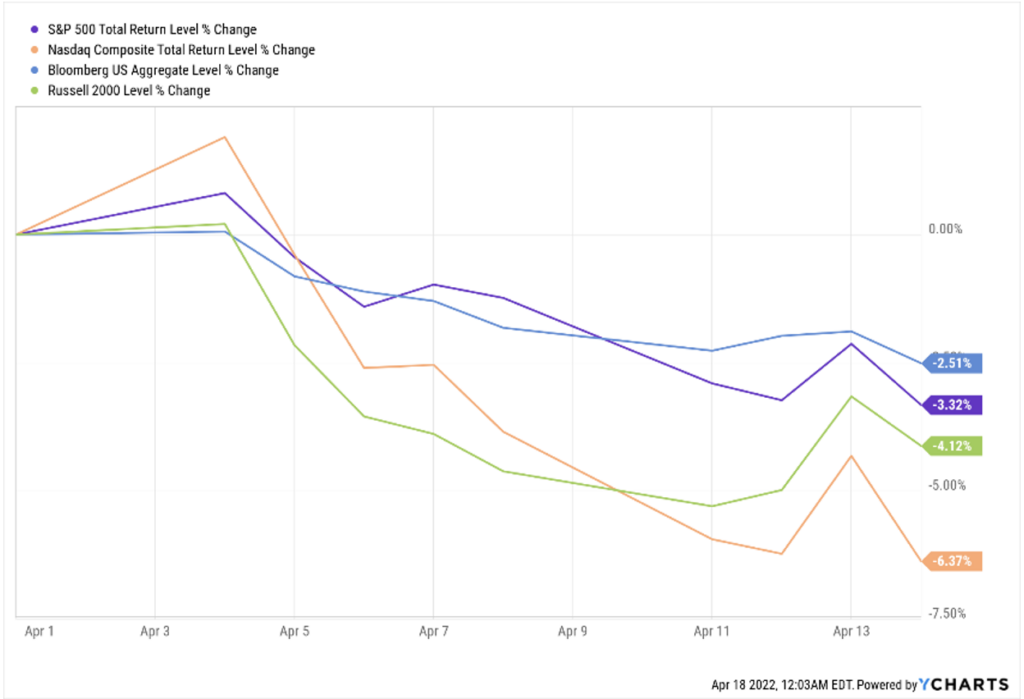

Understanding the Present

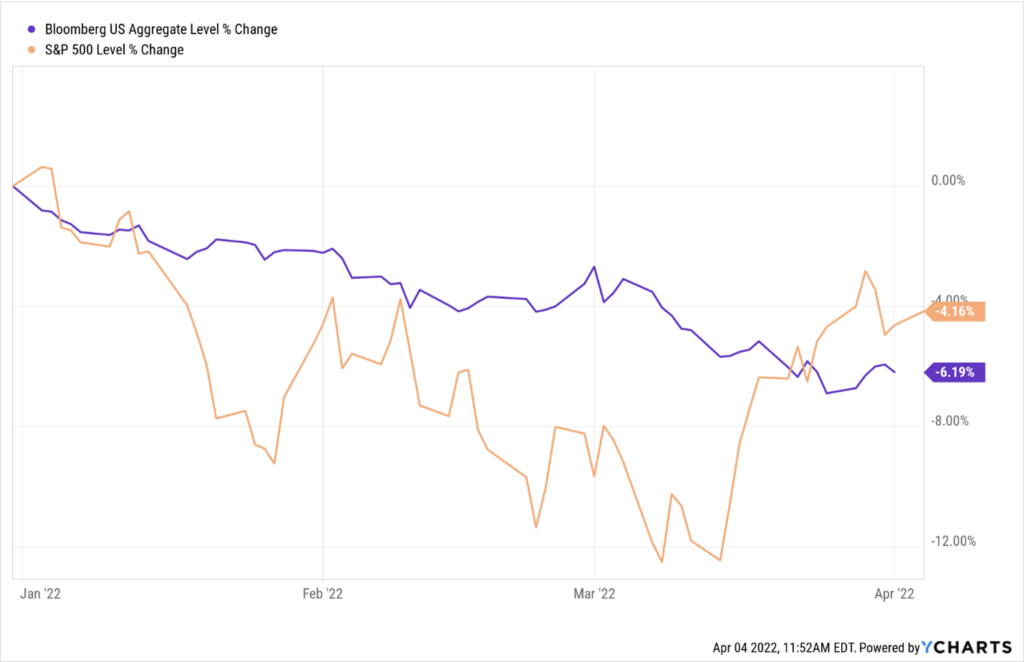

We all know markets were down in the first quarter of this year. We started the second quarter right where we left off in the first quarter. The two charts below show an array of indexes across two separate time frames: 1) The first chart shows the markets for April so far. 2) The second…

Bond Vigilantes Ride – Q1 Market Commentary

We began the first quarter with a sobering message, stating that after several good years (with a punctuated but brief COVID scare) that the investment climate was going to change. We suggested it would be good for people to temper their capital market expectations considering: 1) high stock market valuations, 2) high inflation, and 3)…

Equity and Bond Markets Disagree

Markets have once again demonstrated remarkable resilience as the dual threats of inflation and war did not prevent equity markets from rallying for the second week in a row. One interesting perspective is that the bond markets continue to show some distress (see the green line in the chart below) even while equity markets advance.…

Market Commentary – Nothing Has Changed

The stock market is a fickle barometer of the economy, for sure, swinging wildly in the short term as it grapples with the latest information. This process can be thought of as a mechanism looking to find equilibrium; moving around a great deal when uncertainty is high. This fittingly describes current market conditions. As we…

All Eyes on the Fed This Week

This week should bring some clarity around a couple of the issues that have been causing some of the stock market weakness. But I do not expect the information to materially alter the current bear market nature of the market. Here’s a look at the equity markets for the week just past: Last week we…

All Eyes on Ukraine, Oil, and Inflation: Uncertainty Prevails

The Russian invasion of Ukraine has now been underway for 13 days. There is tremendous uncertainty surrounding the conflict, but one thing seems clear: the duration seems likely to extend for much longer than most experts thought it would when it began. The most important economic impact for the West is the impact of this…

Market Commentary: Russian Invasion

The war in Ukraine has brought additional uncertainty to a market dynamic that is already unsettled. The volatility, intraday reversals, and headline risk that have been present since the beginning of 2022 continue. And from our perspective, there isn’t much changing that will cause the uncertainty to abate. Our view is that the Russian invasion…

Talk Is Cheap?

We’ve all heard the phrase, “Talk is cheap.” Lately, Fed chair Jerome Powell has been giving inflation fighting a great deal of “lip service.” “What we need to see,” Powell said, “is clear and convincing evidence that inflation pressures are abating, and inflation is coming down. And if we don’t see that, then we’ll have…