Markets Are Seemingly “Climbing the Wall of Worry”

Markets rallied mid-week in response to remarks made on Wednesday by Federal Reserve Board of Governors Chairman Jerome Powell, raising hopes that inflation is receding and that most of the rate increases are behind us. Below is a graph for the week just passed depicting the price performance of popular US stock market indices. You…

Santa Claus Rally 2022?

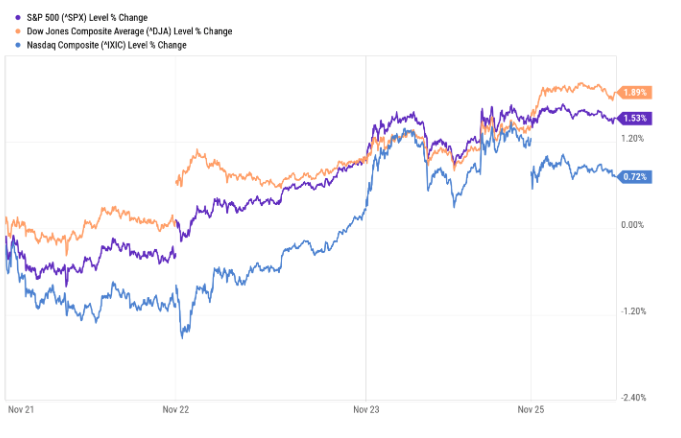

Markets were up last week in an abbreviated trading week (see chart below). As we close November and ring in December, the debate among investors is whether we get a classical year-end “Santa Claus” rally. While a year-end rally has been reliable in the last many years, this year has been full of…

A Fresh Earnings Perspective

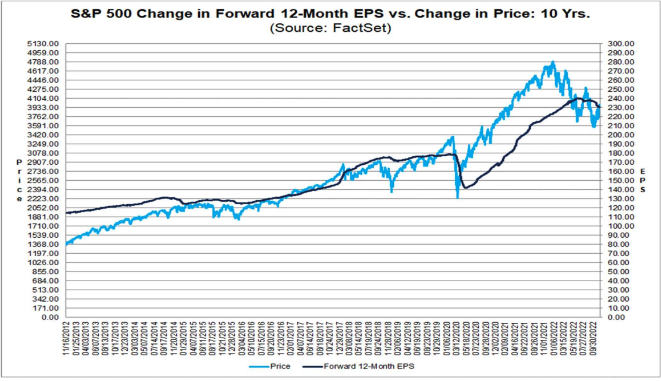

Here’s a fundamental truth: In the long term, stock prices follow earnings. With earnings season for the third quarter largely over, corporate earnings have remained relatively strong while forward earnings estimates are only slightly declining as recession expectations persist. According to FactSet: “Overall, 94% of the companies in the S&P 500 have reported actual results…

A Nice Relief Rally

Here is what the major US stock market indexes did last week: Thursday’s return was a larger one-day upward move that has many proclaiming the worst of the bear market is over. The move on Thursday and the follow-through on Friday are largely a response to the annualized CPI reading of 7.7%, which…

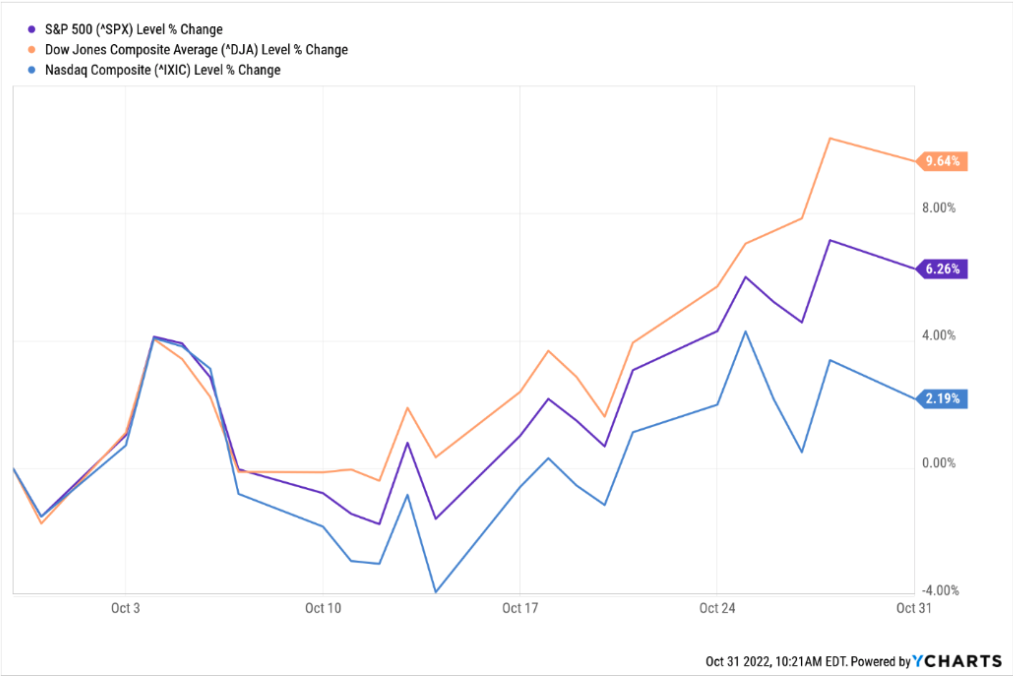

All Hallows Eve and Fed Week: Trick or Treat?

Sometimes the cliché headline is the right choice! While the stock market is completing one of its best months in a long time (see chart above), we enter this week on All Hallows Eve with the specter of another 75-basis point increase in the Fed Funds rate on Wednesday. Many hope the Fed will…

This is not an economic or stock market crisis

With November election political campaigning in full swing, it seems like EVERYTHING is being characterized as a crisis these days. Border Crisis. Ukraine Crisis. Covid Crisis. Climate Crisis. Crime Crisis. Homelessness Crisis. Fentanyl Crisis. Inflation Crisis. Economic Crisis. These are a few of the things being characterized as a crisis in the current climate. Some…

A New Week

Below are US stock market returns for the week just past. The Dow managed to make a gain for the week while the S&P 500 and Nasdaq Indexes headed further into bear market territory. As we head into the second week of quarterly earnings season, it is clear the market is processing two dominant factors…

The Beginning of Earnings Season

Weekly Note Commentary || October 10, 2022 This week marks the start of 3rd quarter earnings reports. We will see only a small trickle of earnings announcements this week and then get into full swing next week. Earnings season will continue into mid-November. Earnings reports take on a heightened level of importance this quarter given…

Alternative Investments Portfolio – October 2022

Below is the chart of the year-to-date returns through September 30, 2022—for both US stocks and bonds. This is UNPRECEDENTED on a couple of important dimensions. First, bonds normally provide a return that offers a low correlation to stocks; meaning that normally when stocks are down like they are this year, bonds provide some positive…

What is the S&P Worth Today? What About in 5 Years?

There seems to be a lot of disagreement around what stocks are worth and what the various index levels “should” be. This debate is reaching a high volume of late due to the uncertainties present. How high will inflation go? How long will it last? What will the Fed do with rates? Can inflation be…

An Unusually Difficult Year

Market Commentary, September 6, 2022 We are all aware of the headlines. Record Inflation. Rising Interest Rates. Potential Recession. Against these headlines we have some conflicting data. For example, corporate earnings remain strong and Wall Street analysts remain optimistic in their earnings forecasts. Analysts are still calling for the S&P 500 Index in aggregate…

Listen to the Money Talk

In April of this year (2022), we wrote a piece called “Money Heaven” in which we discussed money creation and destruction in the US economy. Briefly, this was a treatise postulating that unprecedented excess money growth was a leading cause of inflation. Moreover, we discussed the various ways the economy eliminates “excess” money. To…