Market Volatility: Earnings Reports and Inflation Worries

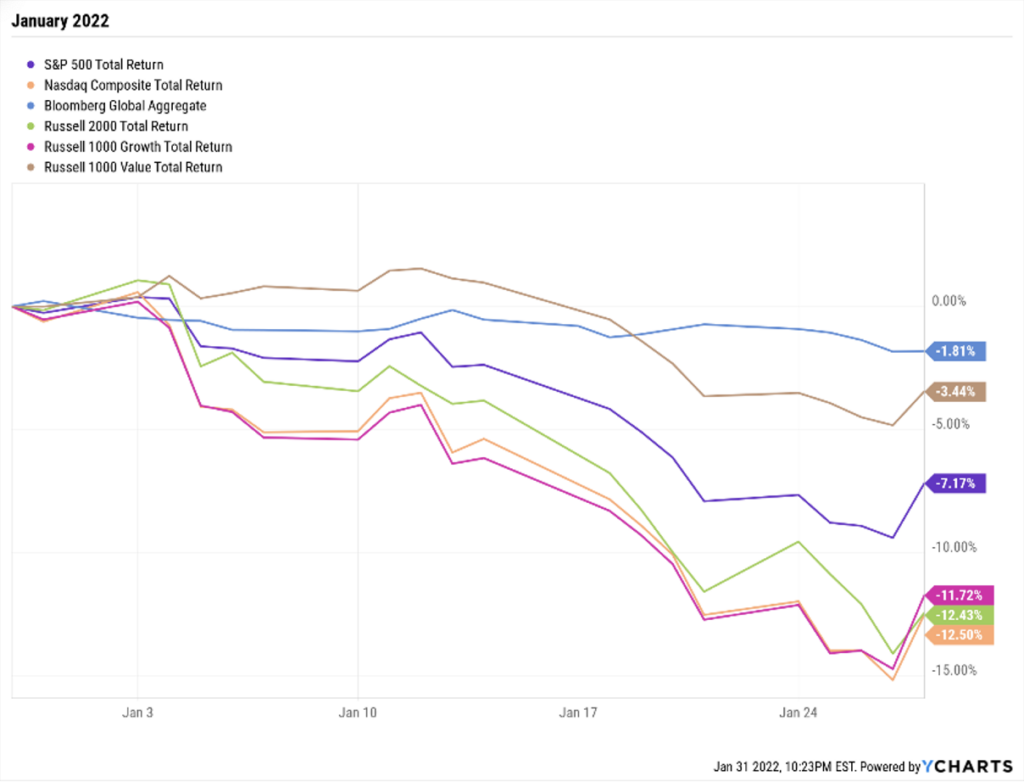

Recently we have been discussing higher market volatility as market participants attempt to understand the inflationary threat (its duration and magnitude) and the Fed’s response. Uncertainty about these things is really at the heart of recently higher market volatility: uncertainty leads to volatility. The chart below plots the major Equity Indices for the week. In…

Volatility as Markets Seek Equalibrium

In our year-end commentary just a month ago we observed that equity markets had experienced strong returns for many years primarily due to extremely supportive Fed policies. The consequent more-than-decade-long bull run resulted in extended equity valuation levels. While we acknowledged strong corporate earnings had contributed substantially to the equity bull market, we nonetheless made…

Investment Team Notes – Market Comments and Rebalancing Notice

Many folks are glued to the screen today watching some interesting market moves. We are too, but we’ve also built the Smarter Portfolios to insulate against some of the micro drama that happens day-to-day. We’ve been speaking recently of the concentration within many of the major indices and are seeing pullback in some big technology…

Year End Market Commentary

Well, that was a wild one. Here’s a bullet-point recap of the year 2021 through the “economic lens”: Continuing Covid pandemic with waves of new variants passing through the population. Negative bond returns. Recovering GDP and corporate earnings. Highly supportive Fed and record money supply. INFLATION with no end in sight. US stock market leads…

Fed Inflation Policy Shift

Inflation and the Fed’s actions to combat it will arguably be the main topic of discussion for the next ten days. On December 10th, the Bureau of Labor Statistics will release the November CPI data. Between May and September 2021, year over year CPI and Core CPI (CPI less Food and Energy) had stayed between…

Market Commentary – Volatility

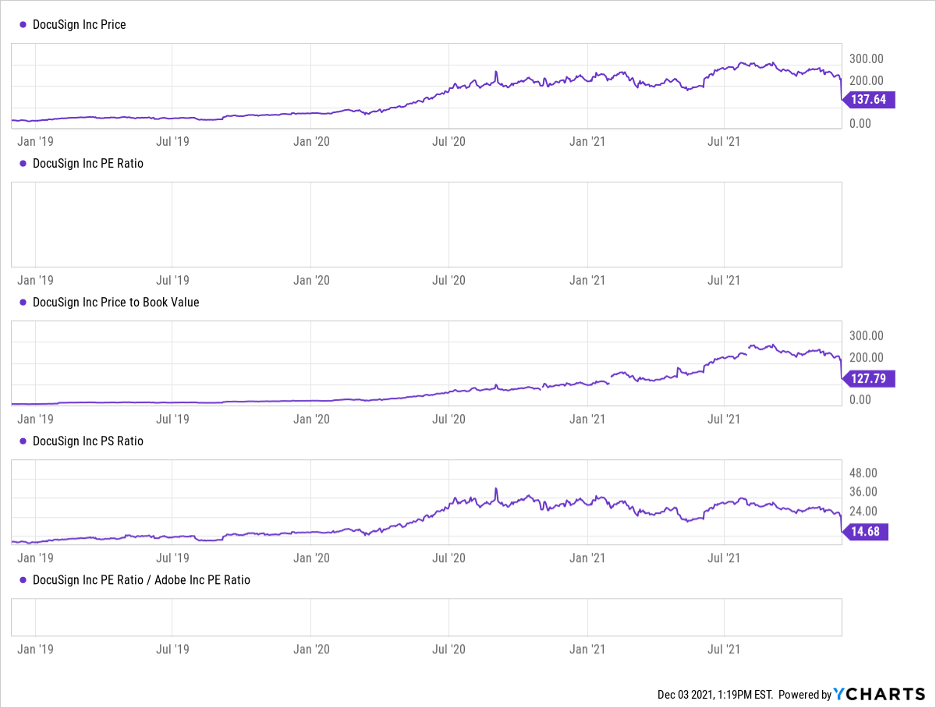

In an increasingly volatile short-term environment, we have had several people ask us if we have any insight on what is going on as the Nasdaq is currently off over 2% midday (at the time of writing this). The largest mover in the market right now is DocuSign (DOCU), which has been trading at around…

Thanksgiving Market Recap

Stocks jumped Monday morning to recover some losses after Friday’s slide, when uncertainty over a new coronavirus variant stoked volatility across global markets. After staging a significant recovery year to date, Oil prices shed about 10% on Friday based on the potential for lockdowns on travel. A paper released over the weekend from Duke University…

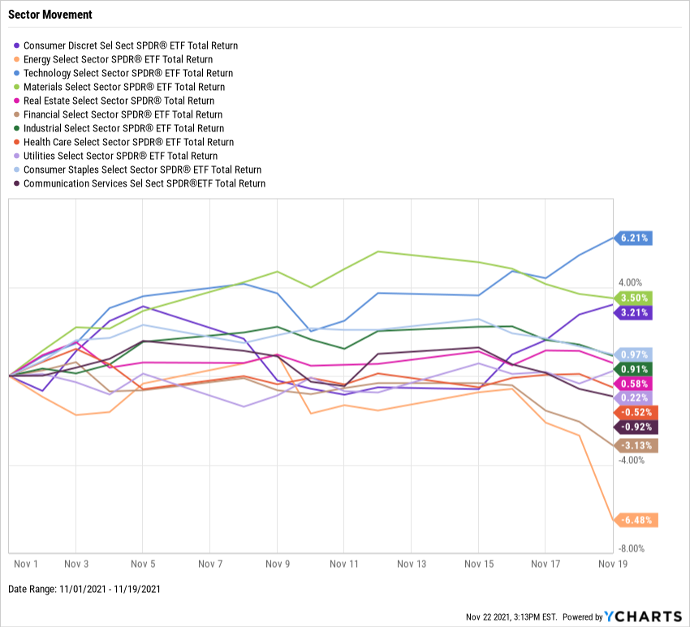

Pre-Turkey Day Market Recap

Stocks ended last week weighed by growing concerns over nationwide COVID-19 lockdowns in Europe which pressured US stocks, oil, and the broader market. The markets were unsettled to start this week as the Austrian government announced a full lockdown starting on Monday, in response to cases of COVID-19 surging in Europe. The lockdown will include…

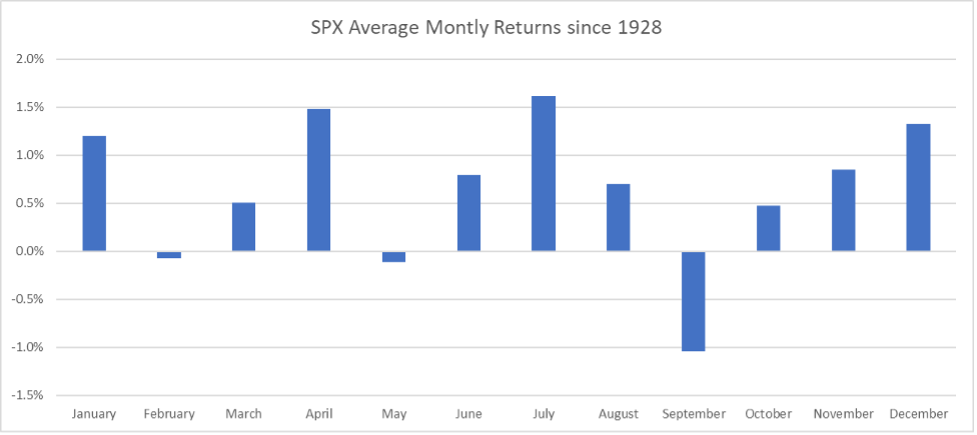

Leaning Into Q4

It looks like winter is upon us. For those of you not in the Omaha area, the first snowfall of the year occurred this past Friday. With about 45 days left in 2021, the markets are entering into a seasonally strong period. Historically, people have attributed the good market returns to the ‘Santa Claus Rally’–…

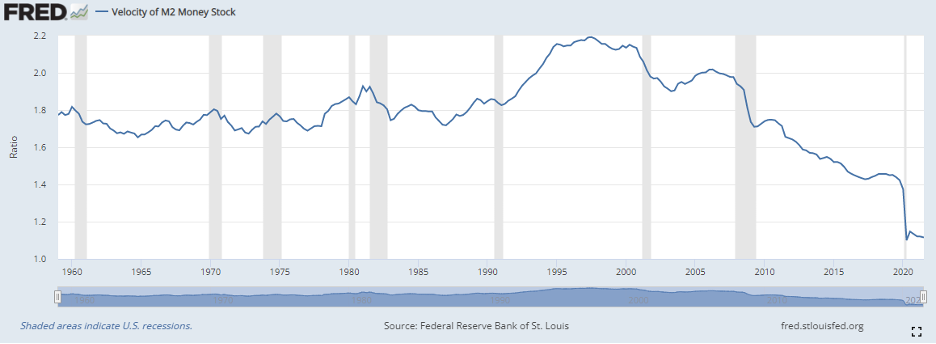

Investor Mailbag: Inflation

What does it mean that the Fed is going to start tapering? To keep the economy humming smoothly, the Fed has been practicing Quantitative Easing—providing liquidity to the market by purchasing $120B in Treasury bonds and mortgage-backed securities each month. The Fed announced that they would commence their tapering operations, reducing purchases by $15B per…

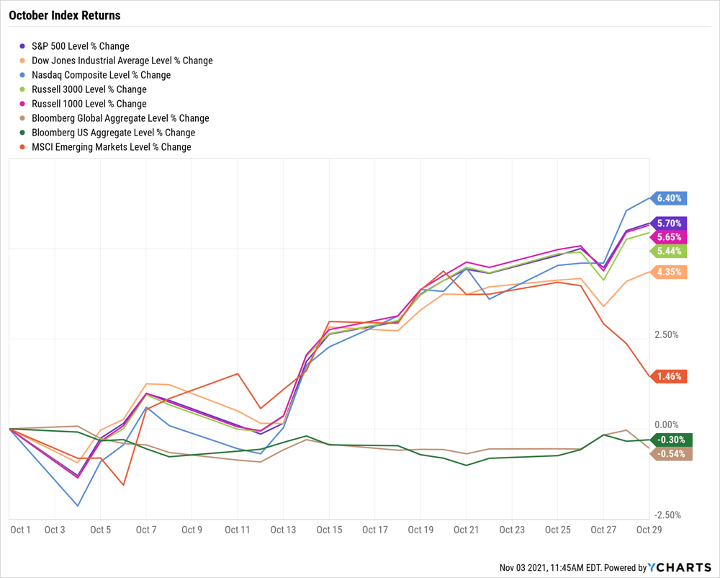

October Recap

After a September pull-back, risk assets resumed their upward trajectory in October, with several equity indices recording record highs at month-end. Bonds posted losses in the quarter as interest rates moved up in response to continuing inflationary pressures. October 2021 Capital Market Returns The magnitude of these moves over one month is large. The rise…

What happened in the week just past?

As we said in our note a week ago, the CPI report would be a meaningful data point for the markets. Unfortunately, the print for inflation was higher than the 7.2% expected annual rate. Inflation came in at 7.5%, spooking markets and truncating what appeared to be an attempt by equity markets to rally to…